Please use a PC Browser to access Register-Tadawul

A Look At Payoneer Global (PAYO) Valuation After Revenue Beat And Cautious Market Reaction

Payoneer Global Inc. PAYO | 5.41 | -0.18% |

Why Payoneer’s latest earnings are drawing attention

Payoneer Global (PAYO) recently reported quarterly revenue of US$270.9 million, up 9.1% year on year and 2.9% above analyst expectations, yet the stock fell 8.3% and now trades around US$5.31.

The latest earnings beat sits against a weak share price backdrop, with a 30 day share price return of 8.64% and a 1 year total shareholder return decline of 50.18%, which suggests recent momentum has been fading despite continued revenue growth and product adoption.

If Payoneer’s reaction has you reassessing fintech opportunities, it could be a useful moment to see how other payment and finance names stack up against fast growing stocks with high insider ownership.

So with Payoneer beating revenue expectations yet sitting on a 1 year total return decline of 50.18%, is the market overlooking improving fundamentals, or already factoring in all the future growth investors are hoping for?

Most Popular Narrative: 38% Undervalued

With Payoneer Global’s fair value in the most followed narrative at US$8.69 versus a last close of US$5.39, the gap between price and narrative value is wide, and it rests on some specific growth and margin assumptions.

“Ongoing investment in blockchain and stablecoin infrastructure, paired with regulatory clarity (e.g., the Genius Act), positions Payoneer to innovate in real-time cross-border treasury management. This could lower transaction costs, broaden addressable use cases, and support future margin expansion. An emphasis on international market diversification (e.g., targeting rest-of-world B2B growth outside China and supporting Chinese merchants selling globally) reduces reliance on any single trade corridor, enhancing earnings resilience while growing customer balances and future revenue potential.”

Curious how that valuation gets built? Revenue growth assumptions, margin shifts, and a richer earnings profile all sit at the core of this story. The key is how far earnings might scale and what kind of earnings multiple that could justify.

Result: Fair Value of $8.69 (UNDERVALUED)

However, it is worth keeping in mind that faster adoption of low cost blockchain payments or slower marketplace volume growth could challenge the margin and earnings thesis that investors are watching.

Another Angle On Valuation

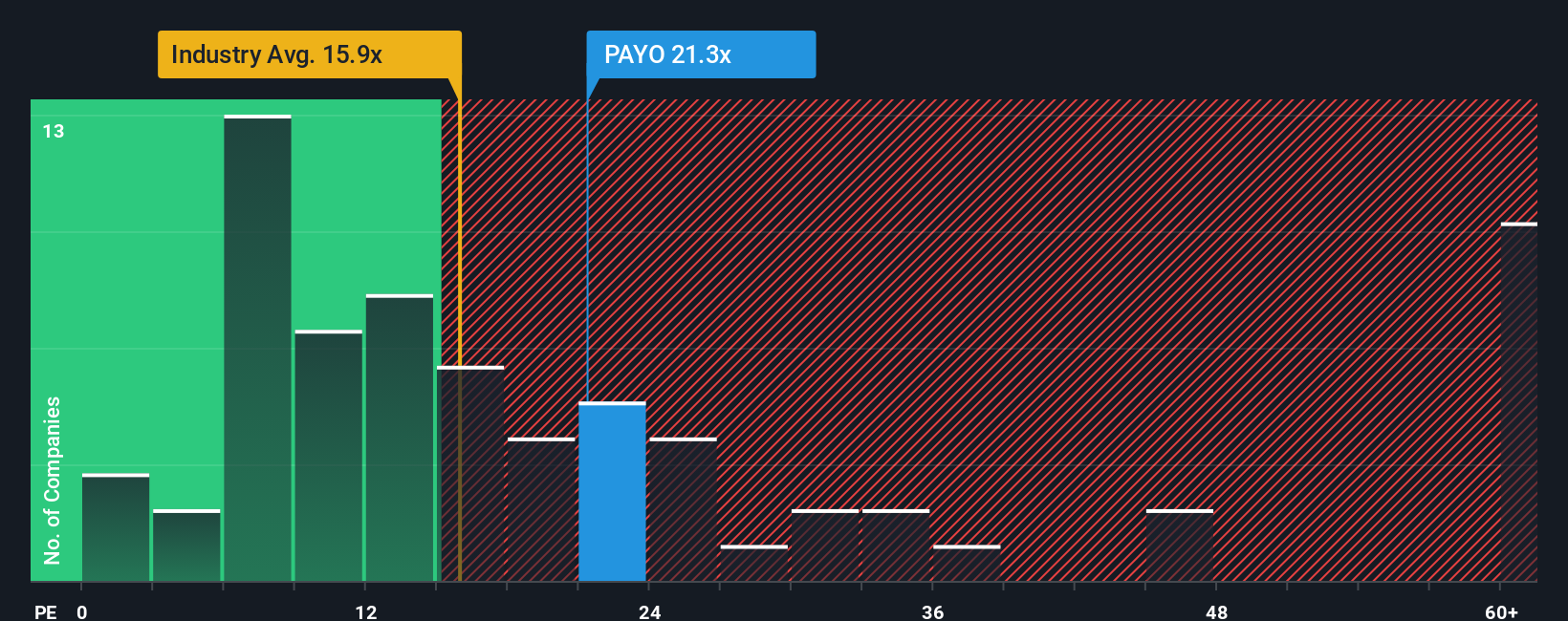

That 38% narrative discount paints Payoneer as undervalued, yet the current P/E of 26.5x sits well above both the US Diversified Financial industry at 14.7x and the fair ratio of 18.2x, even while it is below the peer average of 42.3x. This raises the question of whether the gap points to upside potential or to valuation risk if sentiment cools.

Build Your Own Payoneer Global Narrative

If you see the numbers differently or prefer to work from your own research, you can build a custom view of Payoneer in just a few minutes, starting with Do it your way.

A great starting point for your Payoneer Global research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Payoneer has sharpened your focus on where to put fresh capital, do not stop here, the next stock that fits your checklist could be one screen away.

- Spot potential value candidates by scanning these 863 undervalued stocks based on cash flows that might align with the kind of price to fundamentals profile you are looking for.

- Zero in on future facing themes by checking out these 24 AI penny stocks that tie artificial intelligence to real business models and listed companies.

- Add sharper yield ideas to your watchlist by filtering for these 12 dividend stocks with yields > 3% that could complement growth focused names in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.