Please use a PC Browser to access Register-Tadawul

A Look At Merit Medical Systems (MMSI) Valuation After Strong Q3 Beat And Cautious Full Year Guidance

Merit Medical Systems, Inc. MMSI | 82.21 | +0.45% |

Merit Medical Systems (MMSI) has drawn fresh attention after reporting third quarter revenue growth of 13% year on year, beating analysts’ organic and overall revenue estimates while pairing that result with the weakest full-year guidance among peers.

At a share price of US$82.50, Merit Medical Systems has seen a 3.60% 1 day share price return and a 1.74% 7 day share price return, but a 24.40% decline in 1 year total shareholder return suggests recent momentum has faded despite positive multi year total shareholder returns.

If this earnings update has you thinking about where growth could come from next in healthcare, it might be worth checking out 26 healthcare AI stocks as a starting list of ideas.

With revenue growth running ahead of expectations, a forward P/E of 20.4x and the share price sitting below the average analyst target, the key question is whether this pullback reveals value or if the market is already pricing in future growth.

Most Popular Narrative: 20.3% Undervalued

The most followed narrative currently puts Merit Medical Systems' fair value at $103.55 compared with the last close of $82.50, and it builds that gap on a detailed view of procedure growth, margins and capital allocation.

The expanding global prevalence of chronic diseases and an aging population are increasing the need for interventional, diagnostic, and therapeutic medical procedures. Merit's strong growth in cardiovascular and endoscopy segments, robust new product development, and recent acquisitions (such as Biolife and EndoGastric) position the company to capture a larger share of this growing market and drive sustained long-term revenue growth.

Read the complete narrative. Read the complete narrative.

Want to see what turns that story into a double digit discount estimate? The narrative leans heavily on expanding margins, steady top line gains and a richer earnings base by 2028. The exact mix of revenue growth, profitability and the valuation multiple on those future earnings might surprise you.

On the numbers behind that narrative, analysts are building in consistent revenue growth, higher profit margins and a meaningfully larger earnings pool over the next few years, all discounted back at 7.7% to reach a present fair value of $103.55. The result is a view that Merit Medical Systems is currently trading at a discount to those implied future cash flows and earnings power, with the narrative hinging on execution in cardiovascular and endoscopy as well as successful integration of acquired product lines.

Result: Fair Value of $103.55 (UNDERVALUED)

However, that story can easily change if WRAPSODY reimbursement delays drag on or if tariffs and trade tensions push costs higher and squeeze margins.

Another View: Rich Multiples Temper The Undervaluation Story

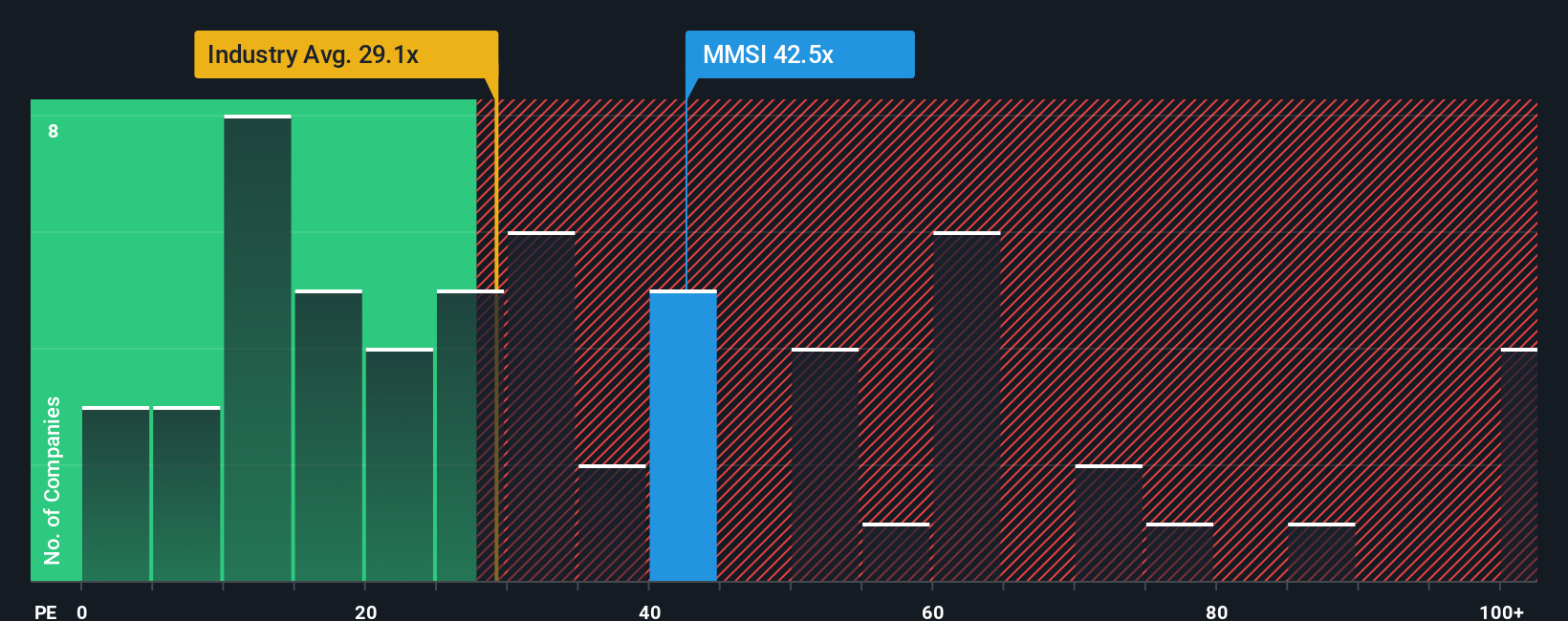

That 20.3% undervalued fair value hinges on future earnings power, but today Merit trades on a P/E of 41.3x. That is well above the US Medical Equipment industry at 30.7x, peers at 26.2x and a fair ratio of 24.5x. Is the current price already baking in a lot of optimism?

Build Your Own Merit Medical Systems Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to build on your own research, you can pull the data together and shape a custom view for Merit Medical Systems in just a few minutes. You can then pressure test it against the market using our tools, all starting with Do it your way

A great starting point for your Merit Medical Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If this has sharpened your thinking on Merit, do not stop here. The screener can quickly surface other opportunities that might fit your style and risk tolerance.

- Target reliable cash generators by scanning for 14 dividend fortresses that may suit an income focused portfolio.

- Hunt for potential bargains using our 53 high quality undervalued stocks as a way to spot ideas with attractive fundamentals.

- Prioritise resilience by checking companies in the 86 resilient stocks with low risk scores if you want business quality front and center.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.