Please use a PC Browser to access Register-Tadawul

A Look At Ultra Clean Holdings (UCTT) Valuation After Appointing Robert Wunar As Chief Operating Officer

Ultra Clean Holdings, Inc. UCTT | 59.15 | +2.91% |

Ultra Clean Holdings (UCTT) is back in focus after the company announced a leadership shake up, with former COO Harjinder Bajwa departing and semiconductor veteran Robert Wunar set to assume the Chief Operating Officer role.

The leadership change comes after a powerful run, with a 59.9% 30 day share price return and a 53.1% 90 day share price return. The 1 year total shareholder return of 18.5% suggests momentum has been building over a longer period too.

If this kind of semiconductor move has your attention, it could be a good moment to see what else is setting up in high growth tech and AI stocks as investors reassess growth stories across the sector.

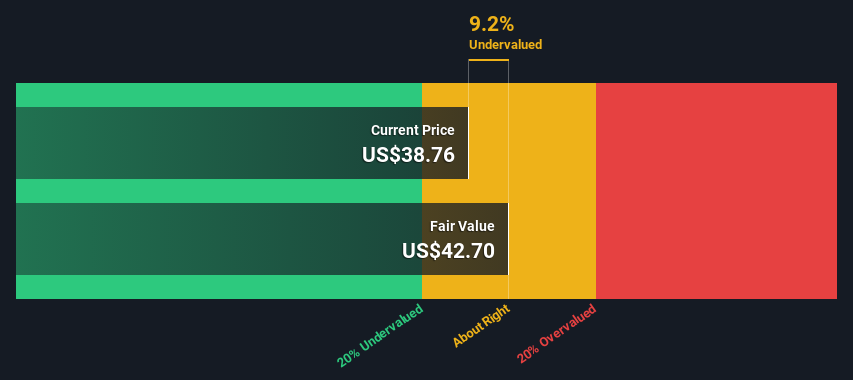

With the shares hitting a 52 week high after an earnings beat but still carrying a recent net loss of US$161.6 million, and trading above the current analyst price target of US$38.75, is there real value left here, or is the market already pricing in future growth?

Most Popular Narrative: 12.7% Overvalued

Ultra Clean Holdings last closed at $43.68, while the most followed narrative sees fair value closer to $38.75, built on detailed long term earnings assumptions.

Progress in vertical integration, particularly the Fluid Solutions business unit along with deployment of company wide SAP systems, is set to improve operational efficiency and streamline customer engagement, driving higher margin mix and improved earnings beginning in early 2026, which supports higher net margins and earnings improvement.

Curious what kind of revenue path and margin shift would need to play out to support that fair value and a higher future earnings multiple? The full narrative lays out specific growth, profitability and valuation assumptions that go well beyond headline EPS targets.

Result: Fair Value of $38.75 (OVERVALUED)

However, the narrative still leans on forecasts that could be challenged if wafer fab equipment spending stays weak or if customer concentration leads to sharper order cuts.

Another View: Cash Flows Point To A Tougher Hurdle

While the most followed narrative pegs fair value at $38.75, our DCF model is less generous, with an estimate of $19.53, which implies Ultra Clean Holdings is overvalued on a cash flow basis. If earnings play out differently than forecast, which lens do you trust more?

Build Your Own Ultra Clean Holdings Narrative

If you see the numbers differently, or simply want to stress test these assumptions yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Ultra Clean Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Ultra Clean Holdings has sharpened your appetite for opportunities, do not stop here. Widen your search now and avoid missing other stocks that may fit your approach.

- Spot potential turnarounds early by checking out these 3525 penny stocks with strong financials that already show solid financial foundations instead of just hype.

- Ride the AI wave with focus by scanning these 24 AI penny stocks that concentrate on artificial intelligence themes rather than broad tech exposure.

- Hunt for value with a clear framework by filtering for these 880 undervalued stocks based on cash flows where cash flow metrics play a central role in the assessment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.