Please use a PC Browser to access Register-Tadawul

A Look At Mirion Technologies (MIR) Valuation After Softer Earnings And 2026 Guidance Disappoint Investors

Mirion Technologies, Inc. Class A MIR | 21.28 | -0.88% |

Leadership changes refocus Mirion after a softer earnings reaction

Mirion Technologies (MIR) is in the spotlight after quarterly revenue and adjusted EPS came in below analyst expectations, and 2026 earnings guidance also trailed consensus, prompting a sharp negative reaction in the share price.

At the same time, management has been reshaping the leadership bench. This matters if you are trying to understand how the company plans to handle margin pressures, recent acquisitions and its exposure to nuclear power and nuclear medicine over the next few years.

The share price reaction around earnings sits against a mixed backdrop, with a 1-day share price return of 4.8% after the initial drop, a 30-day share price return showing a 16.4% decline, and a 1-year total shareholder return of 38.1%. This suggests recent momentum has cooled after strong gains supported by earnings progress, acquisitions and Mirion’s increasing exposure to nuclear power and nuclear medicine.

If Mirion’s recent volatility has you thinking about other ways to invest around the nuclear theme, you may want to scan our 85 nuclear energy infrastructure stocks as a starting list of related names.

With Mirion now valued at US$22.51 per share, sitting about 30% below the average analyst price target yet carrying an intrinsic value estimate at a premium to today’s price, is this volatility creating an entry point, or is expected growth already fully reflected?

Most Popular Narrative: 25.8% Undervalued

The most followed narrative pegs Mirion’s fair value at about $30.33 per share, comfortably above the last close of $22.51, framing the recent pullback in a very different light.

The accelerating global shift toward expanded nuclear power generation, coupled with rising capital budgets for modernization, life extensions, and increased capacity of the existing reactor fleet, is likely to drive sustained double-digit organic revenue growth and expand Mirion's higher-margin installed base business in coming years.

Strong momentum in advanced nuclear projects, including utility-scale new builds and rapid activity in the small modular reactor (SMR) market, has materially broadened Mirion's pipeline of large, multi-year opportunities, creating potential for significant step-changes in future order intake, backlog, and top-line revenue.

Curious how that premium fair value is built. The narrative leans on faster revenue expansion, sharply higher margins, and a rich future earnings multiple. Want to see which assumptions really move the needle.

Result: Fair Value of $30.33 (UNDERVALUED)

However, this hinges on nuclear demand and acquisitions holding up. Any slowdown in new projects or weaker integration outcomes could quickly challenge that upside story.

Another View: Rich P/S Ratio Raises the Bar

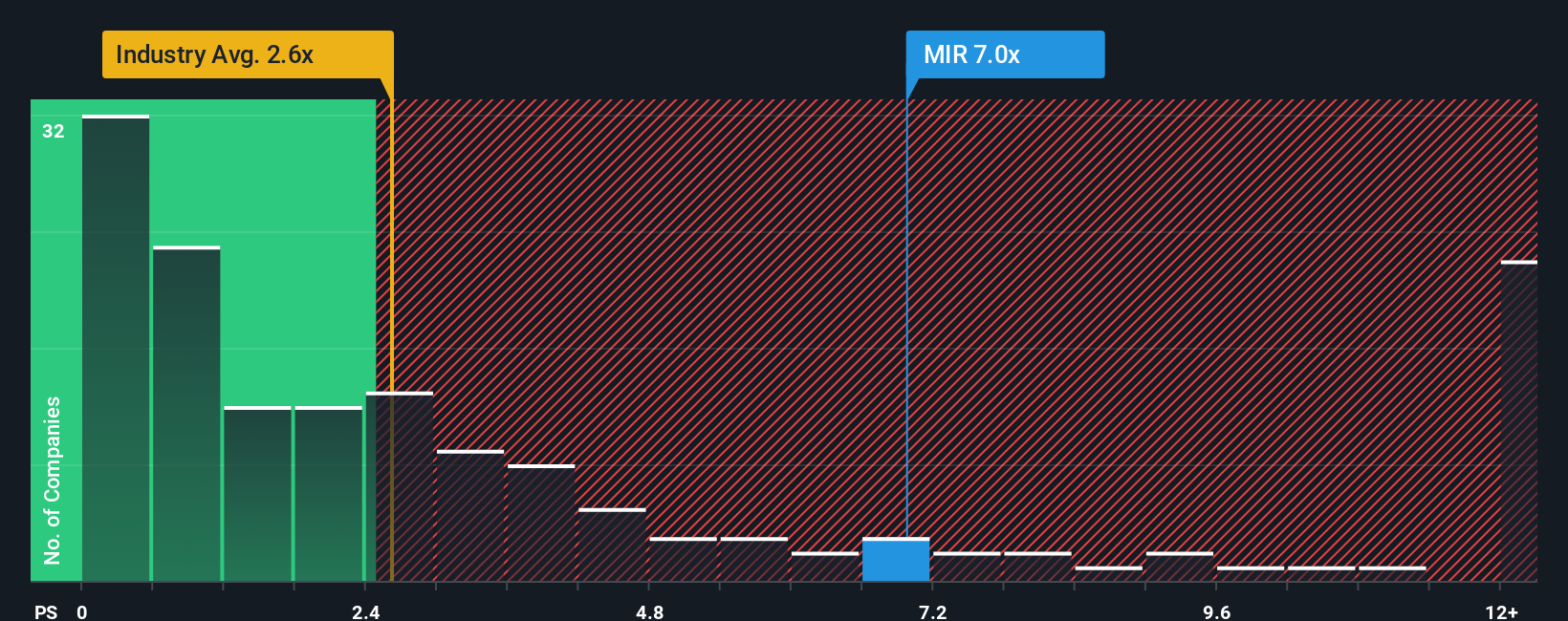

That $30.33 fair value suggests upside, but the current 6x P/S ratio tells a tougher story. It sits well above both the US Electronic industry at 2.8x and Mirion’s own fair ratio of 3.7x, which points to a rich setup. Is the premium simply the price of the nuclear story?

Build Your Own Mirion Technologies Narrative

If you see the data differently or prefer to test your own assumptions, you can build a full Mirion view in just a few minutes. Do it your way.

A great starting point for your Mirion Technologies research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Mirion has sparked your interest, do not stop here. Use the Simply Wall St Screener to quickly spot other opportunities that fit how you like to invest.

- Zero in on value by scanning our 53 high quality undervalued stocks that match solid fundamentals with prices that may not fully reflect their underlying strength.

- Prioritize resilience by checking companies in the 84 resilient stocks with low risk scores where business quality and risk scores work together to support a steadier profile.

- Get ahead of the crowd by browsing a screener containing 23 high quality undiscovered gems before they appear on everyone else’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.