Please use a PC Browser to access Register-Tadawul

A Look At Photronics (PLAB) Valuation After Recent Strong Buy Analyst Upgrades

Photronics, Inc. PLAB | 34.57 | -2.01% |

Photronics (PLAB) has been in focus after recent analyst reports moved the stock into a Strong Buy category, while the company also introduced several senior leadership changes that could influence how investors assess its next phase.

The recent leadership changes arrive as Photronics shares trade at US$34.72, with a 90 day share price return of 44.71% and a 1 year total shareholder return of 53.40%, indicating that momentum has been building rather than fading.

If Photronics has caught your eye, this can be a good moment to see what else is moving in chips and hardware through high growth tech and AI stocks.

With analysts firmly in the Strong Buy camp and a price target above the current US$34.72 level, the key question is whether Photronics is still on sale or if the market is already pricing in future growth.

Most Popular Narrative: 17.3% Undervalued

With the most followed narrative putting fair value at $42.00 versus the last close of $34.72, the story centers on how much of Photronics' future the market is already factoring in.

Strategic investments in U.S. capacity and cutting-edge production (multi-beam mask writer and Texas facility expansion) position Photronics to benefit as major semiconductor fabrication and reshoring initiatives are realized, supporting future revenue growth and margin expansion.

Ongoing and planned technological upgrades in Asia (extension to 6nm and 8nm nodes) enable Photronics to participate in next-generation chip production for edge AI, automotive, and communications, creating new high-value growth streams and potential revenue share gains as industry complexity increases.

Want to see what turns those capacity bets into that $42.00 fair value? Revenue assumptions, margin shifts, and a punchy earnings multiple all sit under the hood.

Result: Fair Value of $42 (UNDERVALUED)

However, this hinges on geopolitical tensions staying manageable, and on heavy capital spending not turning into a drag if demand or advanced-node adoption disappoints.

Another View: Cash Flows Paint A Tougher Picture

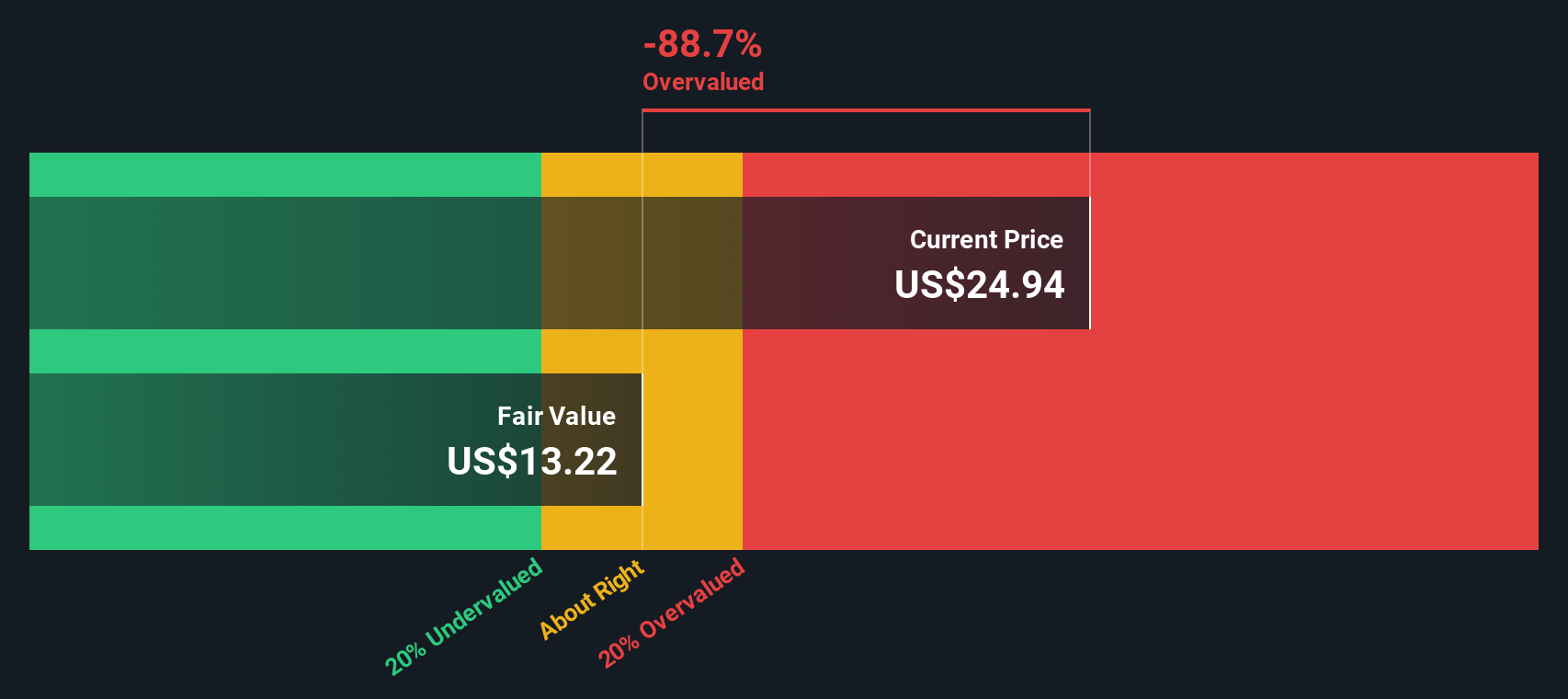

While the narrative fair value of $42.00 suggests Photronics is 17.3% undervalued, our DCF model points the other way, with an estimated future cash flow value of $19.01 at a share price of $34.72. That gap raises a simple question: which story do you trust more, earnings or cash flows?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Photronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Photronics Narrative

If you see the numbers differently or prefer to stress test your own assumptions, you can build a custom narrative in just a few minutes with Do it your way.

A great starting point for your Photronics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Photronics is just the starting point for you, now is the time to widen your watchlist and compare it with other focused ideas across the market.

- Spot potential high risk high reward ideas early by scanning through these 3523 penny stocks with strong financials that already meet basic financial quality checks.

- Ride the AI wave with sharper focus by checking these 23 AI penny stocks that are already filtered for this theme instead of scrolling through endless tickers.

- Target price and value alignment by reviewing these 874 undervalued stocks based on cash flows that are pre sorted using cash flow based metrics so you do not miss candidates outside your usual watchlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.