Please use a PC Browser to access Register-Tadawul

A Look At Ultra Clean Holdings (UCTT) Valuation After New Chief Operating Officer Appointment

Ultra Clean Holdings, Inc. UCTT | 59.15 | +2.91% |

Ultra Clean Holdings (UCTT) has announced the departure of Harjinder Bajwa and the upcoming appointment of industry veteran Robert Wunar as Chief Operating Officer, a leadership shift that may influence how investors view the company’s operational execution.

The COO transition comes as Ultra Clean Holdings’ share price has climbed to US$50.78, with a 30-day share price return of 48.44% and a 90-day share price return of 95.31%, while the 1-year total shareholder return is 34.59%. This suggests momentum has recently been building after a more mixed multi year experience.

If this kind of move has you thinking about where else capital equipment demand could flow, it may be worth checking our screener of 33 AI infrastructure stocks as a starting list of ideas.

With the shares at US$50.78, above an average analyst price target of US$38.75 and with recent returns looking strong, investors may ask whether there is still an opportunity or if the market is already pricing in future growth.

Most Popular Narrative: 31% Overvalued

Ultra Clean Holdings’ most followed narrative pins fair value at $38.75, which sits well below the current $50.78 share price, so the story behind that gap matters.

Progress in vertical integration particularly the Fluid Solutions business unit along with deployment of company wide SAP systems, is set to improve operational efficiency and streamline customer engagement, driving higher margin mix and improved earnings beginning in early 2026. Diversification efforts, including expansion of the Services business and integration of acquired units (Fluid Solutions, Services, HIS), are expected to reduce customer concentration risk and provide more stable, incremental revenue streams even as wafer fab investment cycles remain volatile.

Curious what kind of revenue path and margin lift are baked into that $38.75 figure, and how rich the implied future earnings multiple really is? The popular narrative rests on a specific blend of mid single digit top line growth, margin repair and a premium P/E assumption that leans on semiconductor spending holding up. If you want to see exactly how those moving parts fit together, the full narrative lays out the numbers behind that fair value step by step.

Result: Fair Value of $38.75 (OVERVALUED)

However, this narrative can crack if wafer fab demand stays weak for longer, or if high customer concentration turns small order changes into bigger revenue swings.

Another Take: Multiples Tell a Different Story

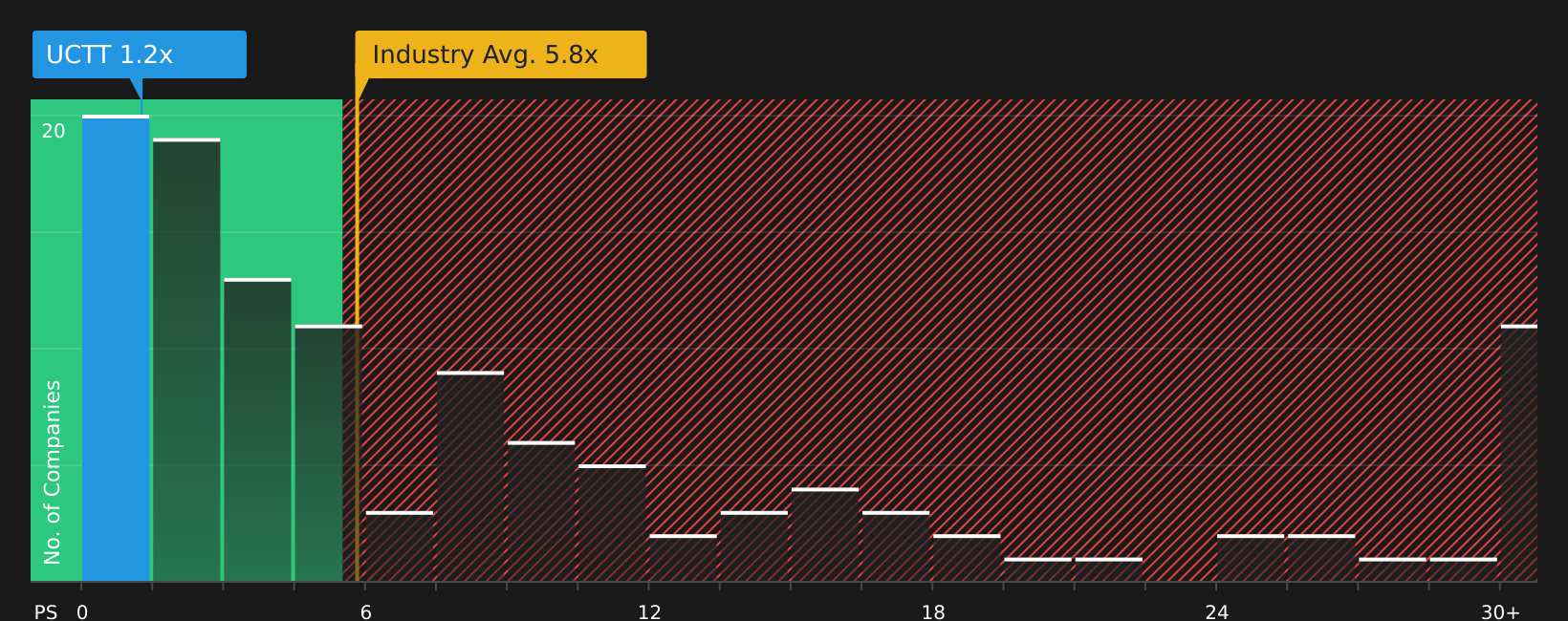

While the popular narrative flags Ultra Clean Holdings as 31% overvalued at $38.75, the current P/S of 1.1x looks very different. It sits well below the US Semiconductor industry at 5.8x, the peer average at 3.5x, and even the 2x fair ratio the market could move towards. That gap points to valuation risk if sentiment cools, but also to potential upside if revenue expectations hold up. Which side of that trade do you think is more realistic?

Build Your Own Ultra Clean Holdings Narrative

If you are not fully on board with this view, or prefer to test your own assumptions against the numbers, you can pull the key data together and shape a custom thesis in just a few minutes. Then Do it your way.

A great starting point for your Ultra Clean Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about sharpening your watchlist, do not stop at a single stock. Use targeted lists to uncover other opportunities that might fit your style.

- Hunt for quality at a discount by scanning our list of 52 high quality undervalued stocks that pair solid fundamentals with prices that may not fully reflect their strengths.

- Lock in potential income streams by reviewing 14 dividend fortresses that focus on higher yield payouts with an eye on resilience.

- Prioritise sleep at night holdings by checking 82 resilient stocks with low risk scores built around companies with lower risk scores and steadier profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.