Please use a PC Browser to access Register-Tadawul

A Look At Mid-America Apartment Communities (MAA) Valuation After Analyst Downgrades And 2026 Guidance

Mid-America Apartment Communities, Inc. MAA | 133.47 | -1.18% |

Mid-America Apartment Communities (MAA) is back in focus after reporting fourth quarter and full year 2025 results alongside 2026 earnings guidance, with analysts reassessing the stock as Sunbelt apartment demand expectations come under scrutiny.

Recent trading has been choppy for Mid-America Apartment Communities, with a 1-day share price return of 1.58% at US$135.55 and a 90-day share price return of 3.93%. The 1-year total shareholder return of 9.93% and 3-year total shareholder return of 8.87% suggest longer term performance has been more muted as investors weigh softer net income, the 2026 earnings guidance and shifting analyst views on Sunbelt demand.

If this earnings update has you reassessing your real estate exposure, it could also be a good moment to look at infrastructure linked names through our 25 power grid technology and infrastructure stocks.

With earnings under pressure, mixed analyst calls and the shares trading at a discount to both some analyst targets and one intrinsic value estimate, you have to ask: is this a reset worth buying into, or is the market already pricing in future growth?

Most Popular Narrative: 7.8% Undervalued

With Mid-America Apartment Communities last closing at $135.55 versus a narrative fair value of about $147, the current setup hinges on how you see future earnings quality and Sunbelt apartment fundamentals.

Decreasing construction starts and ongoing challenges in securing development capital are expected to extend a low-supply environment for several years, allowing MAA's development pipeline and recently completed projects to deliver above-average stabilized yields and fueling long-term net operating income growth and margin expansion.

Curious what kind of rent growth, margins and future earnings multiple are built into that view, and how long this low supply window is assumed to last? The narrative connects all three into one valuation story that is far more aggressive than the current share price implies.

Result: Fair Value of $147 (UNDERVALUED)

However, this hinges on Sunbelt supply not staying elevated, and on operating costs, including maintenance and financing, not eating further into already pressured margins.

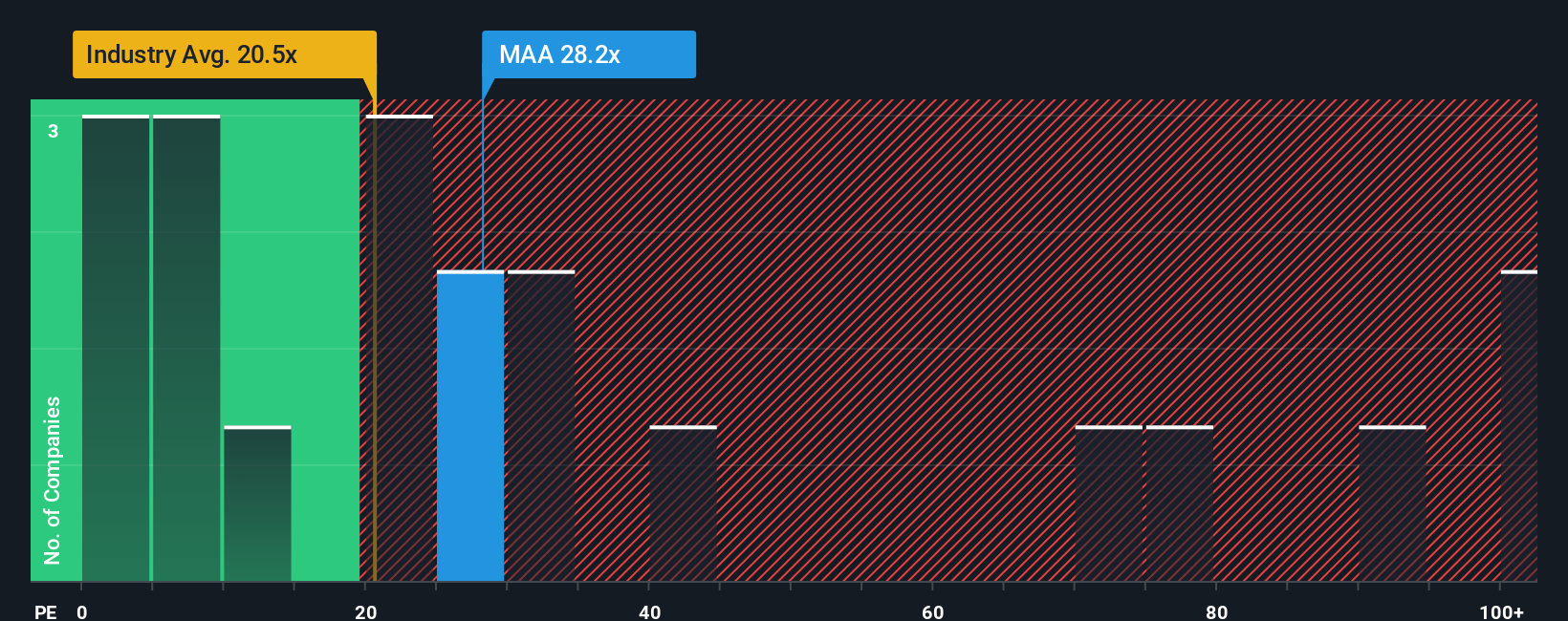

Another View: Earnings Multiple Paints a Different Picture

The DCF work suggests MAA looks 32% undervalued, yet the current P/E of 35.8x is higher than both peers at 27.1x and the North American Residential REITs average at 27.6x, and above a fair ratio of 30.2x. If earnings are forecast to decline, how comfortable are you paying a richer multiple than the sector?

Build Your Own Mid-America Apartment Communities Narrative

If the assumptions here do not quite fit how you see MAA, you can stress test the numbers yourself and build a custom view in minutes with Do it your way

A great starting point for your Mid-America Apartment Communities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If MAA has sharpened your thinking, do not stop here. The right mix of new ideas can be just as important as any single stock decision.

- Spot potential mispricing early by checking companies our screener flags as 54 high quality undervalued stocks, where quality and price are assessed side by side.

- Focus on resilience and sleep better at night by reviewing companies in the 83 resilient stocks with low risk scores that show lower overall risk scores.

- Hunt for underfollowed opportunities by looking through our screener containing 24 high quality undiscovered gems, where strong fundamentals meet limited market attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.