Please use a PC Browser to access Register-Tadawul

A Look at Molina Healthcare's Valuation After EPS Miss and Guidance Cut (MOH)

Molina Healthcare, Inc. MOH | 126.40 | -0.89% |

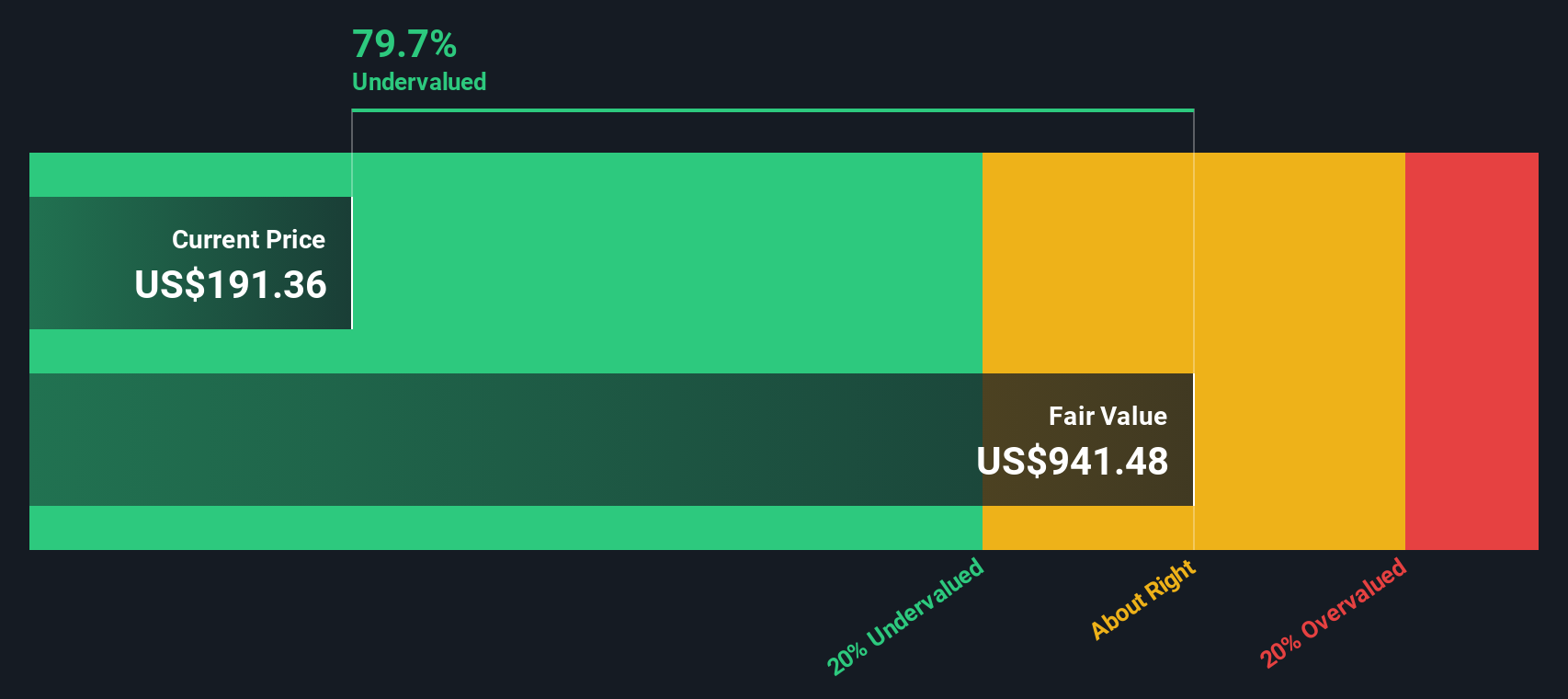

If you’re holding Molina Healthcare (MOH) or considering an investment, you’ve probably seen the headlines. The company just posted a drop in adjusted earnings per share, down 6.5% from last year, and those numbers missed what Wall Street was looking for. Management responded by cutting their outlook for the year, which set off a wave of selling and caught the attention of law firms investigating the earnings shortfall on behalf of investors. For anyone tracking the stock, these developments put valuation in the spotlight and leave the future looking a bit unsettled.

This is not the first bump in the road for Molina Healthcare this year. After a sharp decline following the guidance cut, the share price has fallen almost 46% over the past twelve months, and momentum has been tough to come by even in shorter timeframes. While annual revenue and net income have both grown moderately, the market’s response shows that investors are rethinking the growth story as risk perceptions shift.

After such a sharp drop, some may ask whether Molina Healthcare is a potential value play or if the market is already factoring in more challenging years ahead.

Most Popular Narrative: 57.4% Undervalued

According to WallStreetWontons, the current valuation dramatically underestimates Molina Healthcare's potential, suggesting large upside remains on the table if the company's expected trajectory holds.

Medicare Expansion: Opportunities in the Medicare space are highlighted as a key growth driver.

Pipeline for M&A and RFPs: MOH has a robust pipeline for mergers and acquisitions (M&A) and Request for Proposals (RFPs).

Curious how Molina could be set up for a comeback few are expecting? The narrative's secret sauce is a handful of bold future assumptions, including big revenue jumps and steady margin expansion. But which single factor carries the most weight in driving this surprising fair value? Only those who read deeper get to uncover what could make this valuation possible.

Result: Fair Value of $411.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory changes or unexpected increases in medical costs could quickly shake these projections. This reminds investors that the path forward remains unpredictable.

Find out about the key risks to this Molina Healthcare narrative.Another View: What Does the DCF Say?

Looking from a different angle, our DCF model also points to significant undervaluation. However, DCF relies on forecasting future cash flows, which always involves substantial assumptions. Is the market underestimating what Molina can deliver in the years ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Molina Healthcare Narrative

If you see things differently or want to dig into the numbers yourself, it’s easy to build your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Molina Healthcare.

Looking for more investment ideas?

There’s a world of smart investment opportunities just waiting for you, and you can keep an edge by tapping into unique market themes before everyone else.

- Spot undervalued potential early and seize opportunities with our screener focused on undervalued stocks based on cash flows.

- Fuel your portfolio with strong income prospects by tapping into businesses offering dividend stocks with yields > 3%.

- Uncover the innovators powering tomorrow’s AI breakthroughs by focusing on AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.