Please use a PC Browser to access Register-Tadawul

A Look At Syndax Pharmaceuticals (SNDX) Valuation After Revuforj Data And New Managed Access Program

Syndax Pharmaceuticals Inc SNDX | 19.69 | -4.56% |

Conference spotlight and access program put Syndax Pharmaceuticals (SNDX) in focus

Syndax Pharmaceuticals (SNDX) is back on investors radar after positive Revuforj trial data, a new Managed Access Program with the World Orphan Drug Alliance, and a high profile slot at Guggenheim Securities Emerging Outlook Biotech Summit 2026.

Despite a softer patch recently, with a 1 day share price return of a 3.12% decline and a 7 day share price return of a 2.52% decline, Syndax’s 90 day share price return of 19.21% and 1 year total shareholder return of 37.27% suggest momentum has been building around Revuforj data and the Managed Access Program news.

If Syndax’s story has you watching biotech more closely, it can be useful to compare it with other oncology focused names on our 25 healthcare AI stocks as a next step.

With Syndax shares up 37.27% over the past year but still trading at a discount to analyst price targets and intrinsic estimates, you have to ask yourself: is there mispricing here, or is the market already factoring in future growth?

Most Popular Narrative: 47.9% Undervalued

At a last close of $20.48 versus a narrative fair value of $39.31, Syndax Pharmaceuticals is framed as materially mispriced, with that gap pinned on ambitious growth and profitability assumptions.

Late-stage pipeline advancements (including frontline trials, lifecycle management, and expansion into new indications like IPF for Niktimvo), coupled with strong clinical data and market-leading positions in precision oncology, provide robust long-term growth avenues aligned with surging demand for innovative, targeted therapies, supporting sustained multi-year earnings momentum.

Want to see what is sitting behind that confidence in multi year earnings momentum? The narrative leans heavily on rapid revenue expansion, margin lift, and a rich future earnings multiple, all pushed through a 7% discount rate. The exact mix of growth and profitability that gets to $39.31 might surprise you.

Result: Fair Value of $39.31 (UNDERVALUED)

However, the whole setup still hinges on just two key drugs and assumes smooth regulatory progress, so any safety, label, or uptake setbacks could quickly challenge that optimism.

Another angle on valuation

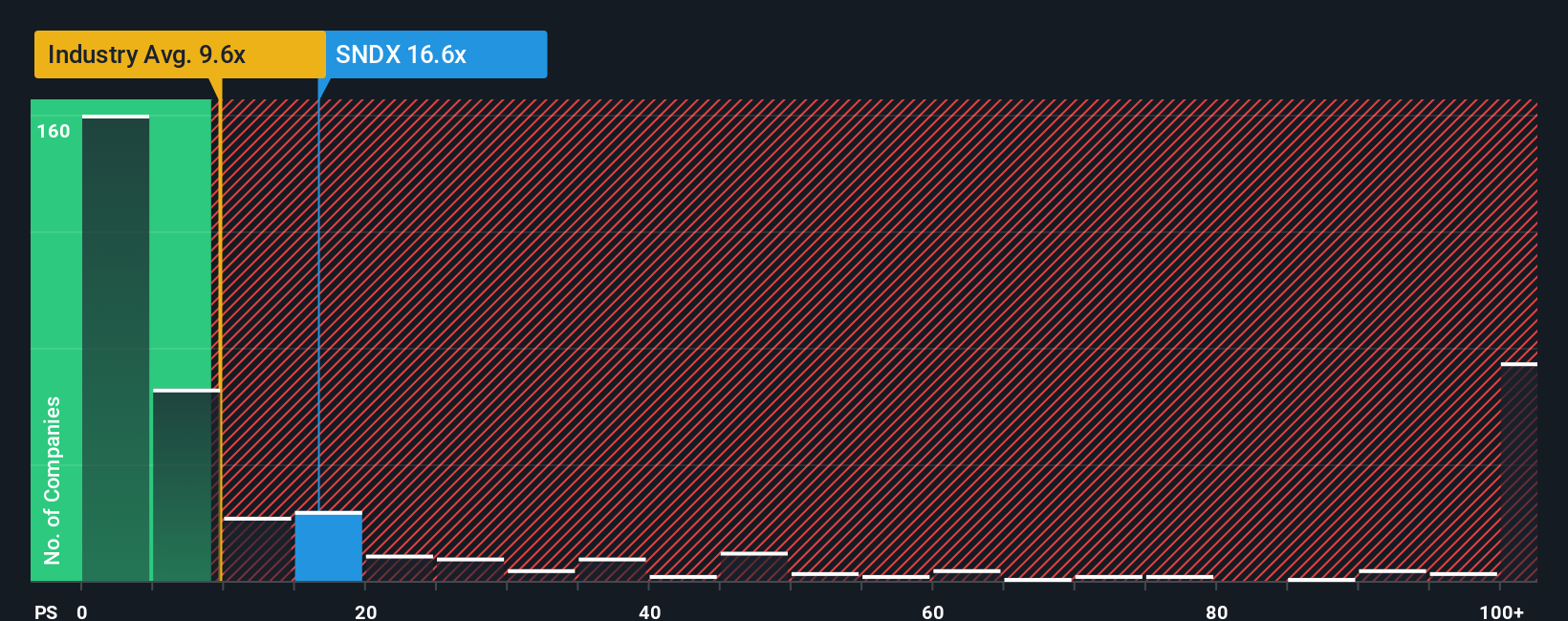

The narrative model pegs fair value at $39.31 and calls Syndax undervalued, but the P/S ratio of 16x tells a different story. It is higher than the US Biotechs industry at 11.3x, peers at 10.2x, and a fair ratio of 1x. This points to meaningful valuation risk if sentiment cools. Which signal do you trust more?

Build Your Own Syndax Pharmaceuticals Narrative

If you see the numbers differently or prefer to stress test your own assumptions, you can build a complete Syndax view yourself in just a few minutes, starting with Do it your way.

A great starting point for your Syndax Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Syndax has sharpened your focus on stock selection, do not stop here. Broaden your watchlist with a few curated sets of companies built from our screeners.

- Spot potential bargains early by reviewing our list of screener containing 23 high quality undiscovered gems that pair strong fundamentals with limited market attention.

- Prioritise resilience by scanning 84 resilient stocks with low risk scores that score strongly on financial and business risk checks.

- Aim for quality and staying power with our solid balance sheet and fundamentals stocks screener (45 results) that highlights companies backed by robust finances.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.