Please use a PC Browser to access Register-Tadawul

A Look At Ryan Specialty Holdings (RYAN) Valuation After Analyst Target Cuts And Softer Insurance Market Commentary

Ryan Specialty Holdings, Inc. Class A RYAN | 47.62 | -1.38% |

Ryan Specialty Holdings (RYAN) has come into focus after several analysts, including Cantor Fitzgerald and Barclays, trimmed their expectations for the stock, citing softer commercial and reinsurance markets and potential near term fundamental pressure.

Ryan Specialty Holdings’ recent move to a US$51.48 share price comes after analyst commentary on softer commercial and reinsurance conditions. A 1-year total shareholder return decline of 22.12% contrasts with a 24.35% gain over three years, suggesting momentum has cooled in the short term while the longer record remains positive.

If you are reassessing insurance exposure after these revisions, it could be a useful moment to broaden your search and check out fast growing stocks with high insider ownership.

So with analyst targets still sitting above the current US$51.48 share price and recent returns under pressure, is Ryan Specialty starting to look undervalued here or is the market already pricing in its future growth?

Most Popular Narrative: 22.6% Undervalued

With Ryan Specialty Holdings’ fair value in the most followed narrative sitting at US$66.53 against a US$51.48 share price, the story centers on how future earnings and margins might bridge that gap.

The company's continued expansion into higher-margin specialty lines, especially through product launches in alternative and complex risks, and acquisition of niche MGUs, should increase the contribution from diverse, less commoditized business, stabilizing and growing earnings even when traditional property pricing cycles are volatile.

Curious what makes this premium insurance broker model support a higher valuation? Revenue growth assumptions, margin expansion and a future earnings multiple all play key roles, but the exact mix might surprise you.

Result: Fair Value of $66.53 (UNDERVALUED)

However, you also need to weigh softer property and casualty pricing and the risk that heavy investment and M&A fail to translate into the margin uplift that analysts expect.

Another View: Earnings Multiple Sends A Different Signal

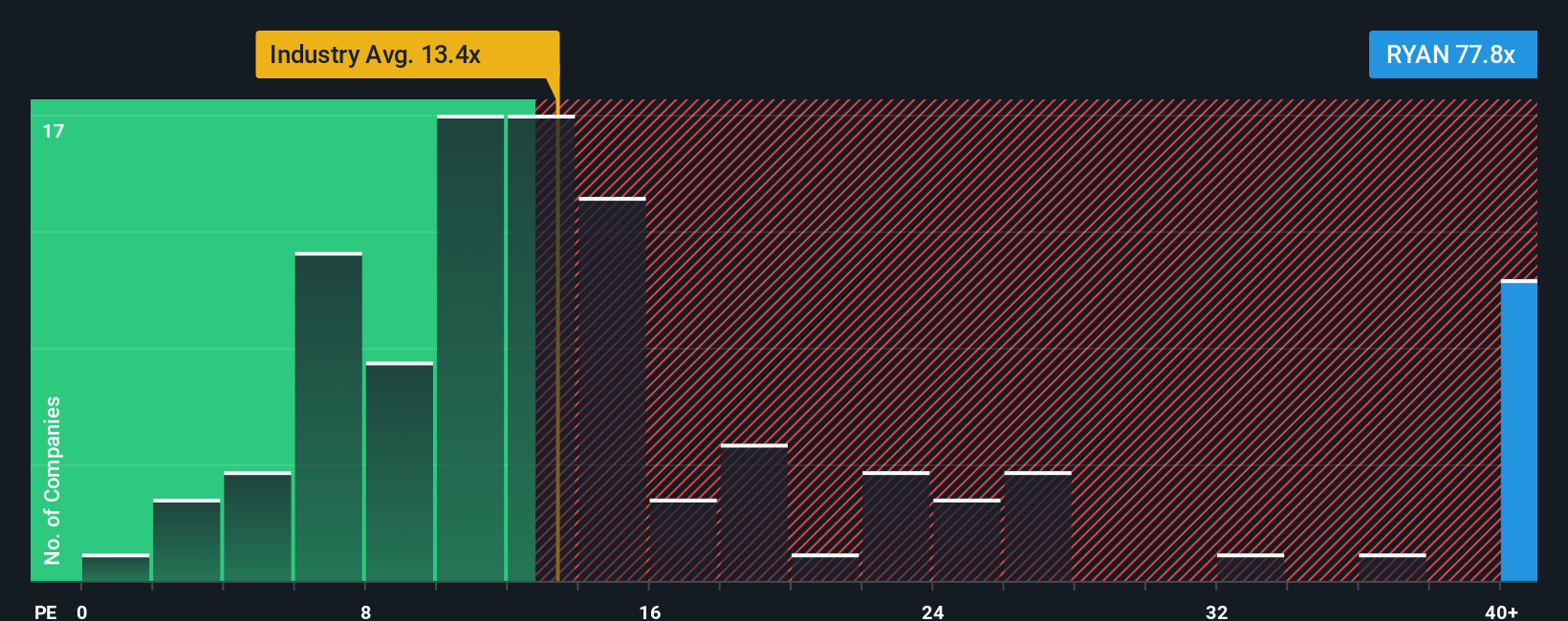

Our SWS DCF model suggests Ryan Specialty Holdings at US$51.48 is trading about 60.7% below an estimated fair value of US$131.06, which points to an undervalued picture. Yet the current 94x P/E sits far above a fair ratio of 27.6x, the US Insurance industry at 12.6x, and peers at 34.9x. That mix of looking cheap on cash flows but expensive on earnings raises a simple question: which lens do you trust more right now?

Build Your Own Ryan Specialty Holdings Narrative

If you look at the numbers and come to a different conclusion, you can still test your own view and build a full narrative in just a few minutes, starting with Do it your way.

A great starting point for your Ryan Specialty Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Ryan Specialty has you thinking harder about where your next opportunity comes from, do not stop here. Broaden your watchlist and test fresh ideas.

- Spot potential value plays early by scanning these 875 undervalued stocks based on cash flows that screen for stocks priced below their estimated cash flow value.

- Explore high growth themes by checking out these 24 AI penny stocks that focus on businesses tied to artificial intelligence trends.

- Strengthen your income stream with these 12 dividend stocks with yields > 3% that focus on companies offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.