Please use a PC Browser to access Register-Tadawul

A Look At SPX Technologies (SPXC) Valuation After Recent Share Price Strength

SPX Technologies, Inc. SPXC | 242.29 | +0.53% |

Event context and recent performance

SPX Technologies (SPXC) has drawn investor attention after recent share price moves, with the stock up about 2% over the past day, 6.7% in the past week, and 6.9% over the past month.

Zooming out, SPX Technologies has paired this short term share price strength with a 9.4% year to date share price return and a 5 year total shareholder return of about 302%. This points to momentum that has been building over time.

If this move in SPX is on your radar, it could be a good moment to broaden your search and check out our screener of 24 power grid technology and infrastructure stocks as another way to find ideas linked to energy and infrastructure themes.

With SPX Technologies posting a 47.2% 1 year total return and trading around $222.32 versus an average analyst price target of $236, the key question now is whether there is still a buying opportunity or if markets are already pricing in future growth.

Most Popular Narrative: 5.8% Undervalued

With SPX Technologies closing at $222.32 versus a narrative fair value of $236, the current setup frames the stock as modestly undervalued on that view.

Heightened regulatory and customer focus on decarbonization, water usage, and energy efficiency is driving rapid adoption of SPX's innovative, value-added solutions, especially in infrastructure modernization. This supports durable demand, premium pricing, and continued net margin expansion through increased differentiation and lower cyclicality risk.

Curious what kind of revenue trajectory and margin profile need to line up to justify that fair value, and what earnings multiple holds it all together? The full narrative unpacks a tight set of growth, profitability, and valuation assumptions that go well beyond headline P/E or near term order trends.

Result: Fair Value of $236 (UNDERVALUED)

However, there are still pressure points to watch, including project timing swings in Detection & Measurement and the risk that acquisition integration does not go to plan.

Another view: pricing in a lot of optimism

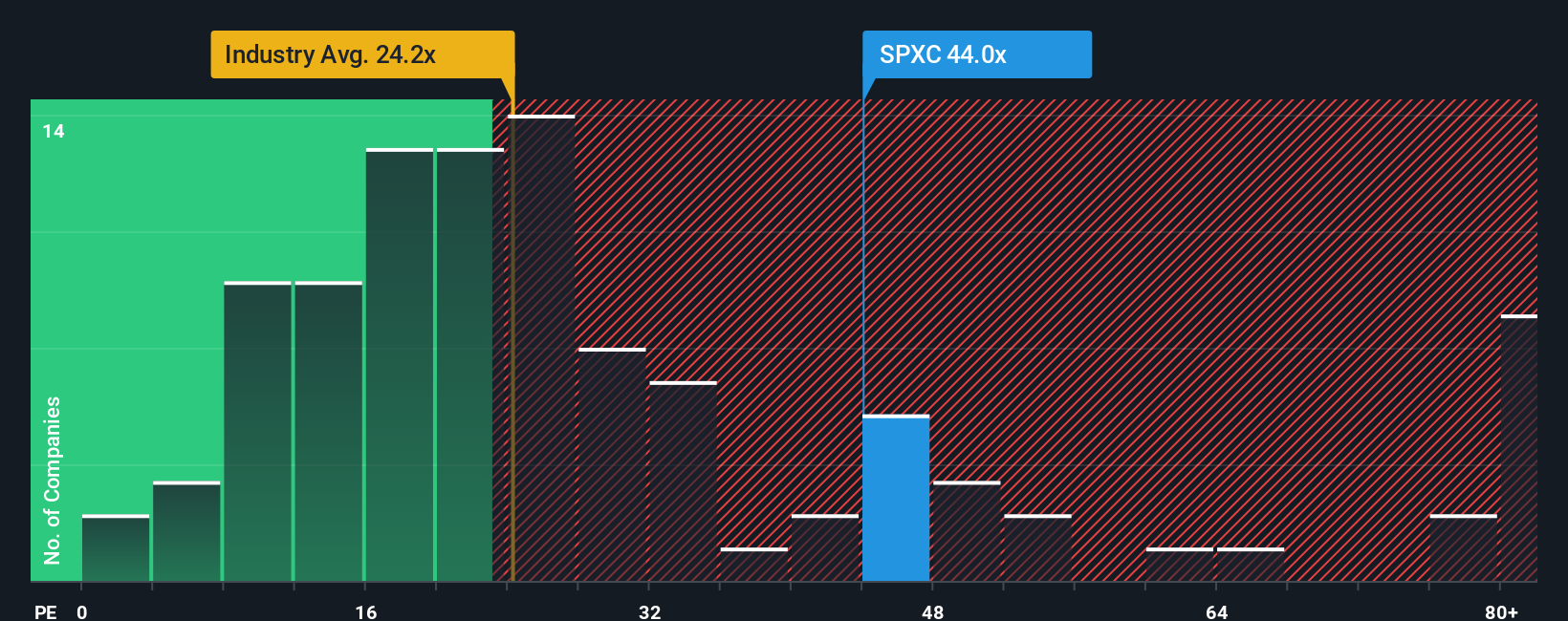

The fair value narrative pegs SPX Technologies at $236, yet the company is also described as expensive on earnings. At a P/E of 49.5x versus peers at 32.8x, and a fair ratio of 30.5x, the market is already paying a steep premium. That raises a simple question: how comfortable are you with that kind of optimism?

Build Your Own SPX Technologies Narrative

If you look at this and feel the story does not quite match your view, take a few minutes to test the numbers yourself and Do it your way.

A great starting point for your SPX Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If SPX has caught your eye, do not stop here. The best portfolios rarely rely on a single name, so keep widening your opportunity set.

- Zero in on quality at a sensible price by searching through 53 high quality undervalued stocks that pair fundamentals with pricing that may still leave room for upside.

- Build a steadier income stream by focusing on 14 dividend fortresses that combine higher yields with business models geared toward consistent shareholder payouts.

- Sleep easier by concentrating on 86 resilient stocks with low risk scores that score well on financial strength and risk, instead of leaving your capital tied up in fragile stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.