Please use a PC Browser to access Register-Tadawul

A Look At Warrior Met Coal (HCC) Valuation After UBS And Moody’s Upgrades On Blue Creek Progress

Warrior Met Coal, Inc. HCC | 85.01 | -0.58% |

UBS has upgraded Warrior Met Coal (HCC) to a Buy rating, citing the ramp-up of the Blue Creek mine and tight metallurgical coal supply as key factors, while Moody’s has revised its outlook on the company to positive.

Even after the UBS and Moody’s upgrades, Warrior Met Coal’s US$89.30 share price has seen a 9.22% 7 day share price decline, although the 90 day share price return of 31.63% and 1 year total shareholder return of 70.20% indicate momentum that has built over a longer stretch. Over three and five years, total shareholder returns of 148.18% and 353.87% respectively show how strongly long term holders have been rewarded, even if recent sessions have reflected some cooling in short term sentiment.

If this kind of price action has your attention, it could be a good time to widen your watchlist with aerospace and defense stocks.

With Blue Creek advancing, analyst upgrades in hand, and the stock trading at a reported 47% intrinsic discount, the key question is whether Warrior Met Coal is still mispriced or if the market is already banking on future growth.

Most Popular Narrative: 2.2% Undervalued

Warrior Met Coal's most followed narrative pegs fair value at about $91.33 per share, only slightly above the recent $89.30 close, so every input matters.

The ahead-of-schedule and on-budget launch of the Blue Creek longwall in early Q1 2026 accelerates Warrior Met Coal's transition from capital investment to higher-volume revenue generation, unlocking increased production capacity and lower-cost, higher-quality tons. This positions the company to grow both revenues and net margins as volumes ramp and cost efficiencies are realized.

Curious what kind of revenue runway, margin shift and future earnings multiple it takes to justify that fair value tag on Warrior Met Coal? The narrative leans on a tight set of growth, profitability and valuation assumptions that all have to line up. If you want to see exactly how those moving parts connect to the $91.33 figure, the full narrative lays it out in black and white.

Result: Fair Value of $91.33 (UNDERVALUED)

However, you still need to weigh the risk that weaker global steel demand or ongoing Blue Creek ramp up costs could pressure coal pricing, margins, and cash generation.

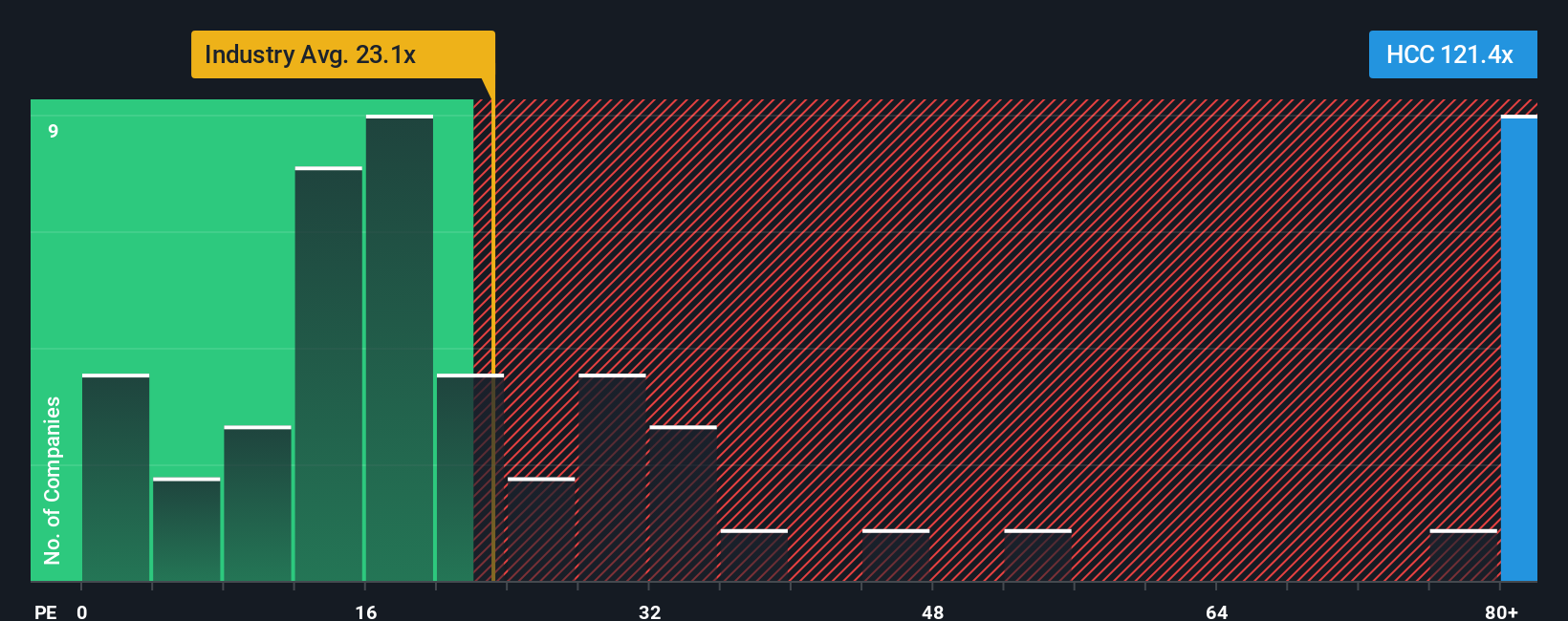

Another View: High P/E Signals A Very Different Story

Our DCF work points to Warrior Met Coal trading at a steep discount to estimated future cash flows, but the current P/E of 133.5x tells a very different story. It sits far above the US Metals and Mining average of 28.3x, the peer average of 20.3x, and even the 69.1x fair ratio, which suggests the market could shift closer to that level over time. That gap can mean plenty of upside if the narrative holds, but also real valuation risk if expectations reset, so which side of that trade do you trust more?

Build Your Own Warrior Met Coal Narrative

If you see the story differently, or prefer working from the raw numbers yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Warrior Met Coal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Warrior Met Coal has sharpened your focus, do not stop here. Widen your opportunity set with a few targeted idea lists that fit very different themes.

- Hunt for early stage businesses with potential by scanning these 3531 penny stocks with strong financials that already show stronger financial footing than many peers.

- Target future facing trends by reviewing these 25 AI penny stocks that tie artificial intelligence to practical, revenue producing products and services.

- Strengthen your income watchlist by focusing on these 14 dividend stocks with yields > 3% that combine higher yields with ongoing market listings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.