Please use a PC Browser to access Register-Tadawul

A Look at ServiceTitan (TTAN) Valuation Following Major AI Launch and Affirm Partnership

ServiceTitan TTAN | 104.07 | -1.85% |

Big moves are happening at ServiceTitan (TTAN), and investors are right to pay attention. The company just launched an ambitious set of AI-powered tools, including its new Atlas feature. These innovations promise contractors end-to-end automation and smarter business decisions. In addition, ServiceTitan’s new partnership with Affirm means contractors can now offer clients flexible payment options. This expands ServiceTitan’s appeal at a critical time for the trades software market.

The excitement around these announcements seems to have rippled into recent trading. Over the month, ServiceTitan’s share price has gained nearly 6%, and it is up around 9% since the start of the year. Previous news, such as its recent commercial and product launches, have added to the positive momentum, even as significant investors like Bessemer Venture Partners have made measured share sales. The stock is gaining attention for both its growth potential and shifting risk profile.

After this run-up, the core question is clear: Is ServiceTitan offering an entry point for investors who believe in its innovation story, or is the market already pricing in all the future upside?

Price-to-Sales of 11.9x: Is it justified?

ServiceTitan is currently valued at a price-to-sales (P/S) ratio of 11.9, which is significantly higher than both peer and industry averages. This suggests the stock is priced at a notable premium relative to the company’s revenue generation.

The price-to-sales multiple measures how much investors are willing to pay for each dollar of revenue. It is especially important for companies in the software sector, where rapid revenue growth and high margins are often central to investment decisions. For unprofitable, high-growth companies like ServiceTitan, P/S is often used in place of earnings-based metrics.

Given ServiceTitan's revenue growth and product momentum, the market appears to be pricing in substantial future expansion. However, this premium valuation may indicate that expectations for future revenue and margin improvement are already reflected in the current share price. This could mean there is less room for upside unless performance exceeds forecasts.

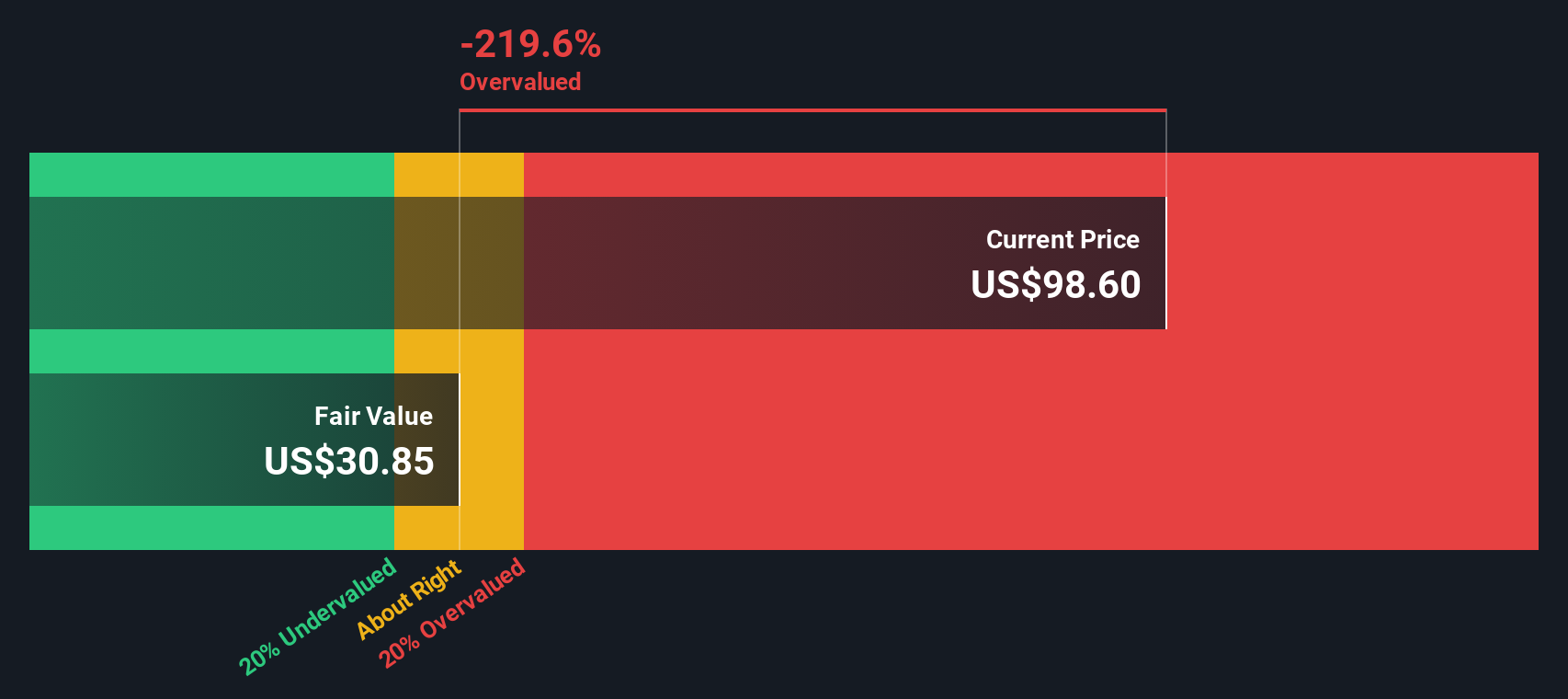

Result: Fair Value of $30.66 (OVERVALUED)

See our latest analysis for ServiceTitan.However, slowing revenue growth or continued net losses could challenge the optimism around ServiceTitan and limit the stock's ability to sustain its premium valuation.

Find out about the key risks to this ServiceTitan narrative.Another View: What Does the SWS DCF Model Say?

While the price-to-sales ratio paints ServiceTitan as expensive, our SWS DCF model reaches a similar verdict. This approach factors in expected cash flows instead of just revenue. However, does using a different lens really mean a different story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ServiceTitan Narrative

If you have your own perspective or want to dig into the numbers yourself, it's easy to assemble your own narrative and test your views in minutes. Do it your way

A great starting point for your ServiceTitan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Winning Stock Ideas?

Don't let a single opportunity slip by. Simply Wall Street's powerful screener gives you handpicked investment angles you might never have considered. Give your portfolio a fresh boost with ideas that fit your strategy.

- Spot income potential by targeting top choices among dividend stocks with yields > 3% yielding over 3%, providing opportunities for growing consistent cash flow.

- Seize the momentum in future tech by focusing on promising AI penny stocks that are pushing the boundaries in artificial intelligence.

- Tap into the market’s hidden gems by discovering undervalued stocks based on cash flows trading below their intrinsic value based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.