Please use a PC Browser to access Register-Tadawul

A Look At ServisFirst Bancshares (SFBS) Valuation After Strong Q4 Results And Dividend Increase

ServisFirst Bancshares Inc SFBS | 86.77 | +1.74% |

What sparked the latest move in ServisFirst Bancshares (SFBS)?

ServisFirst Bancshares (SFBS) shares moved sharply after fourth quarter 2025 earnings topped revenue and profit forecasts, with management pointing to loan growth, wider net interest margins, tighter costs, and a higher dividend.

The recent earnings jump and dividend increase came after a period where the share price has been firming, with a 30 day share price return of 11.41% and a 90 day share price return of 15.59%. This is even though the 1 year total shareholder return is 5.51% lower and the 5 year total shareholder return is up 116.21%, which suggests shorter term momentum has picked up again after a softer patch for long term holders.

If strong bank results have you looking wider across financials, it could be a good moment to see what stands out among solid balance sheet and fundamentals stocks screener (None results).

With the shares up strongly on the back of a robust quarter, SFBS now trades around $81.99 while some models point to an intrinsic discount of about 42%. So is this still a mispriced regional bank, or are markets already factoring in future growth?

Most Popular Narrative: 6.8% Undervalued

ServisFirst Bancshares' most followed narrative puts fair value at $88, a bit above the recent $81.99 close, framing the latest share price jump against a still modest discount.

Expansion of commercial lending teams and ongoing hiring in key Southeastern markets positions the company to capitalize on robust population and business growth in the Sun Belt, supporting above-average organic loan and deposit growth, which is likely to drive top-line revenue and long-term earnings growth.

Want to see what kind of revenue runway that Sun Belt build out implies, and how it feeds into margin assumptions and future earnings power? The most followed narrative lays out a detailed growth path with explicit targets for revenue, profits, and the valuation multiple needed to justify that $88 figure. If you are curious which earnings and margin mix needs to hold for that fair value to stack up, the full story goes into those numbers chapter and verse.

Result: Fair Value of $88 (UNDERVALUED)

However, rising credit costs and ongoing pressure in commercial real estate or deposits could easily knock this earnings path and implied upside off course.

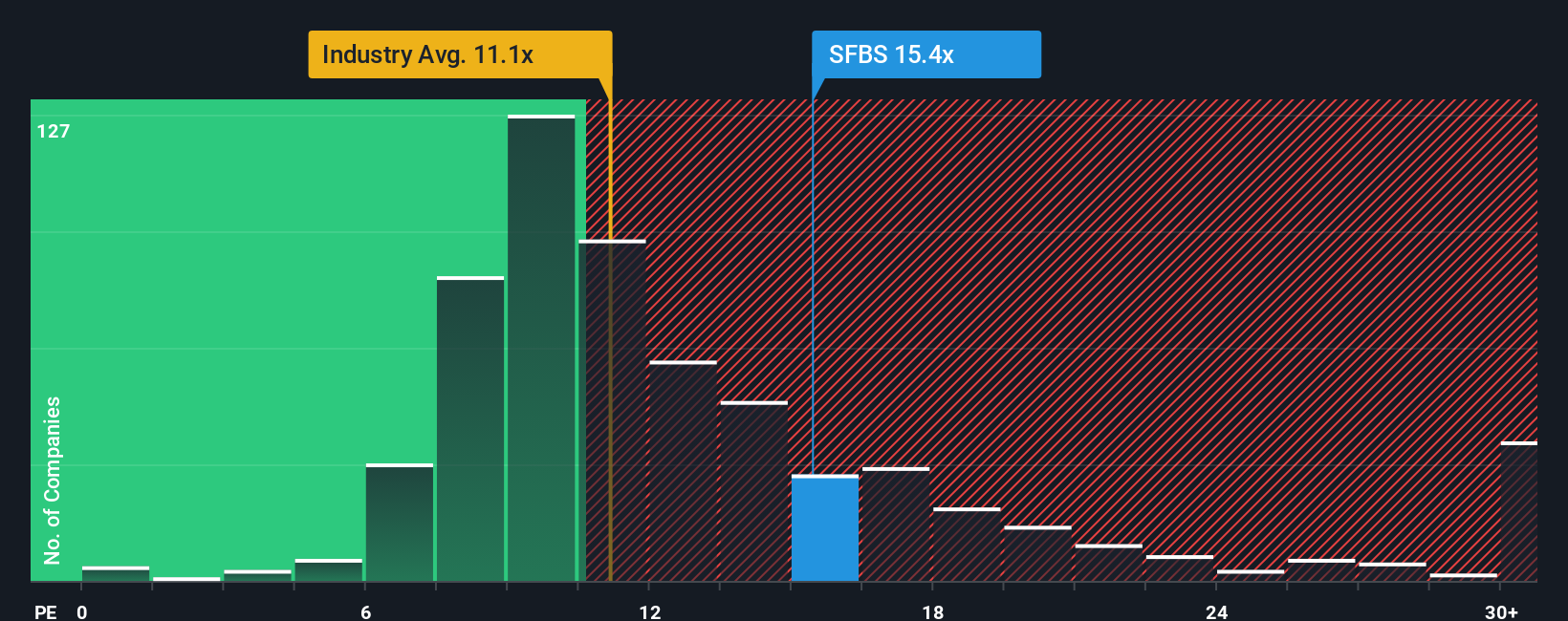

Another View: What Does The P/E Ratio Say?

While one model points to a fair value of $88, the current picture from earnings multiples is less generous. SFBS trades on a P/E of 16.2x, compared with a US Banks industry average of 11.8x and a fair ratio of 14.7x. This suggests the market is already paying a premium for its earnings. If the share price is above both the industry and the fair ratio, how much margin of safety do you really have?

Build Your Own ServisFirst Bancshares Narrative

If you have a different view, or prefer to work from the raw numbers yourself, you can build your own ServisFirst story in just a few minutes. Start with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ServisFirst Bancshares.

Looking for more investment ideas?

If SFBS has you thinking differently about your portfolio, do not stop here, your next opportunity could easily sit in another corner of the market.

- Spot potential turnaround names by scanning these 3523 penny stocks with strong financials that already show stronger financial footing than many expect.

- Position yourself for the next wave of machine learning breakthroughs by checking out these 23 AI penny stocks shaping real world applications today.

- Hunt for mispriced opportunities using these 871 undervalued stocks based on cash flows that appear cheap relative to their cash flow profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.