Please use a PC Browser to access Register-Tadawul

A Look At Strategic Education (STRA) Valuation After Fresh Wave Of Analyst Buy Ratings

Strategic Education, Inc. STRA | 83.92 83.92 | -0.71% 0.00% Pre |

Analyst sentiment sparks sharp move in Strategic Education

Strategic Education (STRA) shares recently climbed 8.7% in afternoon trading after a wave of positive Wall Street analyst sentiment and a clear consensus of Buy ratings drew fresh attention from investors.

The recent 8.7% intraday jump sits against a steadier backdrop, with an approximately 6.8% 1 month share price return and a 1 year total shareholder return of about a 9.5% decline, suggesting that momentum may be picking up after a softer period.

If this kind of sentiment shift has your attention, it could be a good moment to widen your search and check out fast growing stocks with high insider ownership.

With analysts pointing to upside from current levels and valuation tools indicating a possible discount, the key question is whether STRA is still undervalued or if the recent jump already reflects its future growth potential.

Most Popular Narrative: 20.8% Undervalued

With the narrative fair value sitting at US$103.33 against the last close of US$81.79, the valuation gap rests squarely on future earnings power and margins.

The Education Technology Services segment is experiencing significant growth, with revenue increasing by more than 30% in 2024, primarily through the Sophia Learning direct-to-consumer portal and expanding corporate partnerships, potentially boosting earnings. The company has a robust free cash flow, allowing it to continue shareholder returns through dividends and share repurchases, which could enhance earnings per share.

Want to see what sits behind that confidence in higher earnings and richer margins? The narrative leans on specific growth, margin and P/E assumptions that could reshape how you think about US$103.33 as a fair value.

Result: Fair Value of $103.33 (UNDERVALUED)

However, there are real pressure points here, including tighter student rules in Australia and New Zealand, and softer revenue per U.S. student as scholarships and employer programs expand.

Another Angle On Value

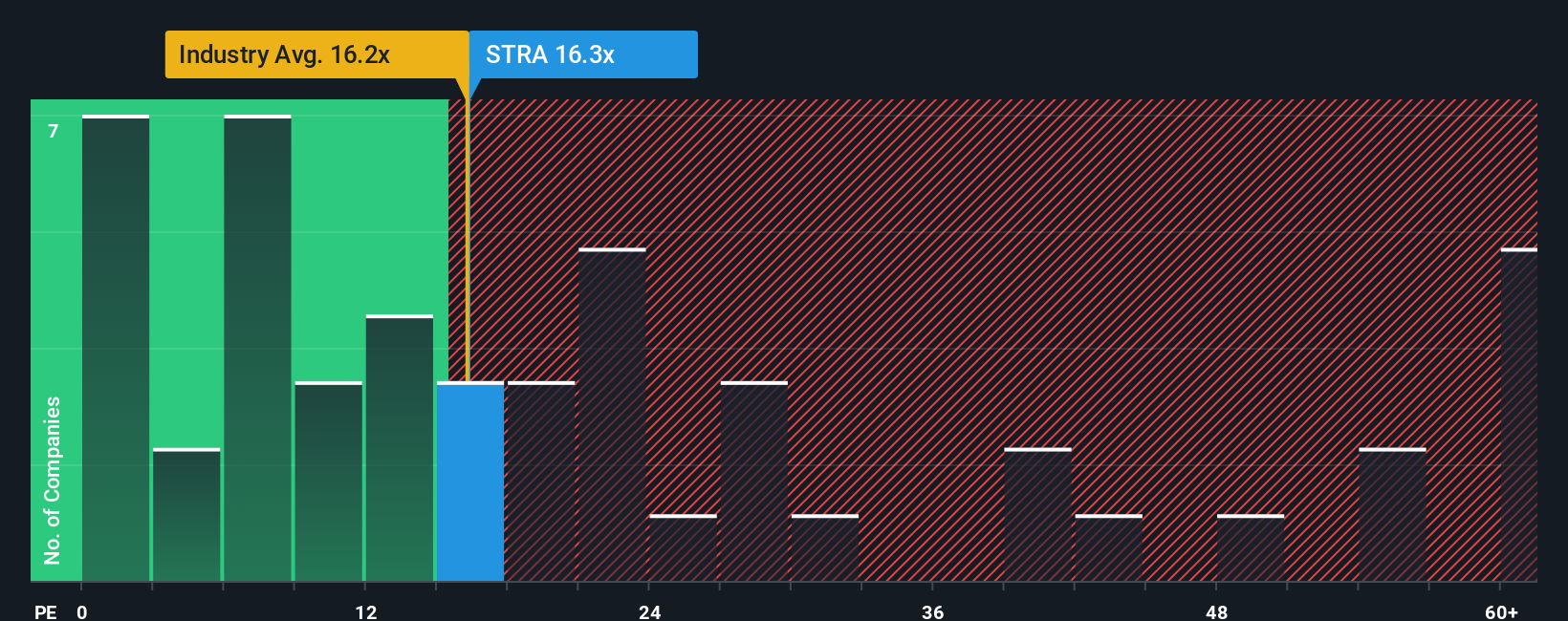

While the narrative fair value points to a 20.8% gap, the current P/E of 17.4x tells a more mixed story. It sits slightly above the US Consumer Services industry at 17.3x, yet below peers at 24.2x and the fair ratio of 21.2x. This raises the possibility that the market may eventually move closer to that higher level.

That mix of a small premium to the industry but a discount to peers and the fair ratio leaves a simple question for you: is this a margin of safety, or a sign that expectations are already priced in?

Build Your Own Strategic Education Narrative

If parts of this story do not quite fit how you see the company, you can weigh the same numbers yourself and build a fresh view in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Strategic Education.

Looking for more investment ideas?

If you only stick with one company, you could miss other opportunities that fit your style, so it makes sense to scan a wider set of ideas today.

- Target potential value by checking these 876 undervalued stocks based on cash flows that screen on price against underlying cash flows and fundamentals.

- Tap into long term themes by reviewing these 79 cryptocurrency and blockchain stocks linked to blockchain, digital payments and new transactional models.

- Focus on income by assessing these 11 dividend stocks with yields > 3% that meet a minimum yield hurdle above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.