Please use a PC Browser to access Register-Tadawul

A Look At Soleno Therapeutics (SLNO) Valuation After VYKAT XR Launch And Upcoming 2025 Business Updates

Soleno Therapeutics Inc SLNO | 39.36 | -0.13% |

Why Soleno Therapeutics Is Back on Investors’ Radar

Soleno Therapeutics (SLNO) is drawing fresh attention after describing 2025 as a transformational year, highlighting early traction for VYKAT XR, and flagging upcoming full financial results alongside a busy investor conference schedule.

The latest 9.75% 1 day share price gain to US$42.32 comes after management framed 2025 as transformational and highlighted early VYKAT XR traction. However, recent 30 day and year to date share price returns of around 10% declines contrast with a very large 3 year total shareholder return, which suggests that momentum has cooled recently after a strong run.

If this kind of rare disease story has your attention, it could be a good moment to see what else is setting up in healthcare stocks.

With Soleno still loss making, recent share price declines, and an analyst target that sits far above the current US$42.32 level, you have to ask whether there is mispricing here or whether the market is already factoring in future growth.

Most Popular Narrative: 70.6% Undervalued

With Soleno Therapeutics last closing at $42.32 and the most followed narrative pointing to a fair value of about $143.71, the gap between price and narrative expectations is wide and raises questions about what is priced in today.

First mover position with the only FDA approved therapy for PWS related hyperphagia in patients 4 years and older, supported by Phase III data in 127 patients and over 400 patient years of exposure, can help sustain pricing power and support revenue resilience and potential scale benefits for earnings.

Want to see what kind of revenue curve and margin profile sits behind that fair value, and how far profitability is expected to swing over the next few years? The narrative lays out a bold earnings ramp, a richer margin structure and a valuation multiple that might surprise you if you usually associate those numbers with much larger biopharma names.

Result: Fair Value of $143.71 (UNDERVALUED)

However, this bullish setup can quickly be challenged if sentiment around VYKAT XR safety hardens further, or if European approval and launch timelines slip.

Another Angle on Valuation

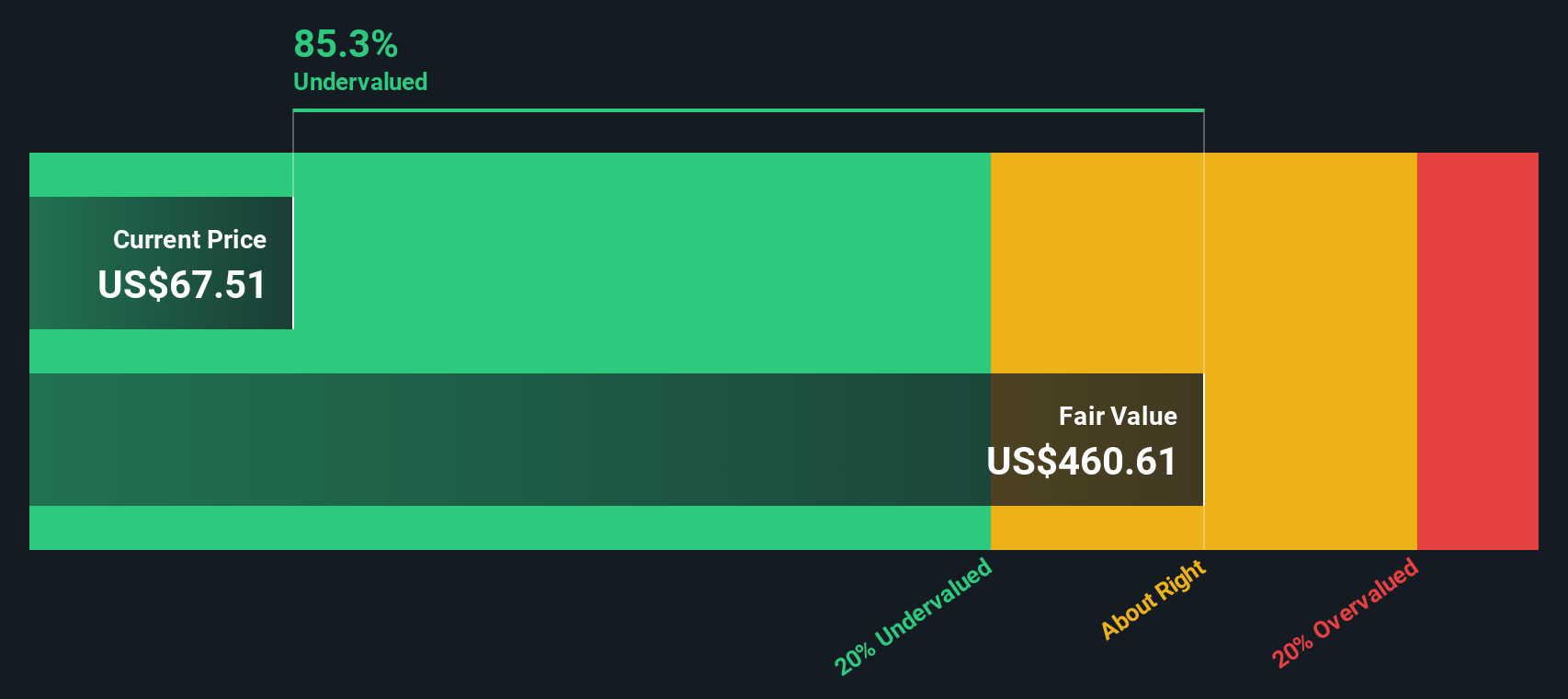

The bullish narrative leans on earnings forecasts and a high fair value, but our DCF model paints an even starker picture, with a fair value of about $436.04 versus the current $42.32. That points to very large implied upside, but how comfortable are you with the assumptions needed to get there?

Build Your Own Soleno Therapeutics Narrative

If you see the story differently, or want to stress test the assumptions yourself, you can create your own view in minutes: Do it your way.

A great starting point for your Soleno Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Soleno has sparked your interest, do not stop there. Use this momentum to scan for other setups that could fit your style before the crowd catches on.

- Target growth at the smaller end of the market by reviewing these 3533 penny stocks with strong financials that already show stronger fundamentals than many expect from low priced names.

- Position yourself closer to long term tech trends by examining these 24 AI penny stocks that tie artificial intelligence themes to listed companies you can actually research.

- Focus on price versus cash flow potential by filtering for these 871 undervalued stocks based on cash flows that might offer more attractive entry points than widely followed large caps.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.