Please use a PC Browser to access Register-Tadawul

A Look At Ryan Specialty Holdings (RYAN) Valuation As Earnings Near And Regulatory And AI Risks Mount

Ryan Specialty Holdings, Inc. Class A RYAN | 41.30 | -0.07% |

Ryan Specialty Holdings (RYAN) is heading into an earnings report with attention sharpened by several moving pieces, including contentious Florida insurance legislation, new insurance focused AI tools, and a fresh expansion push in Canada.

Despite the headline risk around Florida legislation and questions about how new AI tools could affect brokerage models, Ryan Specialty’s 1 day share price return of 2.51% to US$44.88 comes after a 30 day share price return decline of 11.65% and a year to date share price return decline of 11.32%, while the 1 year total shareholder return decline of 32.12% contrasts with a 3 year total shareholder return of 7.52%, suggesting recent momentum has been fading even as longer term investors remain modestly ahead overall.

If regulatory headlines and earnings season are pushing you to widen your watchlist, it could be a good time to scan 23 top founder-led companies for fresh ideas beyond insurance brokers.

With the shares sitting well below analyst targets yet recent returns under pressure, the real question is whether Ryan Specialty is quietly trading at a discount or if the market is already pricing in everything that comes next.

Most Popular Narrative: 32.5% Undervalued

Ryan Specialty’s most followed narrative points to a fair value of $66.53 versus the last close at $44.88, framing a sizable valuation gap that hinges on how its specialty growth story and margin potential play out over time.

The increasing complexity and frequency of emerging risks, such as large-scale catastrophes, social inflation in casualty lines, and rising exposures in cyber and liability, are driving a steady migration of business into specialty markets, positioning Ryan Specialty to capture sustained growth in submission flows and premium volumes, directly supporting revenue expansion over the long term.

Want to see what kind of revenue trajectory and margin uplift that specialty shift is banking on? The narrative leans on ambitious earnings expansion, richer profitability and a future valuation multiple that has to compress meaningfully from today’s level to make the numbers work. If you are curious how those moving parts stack up to reach that fair value, the full story is worth a closer look.

Result: Fair Value of $66.53 (UNDERVALUED)

However, the story can change quickly if softening property and casualty pricing drags on, or if acquisitions fail to integrate cleanly and dilute margins.

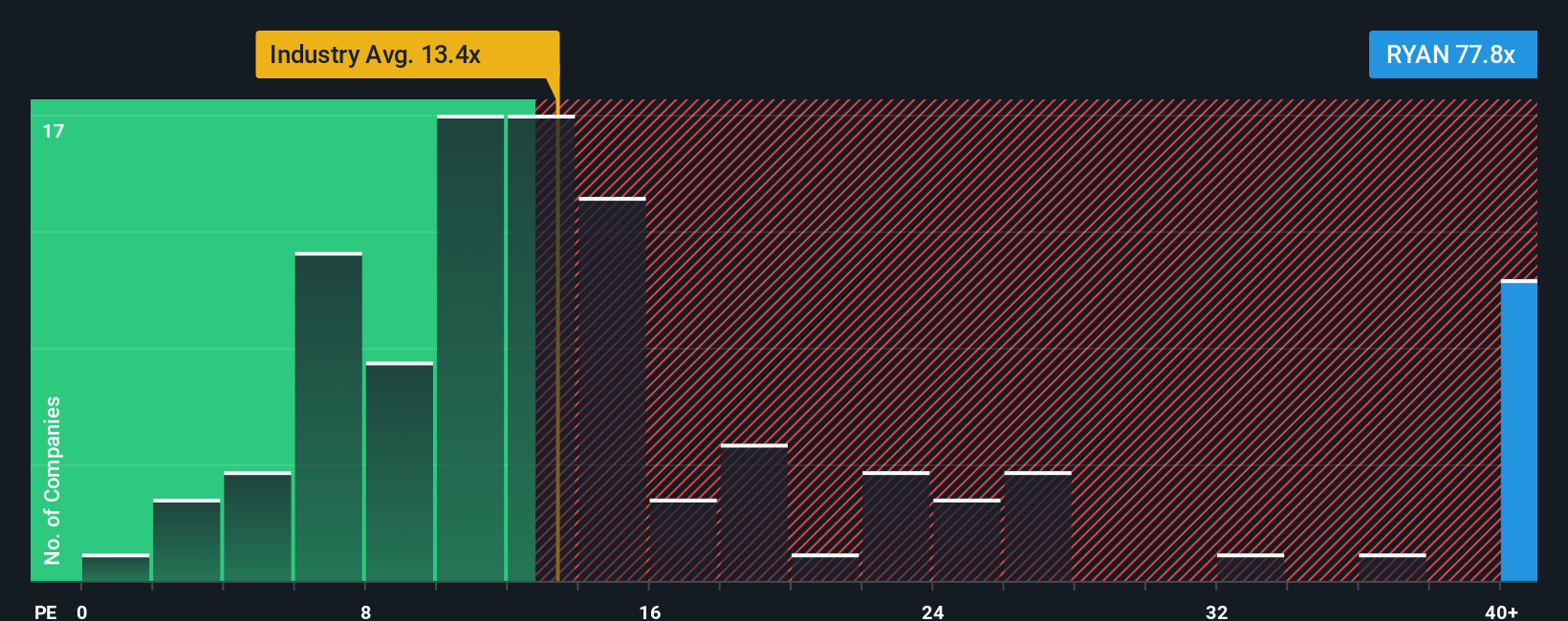

Another Angle On Valuation

Here is the tension. On one hand, Ryan Specialty screens as good value relative to our estimate of future cash flow value at $135.59, with the current $44.88 share price trading 66.9% below that level. On the other hand, the current 82x P/E is far above the US Insurance industry at 12.6x, the peer average at 29x, and an estimated fair ratio of 30.9x. This raises the question of whether the market is putting too much weight on long term earnings forecasts.

Build Your Own Ryan Specialty Holdings Narrative

If you see Ryan Specialty differently or prefer to weigh the data firsthand, you can build a tailored view in just a few minutes: Do it your way.

A great starting point for your Ryan Specialty Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Ryan Specialty has sharpened your thinking, do not stop here. The right screener can surface other opportunities that fit your style and risk comfort.

- Spot potential mispricings early by reviewing our list of 51 high quality undervalued stocks that currently line up with solid fundamentals and measured expectations.

- Lock in potential income streams by scanning 14 dividend fortresses, focused on companies offering yields that stand out without ignoring underlying financial strength.

- Prioritize resilience by checking 83 resilient stocks with low risk scores, highlighting businesses that our model assesses as having relatively lower overall risk profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.