Please use a PC Browser to access Register-Tadawul

A Look At Vulcan Materials (VMC) Valuation After Mixed Earnings And Updated EBITDA Guidance

Vulcan Materials Company VMC | 305.92 305.92 | +1.79% 0.00% Post |

Earnings trigger puts Vulcan Materials in focus

Vulcan Materials (VMC) is back on investors’ radar after a quarterly report that combined 14.4% year-on-year revenue growth with guidance for full-year EBITDA that came in slightly below analyst expectations.

At a share price of $300.07, Vulcan Materials has seen a 2.0% 30 day share price return and a 2.8% 90 day share price return. Its 5 year total shareholder return of 109.46% points to a much stronger longer term payoff profile, suggesting recent momentum is more subdued compared with its longer history as investors weigh the strong revenue print against slightly softer EBITDA guidance.

If this kind of earnings driven story has your attention, it could be a good moment to broaden your watchlist with aerospace and defense stocks as another pocket of potential opportunity.

With revenue up 14.4% year on year, a 109.46% 5 year total shareholder return and the stock trading about 8.7% below the average analyst price target, is there still a buying opportunity here or is future growth already priced in?

Most Popular Narrative: 6.7% Undervalued

Vulcan Materials last closed at $300.07, compared with a widely followed fair value estimate of $321.50, putting the current share price below that narrative mark.

Expanding infrastructure investment and a dominant presence in high-growth metros are fueling sustained revenue growth and strong pricing power for Vulcan Materials. Operational efficiencies, successful acquisitions, and rising demand from infrastructure and renewable projects are supporting margin expansion and long-term profitability.

Curious what earnings trajectory and margin lift need to line up for that fair value? The narrative leans on compounding revenues, fatter profits, and a richer future multiple. The exact mix of those inputs might surprise you.

Result: Fair Value of $321.50 (UNDERVALUED)

However, the story could change quickly if public infrastructure funding slows, or if weather and project delays keep volumes and margins from tracking the current narrative.

Another View: Richer Earnings Multiple Tells A Different Story

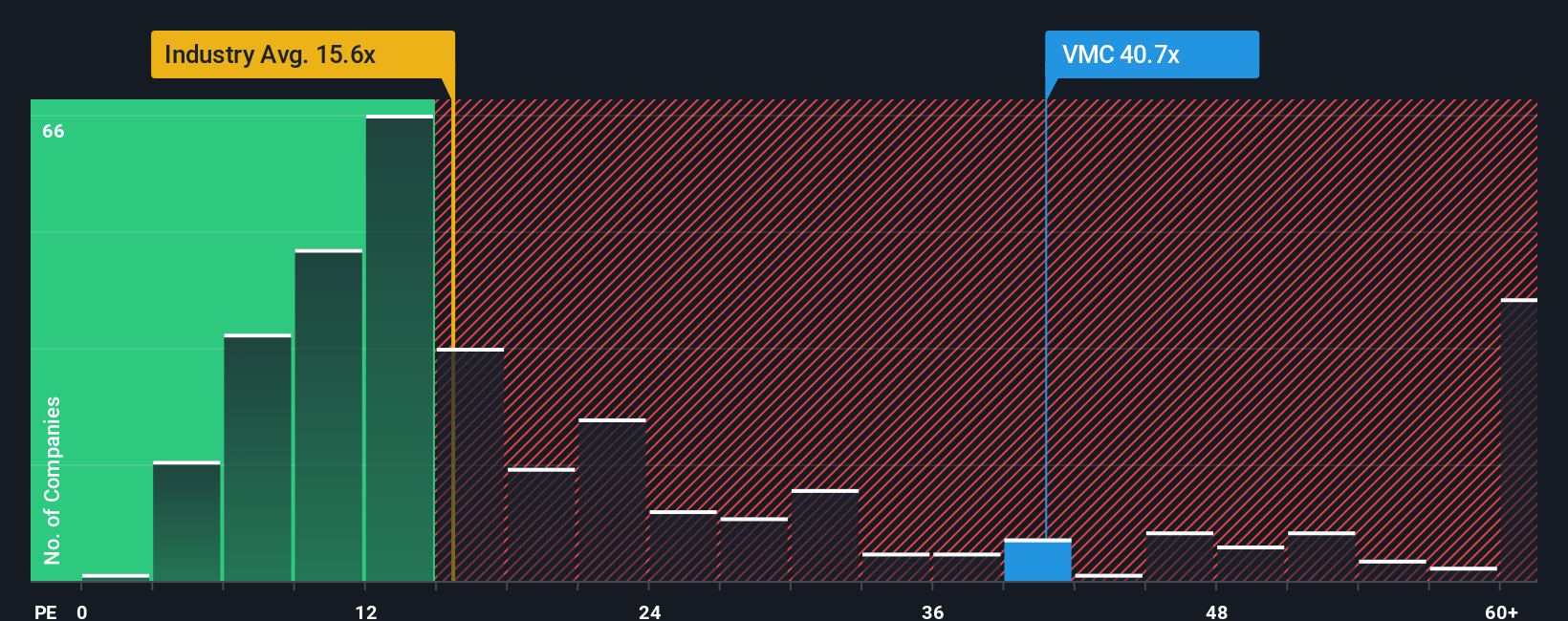

That 6.7% gap to the $321.50 fair value is one side of the story. On current earnings, Vulcan Materials trades on a P/E of 35.2x, compared with 15.5x for the global Basic Materials industry and 25.3x for peers, while the fair ratio sits at 23.5x. That richer set of numbers points to less margin for error than the underpriced narrative suggests, so which signal do you treat as more important?

Build Your Own Vulcan Materials Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom view in minutes: Do it your way.

A great starting point for your Vulcan Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Vulcan Materials has you thinking bigger about your portfolio, do not stop here. The screener is where you can spot the next idea before everyone talks about it.

- Zero in on potential value opportunities by scanning these 872 undervalued stocks based on cash flows that might be pricing in less optimistic expectations than their underlying cash flows suggest.

- Tap into fast growing themes by checking out these 23 AI penny stocks that connect artificial intelligence exposure with listed companies across different parts of the market.

- Lock in recurring income ideas by reviewing these 13 dividend stocks with yields > 3% that offer yields above 3% alongside listed company fundamentals you can inspect in detail.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.