Please use a PC Browser to access Register-Tadawul

A Look At Pulse Biosciences (PLSE) Valuation After Its Recent Share Price Surge

Pulse Biosciences, Inc. PLSE | 21.42 | -14.59% |

What Pulse Biosciences’ Recent Move Might Be Telling You

Pulse Biosciences (PLSE) has attracted fresh attention after a sharp recent move in its share price, with short term returns outpacing its past year performance and prompting investors to reassess the risk and reward trade off.

The 51.6% 1 day share price return, on top of a 35.4% 90 day share price return and a 55.0% year to date share price return, contrasts with a 7.2% decline in 1 year total shareholder return. At the same time, the 3 year total shareholder return is very large, suggesting recent momentum is rebuilding after a tougher stretch.

If this kind of sharp move has your attention, it could be a good moment to broaden your watchlist with 26 healthcare AI stocks that may offer different risk and return profiles to Pulse Biosciences.

With the share price rising to US$20.75 and trading about 25% below a US$26 analyst target while the company still reports a US$74.7m net loss, is this a genuine opportunity or is potential future growth already reflected in the price?

Most Popular Narrative: 5.7% Undervalued

The most followed narrative currently points to a fair value of $22 for Pulse Biosciences, slightly above the last close at $20.75. This helps explain why some investors see the recent share price jump as part of a bigger story rather than a one off move.

Early commercial traction of the nPulse Vybrance system in benign thyroid nodule ablation, supported by growing procedure volumes and positive physician feedback, positions the company to convert existing thyroidectomy volume and unlock a large base of watchful waiting patients, which should accelerate revenue growth and increase recurring disposable sales.

Curious how that growth runway could support a higher valuation? This narrative leans heavily on rapid revenue expansion, margin improvement and a rich future earnings multiple to bridge the gap to its fair value.

Result: Fair Value of $22 (UNDERVALUED)

However, this story can change quickly if clinical data fail to stand out against existing treatments, or if high costs and low revenue keep cash burn elevated.

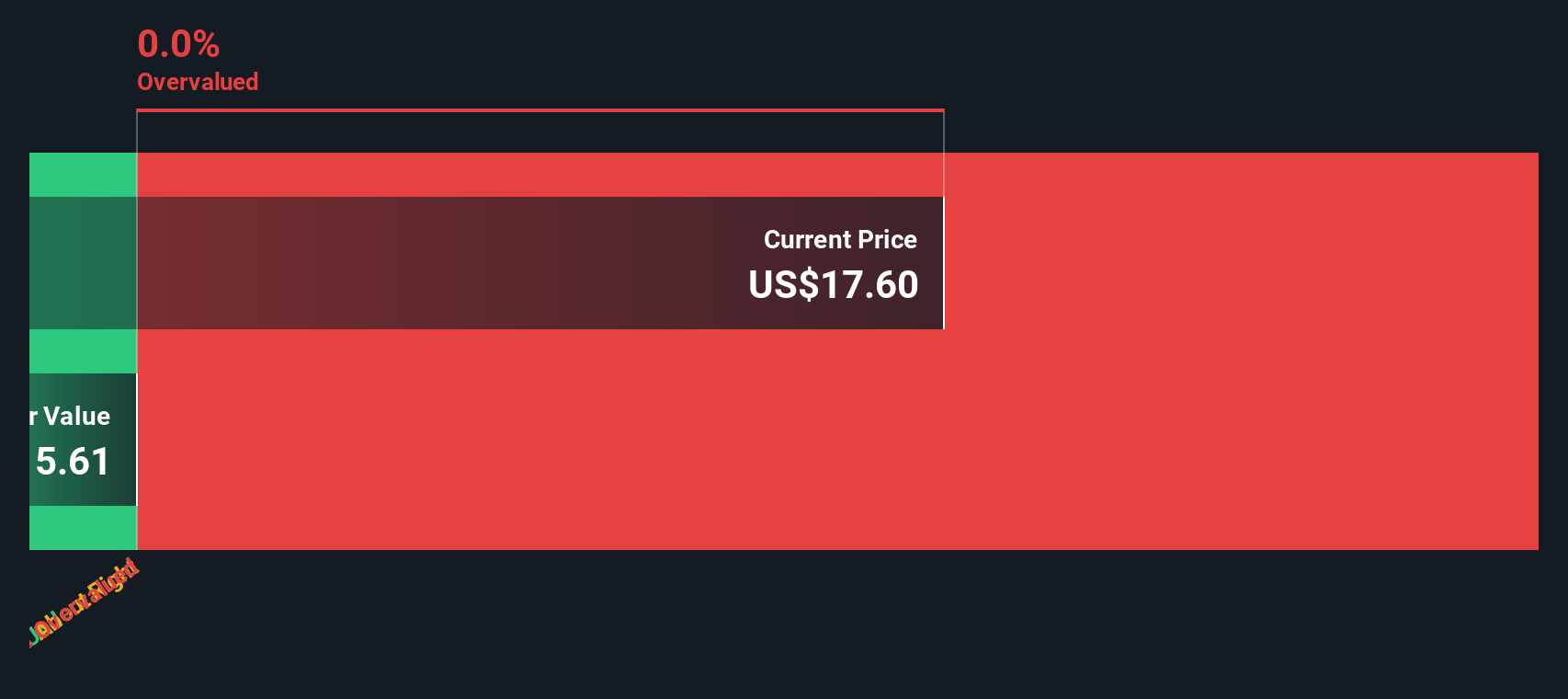

Another View: Market Price Well Ahead of Cash Flows

If you zoom out from the $22 fair value narrative and look at our DCF model, you get a very different picture. On this approach, Pulse Biosciences at $20.75 screens as expensive, with our estimate of future cash flow value closer to $2.66. That kind of gap can cut both ways for risk and reward. Which story do you find more convincing?

Build Your Own Pulse Biosciences Narrative

If you see the data pointing in a different direction or simply prefer to test your own assumptions, you can build a custom thesis in just a few minutes by starting with Do it your way.

A great starting point for your Pulse Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Pulse Biosciences is on your radar, do not stop there. Widening your opportunity set with a few focused screens can reveal very different risk return trade offs.

- Spot potential mispricings early by scanning our list of 52 high quality undervalued stocks that pair solid fundamentals with prices that may not fully reflect their financial profile.

- Lock in income ideas by reviewing 14 dividend fortresses that aim to combine higher yields with businesses built to keep paying through different conditions.

- Reduce portfolio stress by filtering for 83 resilient stocks with low risk scores that our model flags with lower risk scores so you are not only chasing headline moves.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.