Please use a PC Browser to access Register-Tadawul

A Look At Molina Healthcare (MOH) Valuation After Medicare Advantage Payment Shock And Guidance Pressure

Molina Healthcare, Inc. MOH | 181.18 | +0.89% |

The Molina Healthcare (MOH) share move was driven by a policy shock after the Centers for Medicare & Medicaid Services proposed just a 0.09% net payment increase for 2027 Medicare Advantage plans.

At a share price of US$179.59, Molina’s recent 1 day share price return of a 2.89% decline and 7 day share price return of an 11.05% decline sit against a 90 day share price return of 17.33%. The 1 year total shareholder return of a 42.14% decline highlights that, despite shorter term momentum still holding up, longer term holders have faced a much tougher ride as policy headlines, profit guidance cuts and investigations into past disclosures have all influenced how investors view risk around the story.

If this Medicare policy shock has you reassessing health insurers, it could be a useful moment to broaden your watchlist with healthcare stocks.

With MOH trading at US$179.59, showing an intrinsic discount figure alongside a modest gap to the average analyst price target, is the recent sell off handing investors a mispriced compounder or simply reflecting the market’s view on future growth?

Most Popular Narrative: 5.6% Overvalued

At a last close of $179.59 versus a narrative fair value of $170.00, Molina Healthcare is framed as slightly ahead of its implied worth, built on detailed revenue, margin and policy assumptions that stretch over several years.

The analysts have a consensus price target of $196.714 for Molina Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $330.0, and the most bearish reporting a price target of just $153.0.

Want to see what kind of revenue path, margin profile and future earnings multiple are baked into that fair value? The narrative leans on specific growth rates, profitability shifts and a discount rate that together sketch a very particular earnings arc. Curious how that set of assumptions compares with your own view on Medicaid volatility and medical cost trends?

Result: Fair Value of $170.00 (OVERVALUED)

However, this narrative could easily be knocked off course by renewed Medicaid funding cuts or by medical cost trends that keep margins under pressure for longer.

Another View: Multiples Paint A Very Different Picture

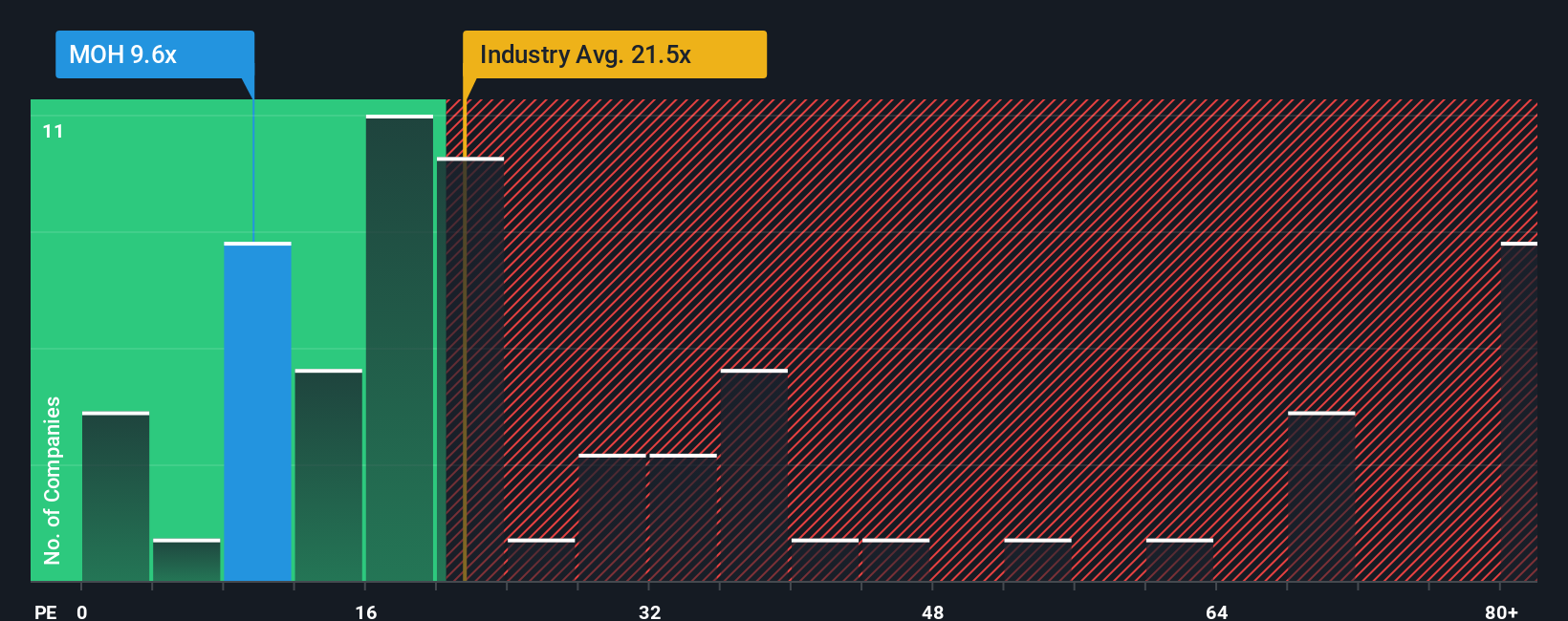

That 5.6% overvalued narrative sits awkwardly beside how the market is actually pricing Molina today. On a P/E of 10.5x versus peers at 26.6x, the US Healthcare sector at 22x and a fair ratio of 23.4x, the gap points to a wide valuation cushion rather than froth.

Build Your Own Molina Healthcare Narrative

If those assumptions do not quite fit how you see Molina, you can stress test the numbers yourself and spin up a fresh narrative in minutes, Do it your way.

A great starting point for your Molina Healthcare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Molina has sharpened your thinking, do not stop there. Use screeners to quickly surface fresh ideas that fit the kind of portfolio you actually want.

- Target income today by checking out these 14 dividend stocks with yields > 3% that may offer yields above what broad markets provide.

- Spot potential mispricings by scanning these 868 undervalued stocks based on cash flows that currently trade below their estimated cash flow value.

- Get ahead of the next tech wave by reviewing these 25 AI penny stocks positioned around artificial intelligence themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.