Please use a PC Browser to access Register-Tadawul

A Look At SoundHound AI (SOUN) Valuation As Bridgepointe Partnership Expands Enterprise Reach

SoundHound AI, Inc Class A SOUN | 7.83 7.88 | +3.85% +0.64% Pre |

SoundHound AI (SOUN) just announced a partnership with tech advisory firm Bridgepointe Technologies, giving the voice AI company potential access to more than 12,000 enterprise customers across sectors including hospitality, retail, and automotive.

SoundHound AI’s latest partnership headlines arrive after a sharp 39.38% 90 day share price return decline and a mixed reaction to its recent earnings, even as the stock still carries a very large 3 year total shareholder return.

If this Bridgepointe deal has you thinking more broadly about voice and automation opportunities, it could be a good moment to scan other high growth tech and AI stocks that sit in similar themes.

With the shares down 39.38% over 90 days, a 1-year total return decline, and analysts’ average price target sitting above the last close, you have to ask: is this weakness an opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 33.2% Undervalued

SoundHound AI's most followed narrative tags a fair value of $16.31 against a last close of $10.90, centering the debate on future growth and margins.

The rapid consumer shift toward personalized, hands-free digital experiences is compelling enterprises to integrate advanced voice solutions as a differentiator; SoundHound's unique Voice Commerce ecosystem, agentic AI platform, and multimodal capabilities offer significant upsell and renewal potential, translating to higher net retention and increased recurring revenue.

Curious how that kind of product thesis turns into a higher fair value? Revenue compounding, margin rebuild, and a punchy future earnings multiple all sit at the core. Want to see exactly how those pieces fit together in the most popular narrative?

Result: Fair Value of $16.31 (UNDERVALUED)

However, there is still a real risk that sustained net losses and volatile, deal driven revenue could challenge the upbeat margin and future P/E assumptions in this narrative.

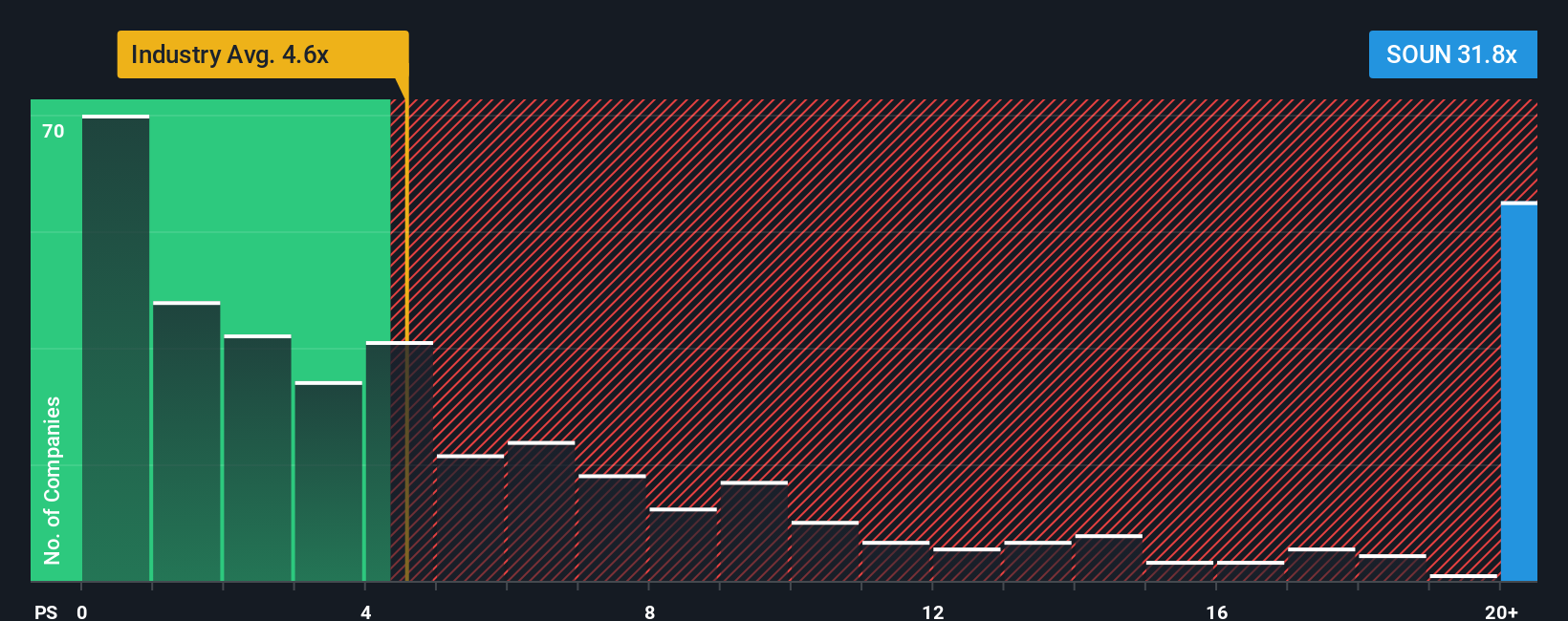

Another View: High P/S Raises A Caution Flag

The popular narrative leans on future growth to argue SoundHound AI looks 33.2% undervalued at a fair value of $16.31, but the current P/S of 30.9x tells a very different story. That is well above the US Software average of 4.5x, a peer average of 18.5x, and an estimated fair ratio of 5.8x, which points to meaningful valuation risk if growth or margins fall short of expectations. Which story you trust more probably comes down to how confident you are in those long term revenue and profitability assumptions.

Build Your Own SoundHound AI Narrative

If you are not fully aligned with this view or prefer to form your own perspective based on the numbers, you can develop a custom thesis, Do it your way.

A great starting point for your SoundHound AI research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If SoundHound AI is on your radar, do not stop there. A broader view across themes and sectors can help you spot opportunities you might otherwise miss.

- Target income first by scanning these 12 dividend stocks with yields > 3% that could complement growth names with regular cash returns.

- Zero in on future tech potential by reviewing these 24 AI penny stocks that sit at the intersection of automation and data.

- Hunt for mispriced names using these 876 undervalued stocks based on cash flows that may offer appealing entry points based on cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.