Please use a PC Browser to access Register-Tadawul

A Look at Scholar Rock (SRRK) Valuation Following FDA Delay of Apitegromab’s Approval

SCHOLAR ROCK HOLDING CORP SRRK | 46.87 46.87 | +0.09% 0.00% Pre |

If you are watching Scholar Rock Holding (SRRK), Tuesday’s FDA decision likely gave you a moment of pause. The agency issued a Complete Response Letter for the company’s application to bring apitegromab, its lead candidate for spinal muscular atrophy, to market. The key thing to note is that the FDA’s rejection did not stem from concerns about the drug’s efficacy or safety. Instead, the stumbling block was related to manufacturing, specifically observations from an inspection of a third-party facility. Scholar Rock plans to address these issues and resubmit. For now, the drug’s launch is delayed.

The market’s reaction was far from panic. Despite an initial drop of around 15% in premarket trading, SRRK shares actually closed up for the day. This suggests growing optimism that the setback is temporary rather than fundamental. Over the past year, Scholar Rock’s stock has posted a 3% gain and delivered solid multi-year returns, even though 2025 hasn’t been smooth sailing. The price action shows momentum might be shifting, especially since long-term growth prospects depend on bringing apitegromab to market.

With all this movement and the company’s confident plan to refile, investors may wonder whether this delay could be an opportunity for those banking on future growth, or if the current price already reflects the potential upside.

Price-to-Book of 16x: Is it justified?

Scholar Rock Holding trades at a price-to-book ratio of 16, positioning it as more expensive than the average US biotech company on this metric. This suggests investors have higher expectations for future growth or value realization compared to industry peers.

The price-to-book ratio compares a company's market value to its net assets, offering a snapshot of how much investors are willing to pay for each dollar of book value. In the biotech sector, where earnings may be volatile and companies are often unprofitable, this ratio helps gauge whether optimism about future breakthroughs is already priced in.

The high multiple signals that the market may be overestimating near-term business fundamentals, potentially overlooking the company's unprofitable status and limited current revenues. Unless Scholar Rock delivers stronger financial results soon, the premium could become hard to justify.

Result: Fair Value of $38.75 (OVERVALUED)

See our latest analysis for Scholar Rock Holding.However, persistent unprofitability and the possibility of further regulatory setbacks could quickly dampen the currently optimistic outlook for Scholar Rock’s future.

Find out about the key risks to this Scholar Rock Holding narrative.Another View: Our DCF Model Offers a Different Take

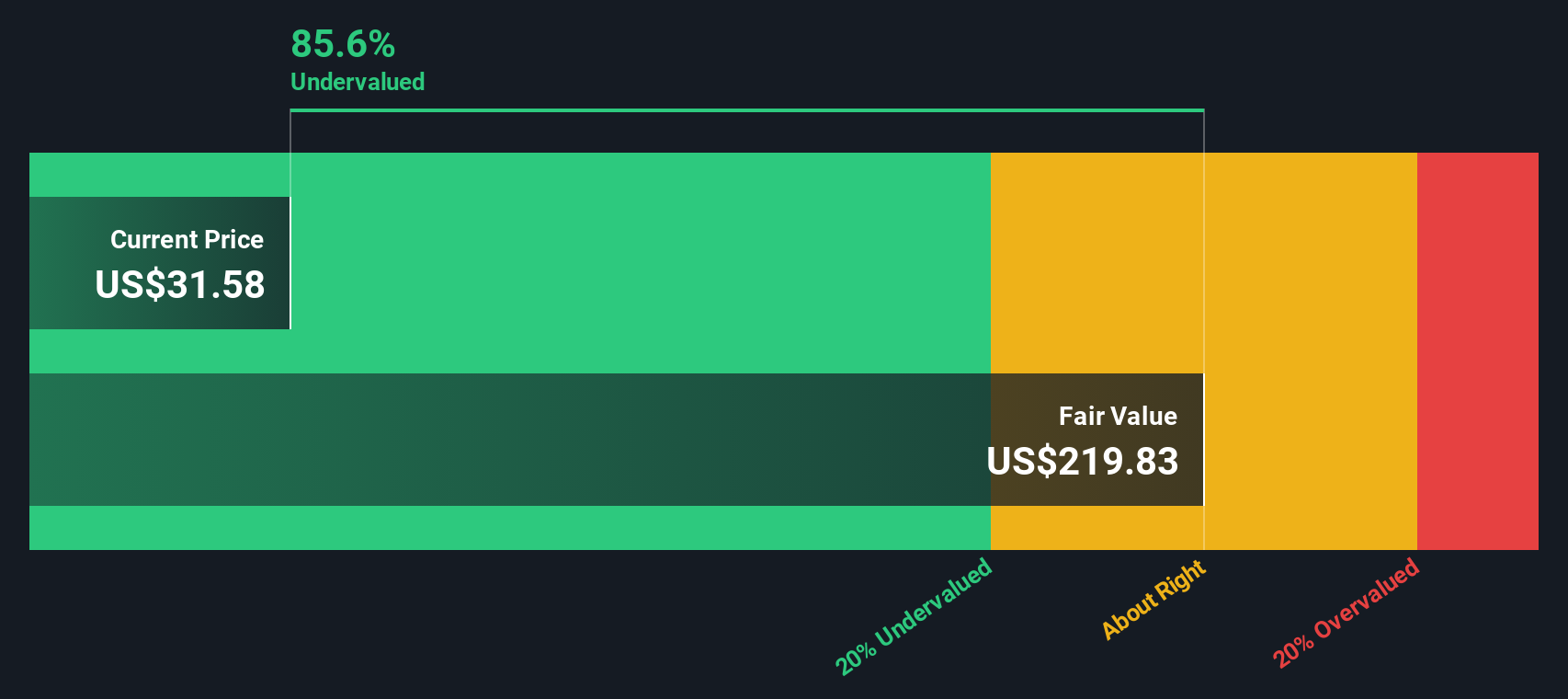

Looking beyond traditional multiples, the SWS DCF model paints a far more positive picture. This approach suggests Scholar Rock might actually be undervalued, which stands in stark contrast to what the current price-to-book suggests. Which view will play out?

Build Your Own Scholar Rock Holding Narrative

If you see things differently or want to reach your own conclusions, you can shape a personalized view with your own research in just a few minutes. Do it your way

A great starting point for your Scholar Rock Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investment Moves?

Don’t let your research stop here. The market is full of fresh ideas. Use Simply Wall Street’s screener to uncover standout stocks in sectors that matter now and get ahead of the next trend.

- Boost your portfolio’s potential with strong, undervalued stocks based on cash flows trading below their true worth and poised for future growth.

- Uncover fast-rising opportunities by targeting companies making waves in artificial intelligence with our pick of AI penny stocks.

- Jump into the future of finance and technology by scouting top names revolutionizing digital currencies via handpicked cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.