Please use a PC Browser to access Register-Tadawul

A Look At National Storage Affiliates Trust (NSA) Valuation After Recent Share Price Momentum

National Storage Affiliates Trust NSA | 33.47 | +1.27% |

National Storage Affiliates Trust (NSA) has recently drawn attention after a period of mixed performance. The stock has shown a one-month return of 9.3% and a one-year total return of 8.7%.

At a share price of US$32.16, National Storage Affiliates Trust has seen a 1 month share price return of 9.28% and a year to date share price return of 15.31%, while its 1 year total shareholder return of 8.71% points to momentum that has been building more gradually for long term holders.

If this self storage REIT has you reassessing where you look for opportunities, it could be a good moment to broaden your search with our 22 top founder-led companies as a fresh source of ideas.

With NSA trading at US$32.16, sitting close to analyst targets and showing a 20% intrinsic discount estimate, the key question is whether this represents a genuine value gap or a stock where the market is already pricing in future growth.

Most Popular Narrative: 3% Undervalued

With National Storage Affiliates Trust trading at US$32.16 against a narrative fair value of about US$33.17, the current setup hinges on how its storage focused portfolio, joint ventures, and REIT sector backdrop evolve over the next few years.

The updated analyst price target for National Storage Affiliates Trust edges slightly lower to about $33.17 from $33.30 as analysts refresh their assumptions on discount rate, modest revenue growth, profit margin, and future P/E in light of mixed but generally constructive storage focused REIT sector research.

Want to see what is baked into that fair value? Revenue progress, margin shifts, and a rich earnings multiple all sit at the core of this narrative.

Result: Fair Value of $33.17 (UNDERVALUED)

However, there are still pressure points to watch, including expense growth outpacing revenue and ongoing competitive supply that could keep pricing and occupancy under strain.

Another Angle On Valuation

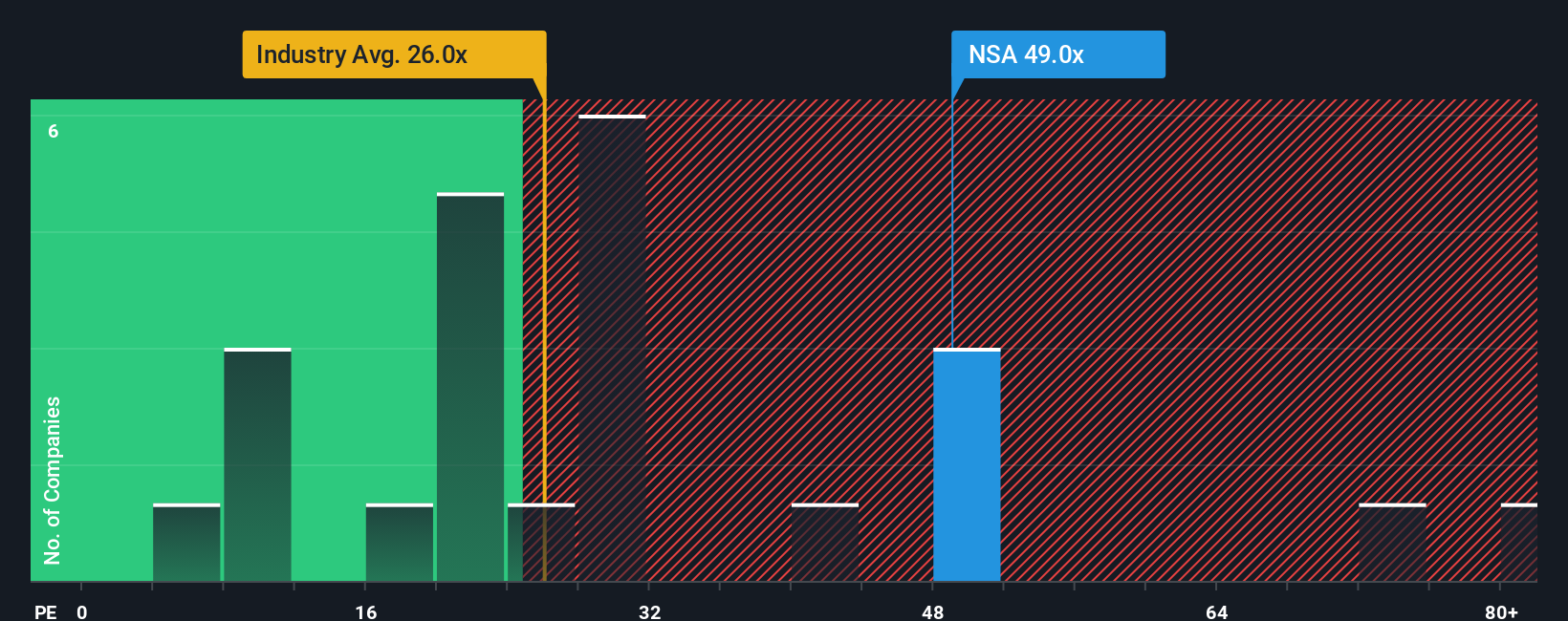

Our model flags National Storage Affiliates Trust as 20.3% below its estimated fair value, yet the current P/E of 52.5x sits well above the North American Specialized REITs average of 26.5x and a fair ratio of 31.5x. Does that premium reflect quality, or does it reduce the margin for error?

Build Your Own National Storage Affiliates Trust Narrative

If you see the numbers differently or prefer to test your own assumptions, you can develop a personalized thesis in just a few minutes by starting with Do it your way

A great starting point for your National Storage Affiliates Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you could miss opportunities that fit your style even better, so keep your options open and keep comparing.

- Target dependable income by scanning companies with steady payouts in our 15 dividend fortresses and see which ones align with your income goals.

- Spot potential value candidates by reviewing our screener containing 25 high quality undiscovered gems, highlighting companies that fewer investors may be focusing on.

- Prioritize resilience by checking out the 81 resilient stocks with low risk scores and focus on businesses with risk profiles that may better match your comfort level.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.