Please use a PC Browser to access Register-Tadawul

A Look At Oscar Health’s Valuation As Barclays Upgrade Sparks Fresh Interest In Insurers

Oscar Health, Inc. Class A OSCR | 13.23 | -3.64% |

Oscar Health (OSCR) drew fresh attention after Barclays shifted to a more neutral stance on the stock, citing attractive pricing, reduced policy risk concerns, and potential profit margin expansion across the managed care sector.

Barclays’ upgrade fits into a mixed year for Oscar Health, with a 7 day share price return of 14.68% and a 10.09% year to date share price return. At the same time, the 3 year total shareholder return is very large, suggesting momentum has recently cooled but longer term holders have still seen strong gains.

If this shift toward health insurers has your attention, it could be a good moment to broaden your watchlist and check out healthcare stocks as potential next ideas.

With shares now around $16.48 after a sharp 7 day rebound, yet trading at a small premium to the average analyst target of about $15.22, you have to ask whether there is still a buying opportunity here or whether the market is already pricing in future growth.

Most Popular Narrative: 8.3% Overvalued

With Oscar Health closing at US$16.48 against a narrative fair value of about US$15.22, the current price sits above that modeled estimate, putting more focus on the assumptions behind it.

The normalization of higher market morbidity through aggressive repricing (double-digit rate increases for 2026 already refiled in nearly all markets) and productive regulator engagement increase confidence in future margin recovery and a return to positive earnings.

Curious what has to happen for those margin gains to hold, while revenue keeps climbing and earnings flip from losses to profits? The full narrative walks through a detailed path for membership, pricing power and profitability, and then applies a higher future earnings multiple than the broader US insurance sector. Want to see how that combination leads to a fair value below where the shares trade today?

Result: Fair Value of $15.22 (OVERVALUED)

However, there is still a chance that faster cost cuts and Oscar’s $5.4b cash and investments could support margins sooner than this cautious narrative assumes.

Another Angle on Oscar Health’s Valuation

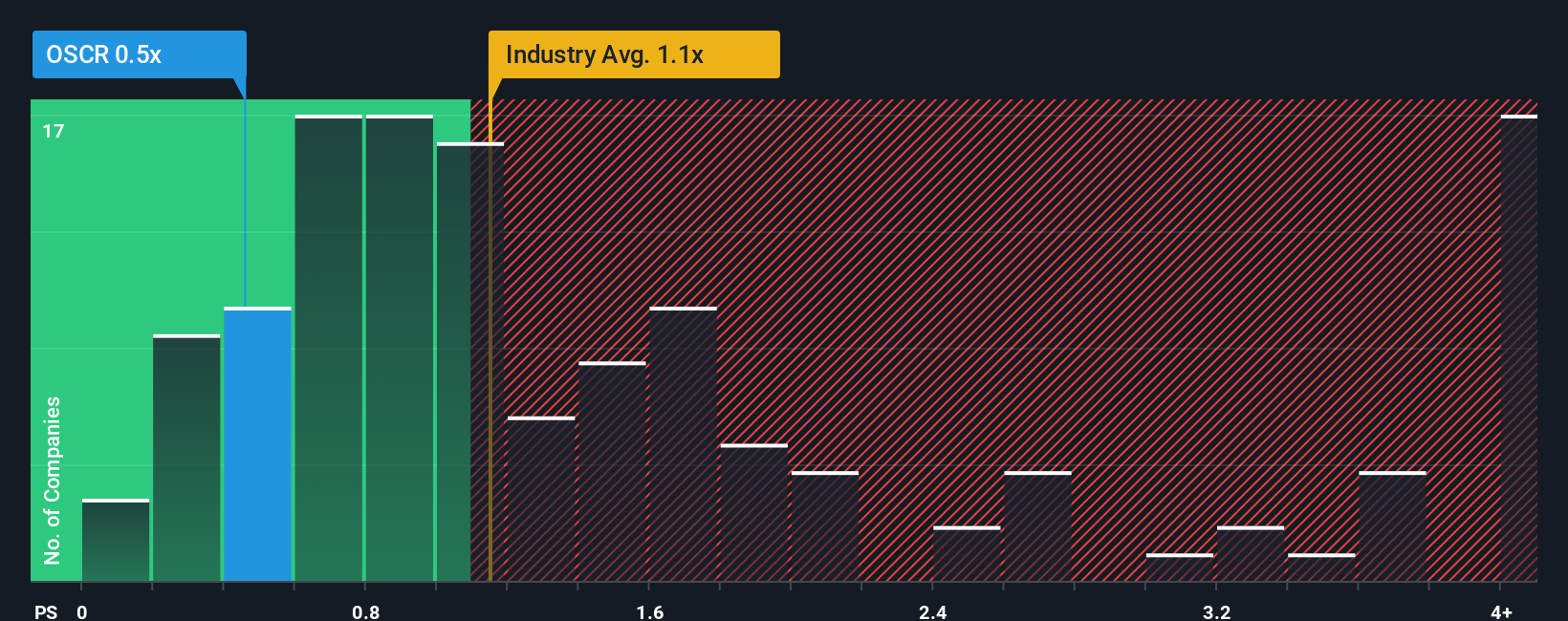

That 8.3% premium to the narrative fair value sits alongside a very different signal from the market’s favorite yardstick here, revenue. Oscar Health trades on a P/S ratio of 0.4x, compared with 1.1x for the US insurance sector and a fair ratio of 0.6x based on our model.

In plain terms, the share price is already above one earnings based fair value. However, the current P/S implies a discount to both peers and the level suggested by the fair ratio. This raises the question of whether that gap points to mispricing, or simply reflects the risk that profits are still some way off.

Build Your Own Oscar Health Narrative

If you see the numbers differently or simply want to test your own view against the model, you can build a custom narrative in just a few minutes, starting with Do it your way

A great starting point for your Oscar Health research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Oscar Health is on your radar, do not stop there. Use the screener to spot other opportunities that fit your style before the crowd catches on.

- Spot potential bargains by checking out these 880 undervalued stocks based on cash flows that may trade below what their cash flows suggest.

- Ride powerful technology trends by scanning these 27 AI penny stocks shaping how artificial intelligence reaches everyday products and services.

- Lock in reliable income streams by reviewing these 12 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.