Please use a PC Browser to access Register-Tadawul

A Look At Nabors Industries (NBR) Valuation After Recent Share Price Momentum

Nabors Industries Ltd. NBR | 78.19 | +2.06% |

What Nabors Industries’ Recent Returns Signal for Investors

Nabors Industries (NBR) has drawn fresh attention after a recent move in its share price, with a 6.6% gain over the past day and double digit returns over the past month and past 3 months.

At a last close of US$68.10, the stock reflects a year to date return of 22.9% and a 1 year total return of 44.3%. Over longer periods, the 3 year total return stands at a 56.2% decline and the 5 year total return shows a 22.1% decline.

Alongside these return figures, Nabors reports revenue of US$3.18b and net income of US$247.34m, with annual revenue growth of 2.6%. The company also carries a value score of 4, offering investors a starting point for comparing it with other energy names.

The sharp 1 day share price return of 6.6% stands out against a 9.7% 30 day share price return and a 43.7% 90 day share price return. This suggests momentum has been building, despite longer term total shareholder returns remaining negative over three and five years.

If this kind of rebound in drilling and energy services is on your radar, it could be worth scanning our list of 25 power grid technology and infrastructure stocks as another way to find related infrastructure names.

With a value score of 4, a calculated intrinsic value suggesting a sizeable discount, but a share price sitting above analyst targets, the key question is whether Nabors is mispriced or whether the market is already accounting for future growth.

Most Popular Narrative: 16.9% Overvalued

With Nabors Industries last closing at $68.10 against a widely followed fair value estimate of $58.25, the current price sits above that narrative anchor, putting the focus on whether recent momentum lines up with those longer term assumptions.

The analysts have a consensus price target of $38.111 for Nabors Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $50.0, and the most bearish reporting a price target of just $28.0.

Want to see why this popular framework lands where it does? Revenue progress, margin rebuild and a compressed profit multiple all sit at the core of the fair value math, but the narrative only works if a few key assumptions hold together over time.

Result: Fair Value of $58.25 (OVERVALUED)

However, that story can be knocked off course if U.S. rig margins stay under pressure or international activity disappoints, which could challenge today’s fair value assumptions.

Another View On Valuation

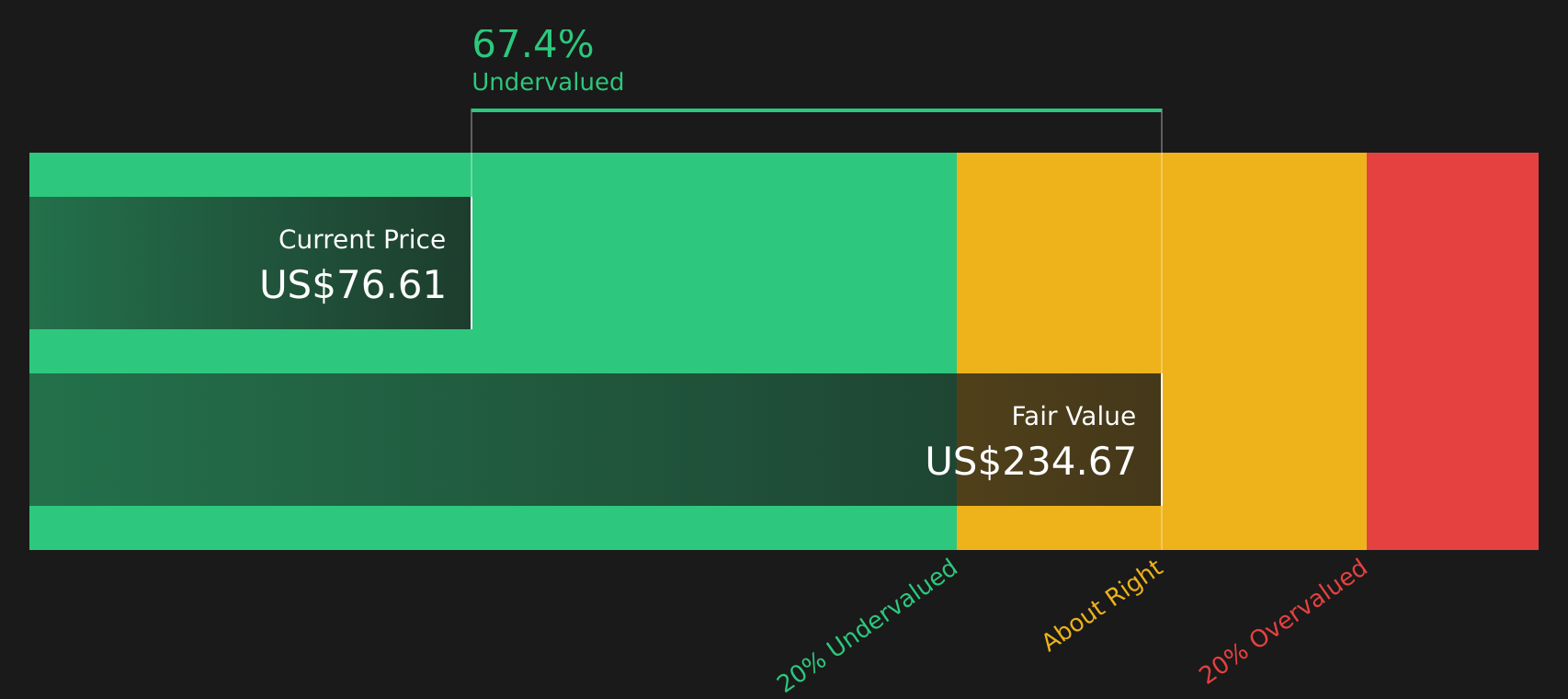

The narrative model estimates Nabors Industries at a fair value of US$58.25 and describes the current US$68.10 share price as overvalued. In contrast, our DCF model arrives at a future cash flow value of US$332.65, which appears deeply undervalued. Which perspective do you think aligns with the risk profile you are comfortable with?

Build Your Own Nabors Industries Narrative

If this valuation mix does not sit right with you, or you prefer to test your own assumptions against the numbers, you can build a custom view for Nabors Industries in just a few minutes, starting with Do it your way.

A great starting point for your Nabors Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Nabors has caught your eye, do not stop here. Use this momentum to broaden your watchlist and pressure test your thinking against other opportunities.

- Target strong businesses at reasonable prices by scanning our list of 53 high quality undervalued stocks that pair fundamental strength with appealing valuations.

- Prioritise resilience first by checking out 84 resilient stocks with low risk scores, focused on companies with characteristics that may help smooth out portfolio volatility.

- Hunt for potential future standouts with our screener containing 23 high quality undiscovered gems and see which names the market might not be paying close attention to yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.