Please use a PC Browser to access Register-Tadawul

A Look At Ryman Hospitality Properties (RHP) Valuation After Expanded Credit Facility And Extended Maturity

Ryman Hospitality Properties, Inc. RHP | 104.85 | +1.74% |

Ryman Hospitality Properties (RHP) caught investor attention after refinancing its revolving credit facility, lifting total capacity to US$850 million and extending the maturity to January 2030 while keeping pricing largely unchanged.

The refinancing headlines come after a mixed stretch for the stock, with a 1-day share price return of 1.26% at US$94.66, set against a 90-day share price return of 8.92% and a 1-year total shareholder return decline of 5.89%. Together, these figures indicate that recent momentum has picked up compared with the longer term.

If this kind of balance sheet move has your attention, it could be a moment to widen your watchlist and look at fast growing stocks with high insider ownership.

With Ryman trading around US$94.66 and an indicated analyst price target near US$112, plus an internal estimate suggesting a wider intrinsic discount, you have to ask: is this an overlooked value, or is the market already pricing in future growth?

Most Popular Narrative: 15.5% Undervalued

With Ryman Hospitality Properties at $94.66 versus a widely followed fair value narrative around $112, the current share price sits meaningfully below that reference point.

Recent acquisitions and ongoing capital investments (e.g., JW Marriott Desert Ridge, meeting space upgrades at Gaylord properties) put Ryman in a strong position to capitalize on renewed appetite for large-scale experiential travel and gatherings, supporting revenue growth and long-term cash flow.

Curious what earnings path and revenue mix are baked into that fair value, and how margins and future multiples fit together? The narrative spells out a detailed set of growth, profitability, and valuation assumptions that connect today’s price to that higher number. The full picture only really clicks when you see how those moving parts interact over the next few years.

Result: Fair Value of $112.07 (UNDERVALUED)

However, you also have to weigh risks related to higher competition in core markets, as well as the impact of structurally higher interest rates on funding costs and cash flow flexibility.

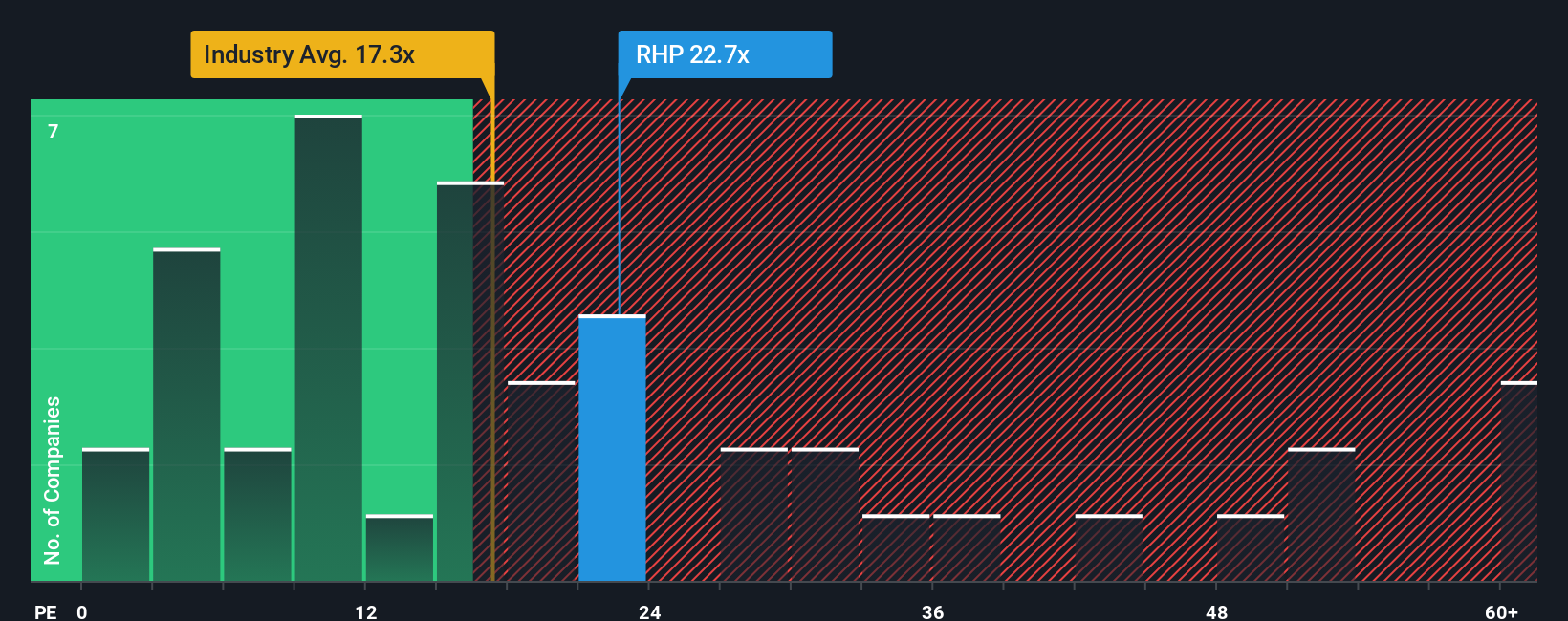

Another View: What The P/E Ratio Is Saying

Our cash flow based fair value of $206.80 suggests Ryman looks undervalued, but the P/E ratio tells a tighter story. At 24.7x earnings, the shares trade above both peer averages of 23.2x and the global Hotel and Resort REITs at 15.1x, yet below our fair ratio of 36x. This raises the question of whether the current valuation represents a reasonable compromise or a discrepancy that may eventually narrow.

Build Your Own Ryman Hospitality Properties Narrative

If you see the story differently or simply prefer to test the assumptions yourself, you can build your own view in just a few minutes, starting with Do it your way.

A great starting point for your Ryman Hospitality Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Ryman has sparked your curiosity, do not stop here, use the screener to spot other opportunities that fit your style before the crowd catches on.

- Target reliable cash flows by scanning for income focused ideas through these 14 dividend stocks with yields > 3% that might suit a steady return profile.

- Back bold growth themes by filtering for future focused companies in these 25 AI penny stocks where artificial intelligence is central to their business story.

- Position ahead of potential shifts by checking these 18 cryptocurrency and blockchain stocks for businesses tied to digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.