Please use a PC Browser to access Register-Tadawul

A Look at Veeco Instruments's Valuation After Strong Q2 Earnings Beat (VECO)

Veeco Instruments Inc. VECO | 30.09 | -2.19% |

Most Popular Narrative: 6.1% Undervalued

According to the most widely followed narrative, Veeco Instruments appears to be modestly undervalued relative to analysts’ estimates for its future earnings and growth potential.

Strong product differentiation, market expansion, and innovation drive long-term growth. Regional challenges are offset by recurring revenue and robust demand in other key markets. Catalysts about Veeco Instruments include its development, manufacturing, sale, and support of semiconductor and thin film process equipment, primarily used in the production of electronic devices.

How does this modest undervaluation come together? The answer is in the bold financial projections and ambitious growth assumptions woven into this narrative. Want to see which growth levers analysts are betting on to justify a higher price? Uncover the specific numbers and future benchmarks that underpin the outlook, as these estimates may surprise you.

Result: Fair Value of $27.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including intensified competition and regional revenue concentration. These factors could challenge forecasts and reshape expectations for Veeco’s future performance.

Find out about the key risks to this Veeco Instruments narrative.Another View: Discounted Cash Flow Puts Numbers to the Test

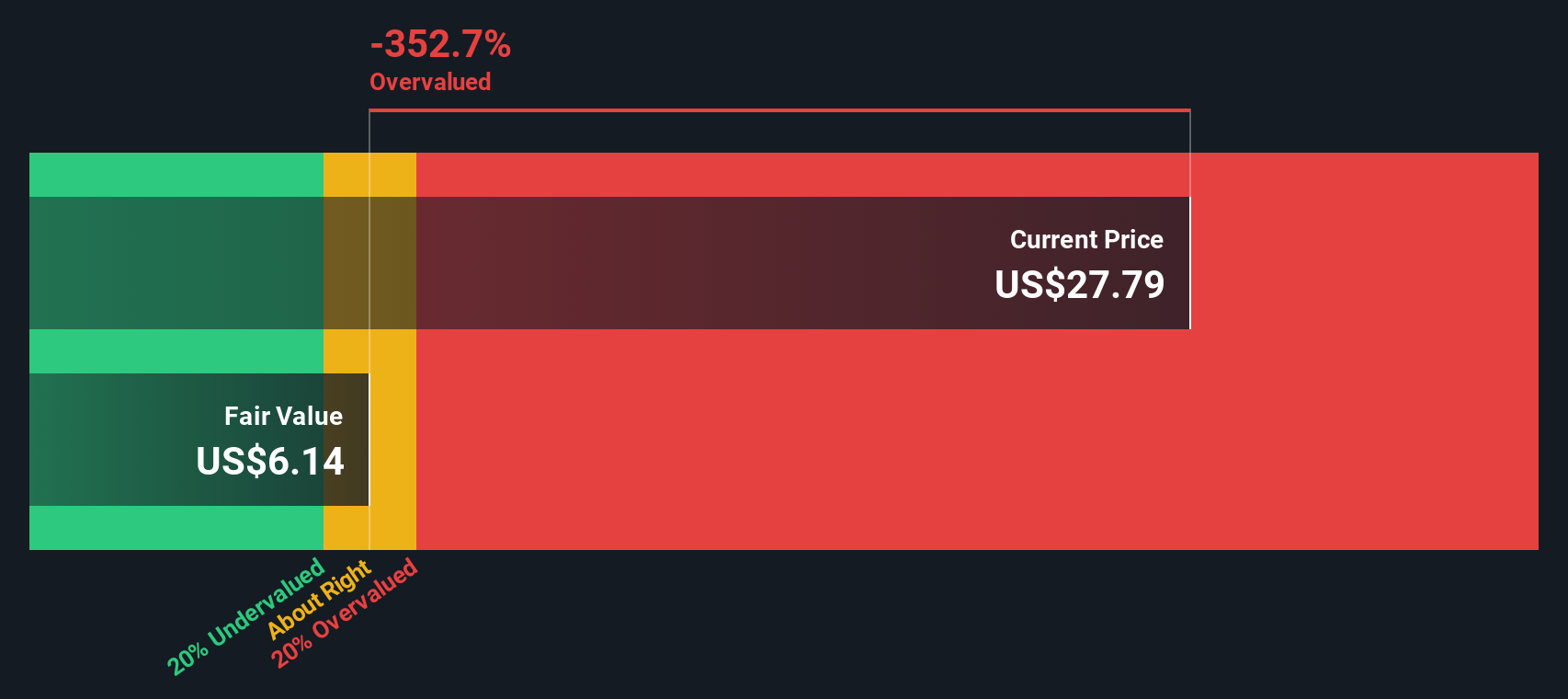

Taking a second look, the SWS DCF model suggests Veeco Instruments may not be as cheap as the analyst consensus implies. This approach signals the shares might be trading above their underlying value and raises a different set of questions.

Build Your Own Veeco Instruments Narrative

If you want to dig deeper or challenge the story for yourself, you can craft your own independent view in just a few minutes. Do it your way.

A great starting point for your Veeco Instruments research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Broaden your portfolio and stay a step ahead by uncovering unique opportunities that others might be missing. The smartest investors always keep fresh ideas on their radar. Here are a few worth your attention:

- Uncover hidden bargains bolstered by strong financials through our selection of penny stocks with strong financials.

- Ride the future of medicine and technology by checking out healthcare AI stocks, making big moves in healthcare innovation.

- Boost your income strategy by focusing on stocks offering consistent and attractive yields with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.