Please use a PC Browser to access Register-Tadawul

A Look At Payoneer Global (PAYO) Valuation After New Local Payment Services In Indonesia And Mexico

Payoneer Global Inc. PAYO | 5.41 | -0.18% |

Payoneer Global (PAYO) has been in focus after announcing new local collection capabilities in Indonesia and upgraded peso services in Mexico, giving its small and medium sized business customers more options for receiving ecommerce payments.

Those new collection tools arrive after a period where the share price has shown shorter term momentum, with a 30 day share price return of 17.46% and year to date gain of 17.46%, but the 1 year total shareholder return of a 39.72% decline signals longer term holders have had a tougher run.

If Payoneer’s move into more local payment options has caught your eye, this could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With Payoneer reporting annual revenue of US$1.04b and net income of US$72.37m, along with recent product expansions and regulatory progress, the key question is whether the current share price offers potential upside or already reflects future growth.

Most Popular Narrative: 26.4% Undervalued

With Payoneer Global’s fair value narrative at $8.69 versus a last close of $6.39, the current price sits below what this model suggests.

Adoption and expansion of higher margin B2B payments and value added services such as automated accounts payable/receivable and virtual cards are driving take rate expansion, supporting higher revenue and net margin growth as Payoneer continues to move upmarket to serve more complex, multi entity customers globally.

Want to see what sits behind that earnings power story? The narrative leans heavily on revenue compounding, margin uplift, and a richer mix of higher value services. Curious how those pieces connect to that $8.69 fair value and the implied future earnings profile?

Result: Fair Value of $8.69 (UNDERVALUED)

However, that story could be challenged if competition squeezes pricing or if heavy reliance on large ecommerce marketplaces results in more uneven transaction volumes over time.

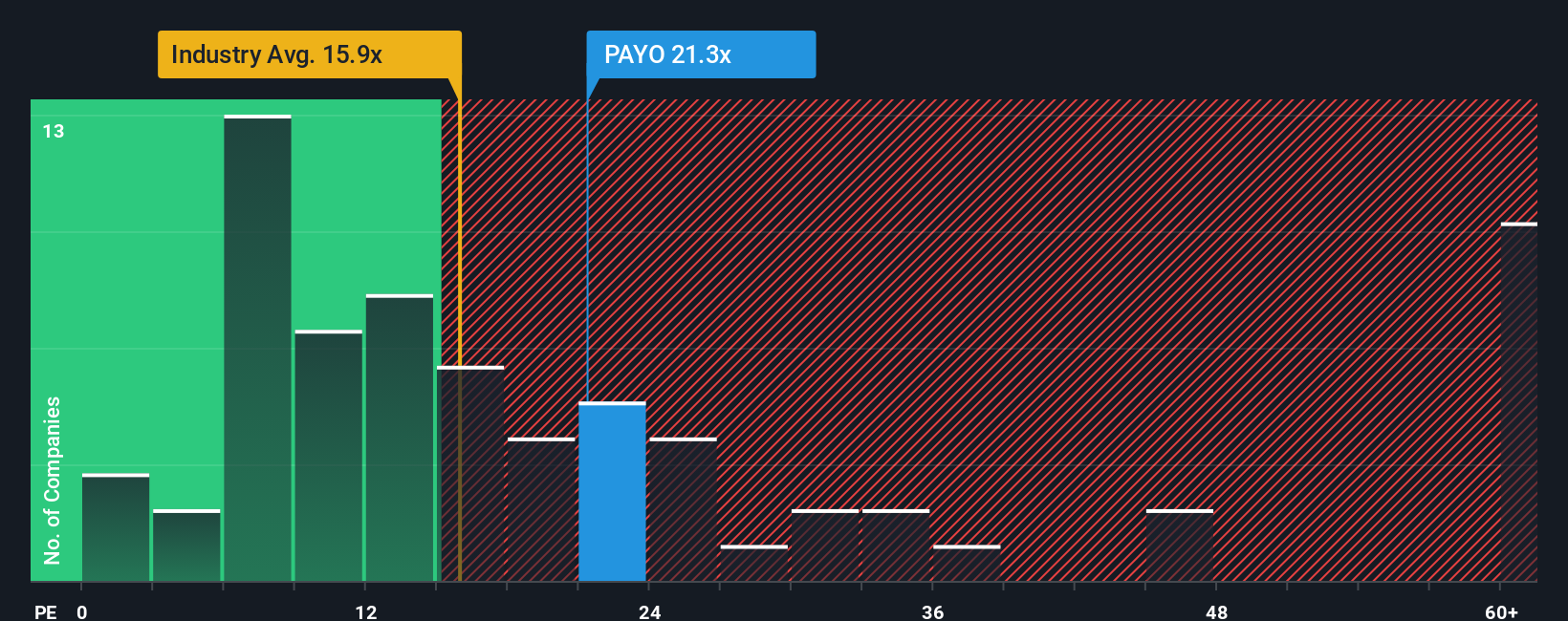

Another View: Earnings Multiple Sends A Different Signal

While the fair value narrative suggests Payoneer Global is 26.4% undervalued at $6.39, the current P/E of 31.5x tells a tougher story. It sits well above the US Diversified Financial industry at 15.3x and the fair ratio of 19x. This points to meaningful valuation risk if expectations slip. Which signal do you put more weight on, the modelled fair value or what today’s multiple implies?

Build Your Own Payoneer Global Narrative

If you look at the numbers and come to a different conclusion, or simply prefer running your own checks, you can quickly build a custom thesis with Do it your way.

A great starting point for your Payoneer Global research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Payoneer is on your radar, do not stop there. Widening your search now can help you spot opportunities that might otherwise slip past you.

- Spot potential high growth names early by scanning these 3528 penny stocks with strong financials that already show stronger financial footing than many peers.

- Tap into the AI trend by filtering for these 24 AI penny stocks that marry cutting edge themes with the transparency of listed companies.

- Hunt for price tags that may not fully reflect underlying cash flows with these 875 undervalued stocks based on cash flows tailored to that exact angle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.