Please use a PC Browser to access Register-Tadawul

A Look At Victory Capital (VCTR) Valuation After Recent Share Price Volatility

Victory Capital Holdings, Inc. Class A VCTR | 75.59 | -0.51% |

Victory Capital Holdings (VCTR) has drawn attention after recent trading left the stock around $67.07, with mixed short term returns including a 2.7% one day decline and modest gains over the past month.

The recent 1 day share price decline and mixed short term moves sit against a longer backdrop where the share price return so far this year has been positive, while the 1 year and multi year total shareholder returns have been strong, hinting that momentum, while currently cooler, has not fully faded.

If recent moves in Victory Capital have you thinking about what else might be setting up for future growth, this could be a good moment to check out fast growing stocks with high insider ownership.

So with Victory Capital’s shares near $67 and trading only slightly below the average analyst target, is the current valuation offering a genuine entry point, or is the market already pricing in further growth?

Most Popular Narrative: 9% Undervalued

With Victory Capital’s fair value estimate at $73.67 versus a last close of $67.07, the most followed narrative sees a valuation gap worth unpacking.

The analysts have a consensus price target of $76.429 for Victory Capital Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $83.0, and the most bearish reporting a price target of just $67.0.

Forecasts point to faster top line growth, a much fatter profit margin, and a sharply different earnings multiple by the time those numbers are reached. Curious which assumption really drives that $73.67 fair value gap?

Result: Fair Value of $73.67 (UNDERVALUED)

However, this hinges on Victory turning current net outflows and fee compression into steadier, higher-quality inflows that support those long-range earnings assumptions.

Another Way to Look at the Price

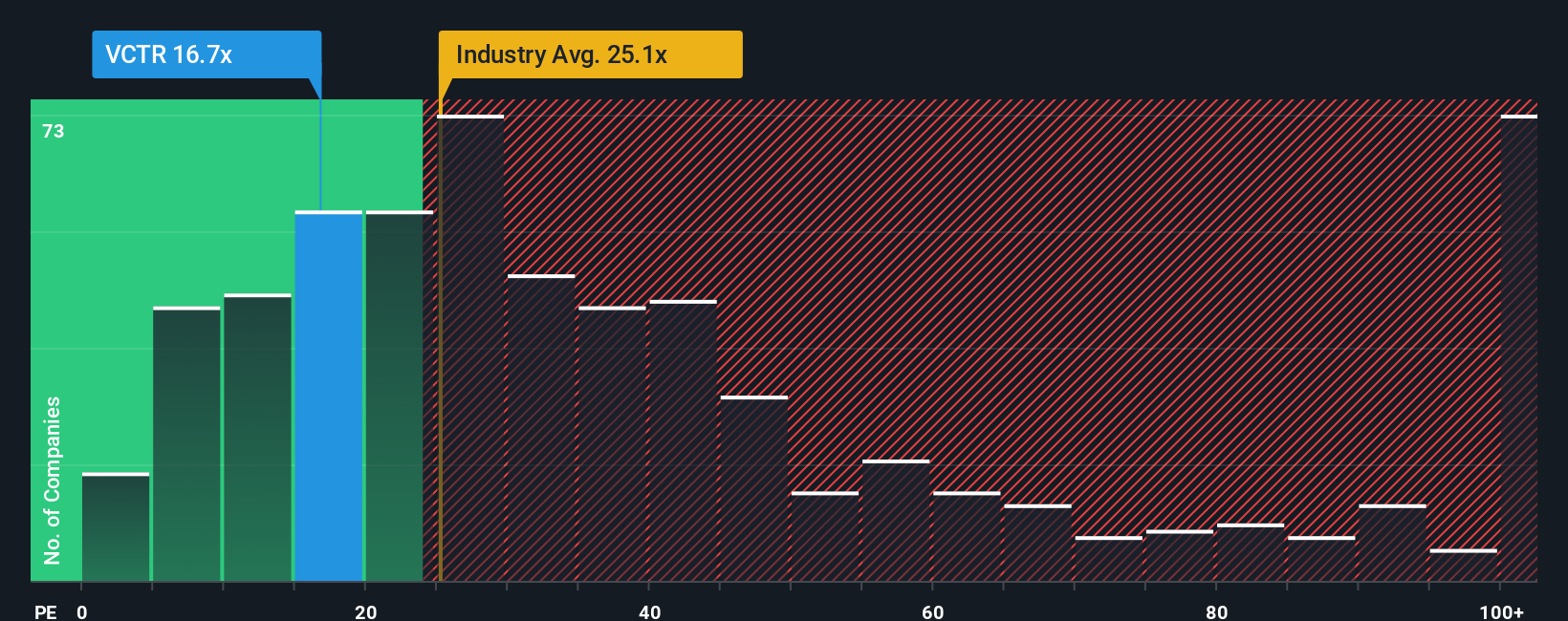

Those fair value and analyst target figures suggest some upside, but the P/E ratio tells a more cautious story. Victory Capital trades on 16.8x earnings, above the peer average of 11x, even though its fair ratio is 20.7x. That gap hints at both room to move and real valuation risk. Which side of that trade-off matters more to you?

Build Your Own Victory Capital Holdings Narrative

If you interpret the numbers differently or want to test your own assumptions, you can build a custom view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Victory Capital Holdings.

Looking for more investment ideas?

If Victory Capital has sharpened your thinking, do not stop here. Use the Simply Wall St Screener to spot fresh ideas that fit your style before others do.

- Target potential value opportunities by scanning these 886 undervalued stocks based on cash flows that line up with your view on price versus fundamentals.

- Ride long term themes by checking out these 25 AI penny stocks that sit at the intersection of technology and real-world use cases.

- Boost your income focus by reviewing these 13 dividend stocks with yields > 3% that aim to combine yield with underlying business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.