Please use a PC Browser to access Register-Tadawul

A Look At Pangaea Logistics Solutions (PANL) Valuation After Earnings Beat And Strong Share Price Reaction

Pangaea Logistics Solutions Ltd. PANL | 9.30 | +2.99% |

Why Pangaea Logistics Solutions Is Back on Investor Radars

Pangaea Logistics Solutions (PANL) recently reported quarterly results with revenue 5.9% above analyst expectations and adjusted EBITDA up 20%, helped by Arctic trade activity and high utilization of its ice class fleet.

The quarterly beat has arrived alongside strong momentum in the shares, with a 1 day share price return of 16.39% and a 90 day share price return of 72.05%. Over the longer run, the 1 year total shareholder return of 58.40% and 5 year total shareholder return of 288.94% indicate that recent enthusiasm is building on an already strong history of compounding.

If this kind of move has you thinking about what else is on the move, it could be a good time to broaden your search with fast growing stocks with high insider ownership.

With revenue growth of 10.86%, net income growth close to a very large multiple, and the share price still only slightly below the US$8.75 analyst target, is Pangaea a rare value in shipping or already pricing in future growth?

Most Popular Narrative: 5% Undervalued

With Pangaea Logistics Solutions last closing at $8.31 against a widely followed fair value of $8.75, the narrative points to a modest valuation gap that hinges heavily on long term earnings power and capital allocation.

Expansion of port and logistics infrastructure in Tampa and upcoming new terminal operations in Texas, Louisiana, and Mississippi enhance Pangaea's vertically integrated logistics model, positioning the company to capture more value across the supply chain and reduce earnings volatility, supporting greater and more stable revenue growth over time.

Want to see what drives that fair value? Revenue stepping up, margins rebuilding, and a future profit multiple that looks very different to today. Curious which assumptions matter most?

Result: Fair Value of $8.75 (UNDERVALUED)

However, rising vessel operating expenses and US$376 million of debt could pressure margins and limit flexibility if freight rates or cargo volumes soften.

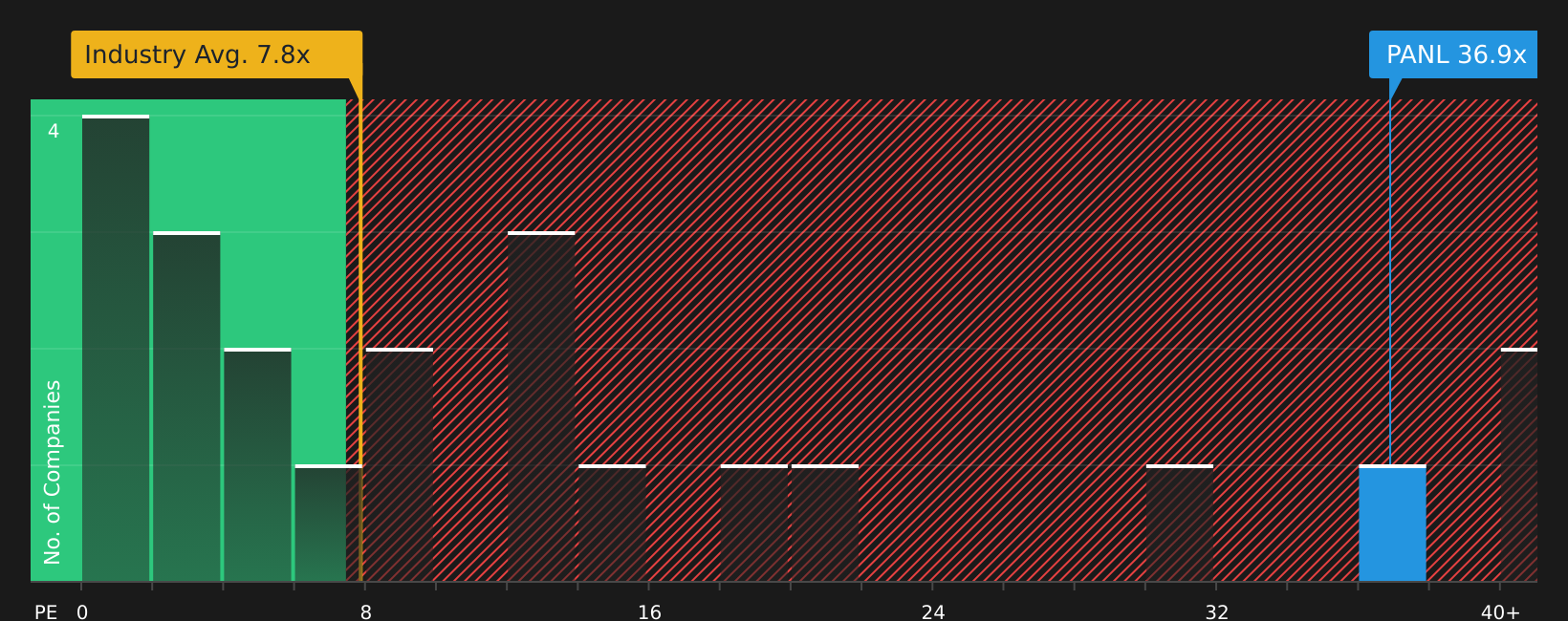

Another View: Earnings Multiple Sends a Different Signal

While the fair value estimate points to upside, the current P/E of 33.9x sits far above both peers at 10.8x and the North American shipping group at 7.1x, yet below a fair ratio of 55.2x. That gap suggests both valuation risk and potential, so which side do you think wins out?

Build Your Own Pangaea Logistics Solutions Narrative

If you see the numbers differently or prefer to piece together your own view from the data, you can build a custom thesis in minutes with Do it your way.

A great starting point for your Pangaea Logistics Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Pangaea has caught your attention, do not stop there. Use the screener to quickly spot other opportunities that fit the way you like to invest.

- Target income today by focusing on these 12 dividend stocks with yields > 3% that aim to pair regular payouts with underlying business strength.

- Capture growth potential at a discount by scanning these 880 undervalued stocks based on cash flows that may be trading below their estimated cash flow value.

- Get early exposure to themes reshaping finance through these 19 cryptocurrency and blockchain stocks that are building around digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.