Please use a PC Browser to access Register-Tadawul

A Look At Matson (MATX) Valuation After Strong Preliminary Q4 Results And Steady 2026 Outlook

Matson, Inc. MATX | 167.75 | +1.88% |

Matson’s latest results and dividend decision

Matson (MATX) shares are in focus after the company reported preliminary fourth quarter results that surpassed expectations, supported by stronger freight rates and volumes in its China service.

Matson’s strong preliminary fourth quarter update and recent dividend declaration come after a sharp 58.79% 90 day share price return. The 5 year total shareholder return of 166.31% points to longer term compounding, suggesting momentum has been building recently.

If Matson’s move has you thinking about what else is working in transport, this could be a useful moment to scan fast growing stocks with high insider ownership and see which other names catch your eye.

After a 59% 90 day return and a 166% 5 year total shareholder return, plus a recent price target above the current US$160.30 share price, you have to ask: is there still value here, or is the market already pricing in future growth?

Most Popular Narrative: 10.2% Undervalued

Matson’s most followed narrative points to a fair value of $178.50 versus the last close at $160.30, framing the recent rally against a higher long term anchor.

Exclusive access to U.S.-flag, Jones Act-protected shipping routes provides Matson with a strong competitive moat and reliable pricing power, supporting stable long-term earnings and cash flows even amidst ongoing industry volatility.

Curious what justifies a higher fair value when earnings are expected to trend lower and margins compress over time, yet the required return stays relatively modest and the assumed future earnings multiple climbs well above today’s level? The full narrative lays out how these moving parts fit together.

Result: Fair Value of $178.50 (UNDERVALUED)

However, you also need to factor in risks such as softer global trade and concentrated exposure to a few trade lanes, which could challenge those higher fair value assumptions.

Another angle on valuation

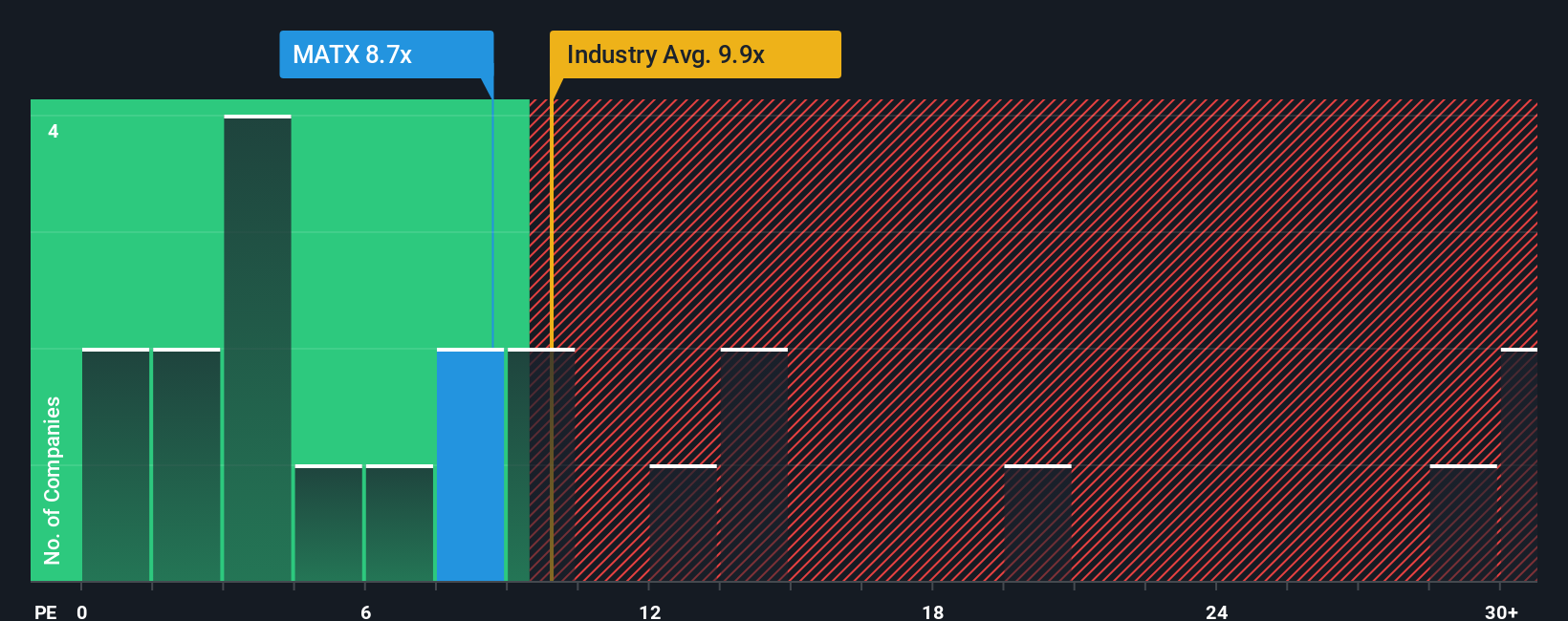

While the fair value narrative lands at $178.50 and tags Matson as 10.2% undervalued, the current P/E of 11.6x paints a different picture. It is higher than the North American Shipping industry at 7.3x and above the fair ratio of 10.4x, which points to a richer entry point than peers. Is this a premium you are comfortable paying?

Build Your Own Matson Narrative

If you are not fully on board with this view, or simply want to test the numbers yourself, you can build a version that reflects your own assumptions in just a few minutes with Do it your way.

A great starting point for your Matson research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Matson has sharpened your interest in what else might be setting up well, do not stop here, the next idea you skip could be the one that really counts.

- Spot potential high risk high reward opportunities early by scanning these 3531 penny stocks with strong financials that meet your criteria for size and fundamentals.

- Consider the growth potential of artificial intelligence by checking out these 25 AI penny stocks that align with themes you already follow.

- Seek out value focused ideas by reviewing these 868 undervalued stocks based on cash flows that might fit a long term, fundamentals driven approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.