Please use a PC Browser to access Register-Tadawul

A Look At United Bankshares (UBSI) Valuation After Record 2025 Earnings And Q4 Beat

United Bankshares, Inc. UBSI | 44.28 | +0.48% |

United Bankshares (UBSI) is back on investors’ radar after reporting record 2025 earnings, with fourth quarter profit and revenue ahead of Wall Street expectations and analysts responding with upgraded views on the stock.

United Bankshares’ recent buybacks and Q4 earnings beat come against a backdrop of steady share price momentum, with a 30-day share price return of 4.96% and a 90-day gain of 13.40%, while the 1-year total shareholder return of 12.44% and 5-year total shareholder return of 60.39% point to sustained value creation for long term holders.

If strong bank results have you looking beyond a single ticker, you may want to widen your watchlist with fast growing stocks with high insider ownership.

With UBSI trading at $41.46, only about 7% below the average analyst price target of $44.30 and an estimated intrinsic value gap of roughly 34%, investors now have to ask: is this a genuine value opportunity, or is the market already baking in future growth?

Price-to-Earnings of 13.5x: Is it justified?

On a P/E of 13.5x at a last close of $41.46, United Bankshares trades at a premium to the broader US Banks industry, but slightly below its closest peers.

The P/E multiple compares the current share price to earnings per share, so for a bank like United Bankshares it reflects what investors are willing to pay for each dollar of current earnings. For a mature, profitable bank, this often captures expectations around earnings quality, growth consistency and perceived risk.

Here, the data sends a mixed message. United Bankshares is described as expensive versus the US Banks industry average P/E of 11.8x, and also above an estimated fair P/E of 12.4x. This points to the possibility that the market is pricing in relatively strong earnings resilience already. At the same time, the stock is labelled good value versus a 15.1x peer average. This suggests that within its closer peer group there are banks trading on richer earnings multiples that could act as a reference level the market could move towards if sentiment remains supportive.

Against the wider industry at 11.8x, the 13.5x P/E stands out as meaningfully higher, which can indicate that investors are willing to pay more for United Bankshares’ earnings profile than for the typical US bank. Compared with the fair P/E of 12.4x, the current multiple also sits above the level some models suggest could be more in line with fundamentals, again pointing to an earnings valuation that runs ahead of those fair value estimates.

Result: Price-to-Earnings of 13.5x (OVERVALUED)

However, you still have to watch for a shift in sentiment if earnings quality is questioned or if higher relative pricing starts to weigh on demand for the shares.

Another view on value: cash flows tell a different story

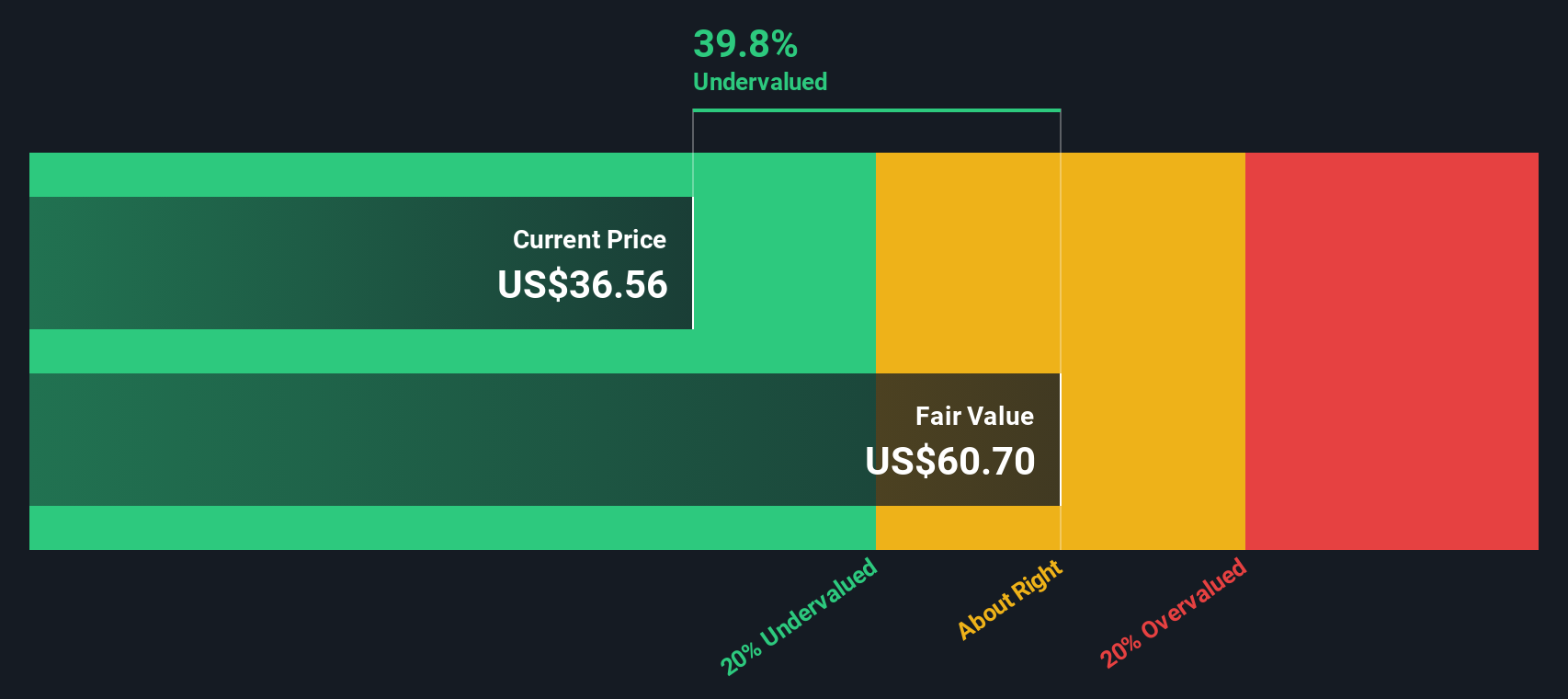

If you only look at the 13.5x P/E, UBSI can seem a bit rich, yet our DCF model points the other way. With the shares at $41.46 and the DCF estimate at $63.26, the stock screens as undervalued. This raises a simple question: which signal do you trust more, price or cash flows?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out United Bankshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own United Bankshares Narrative

If you look at the numbers and come to a different view, or prefer to test the assumptions yourself, you can build a fresh narrative in minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding United Bankshares.

Looking for more investment ideas?

If UBSI has sharpened your thinking, do not stop here. Use the Screener to find other opportunities that might suit your approach before the crowd catches on.

- Spot potential bargains early by checking out these 872 undervalued stocks based on cash flows, where cash flow metrics help surface shares that may be priced below their fundamentals.

- Tap into cutting edge themes by scanning these 23 AI penny stocks for companies tied to artificial intelligence that fit your risk and return preferences.

- Explore income focused ideas with these 13 dividend stocks with yields > 3% and see which companies currently offer dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.