Please use a PC Browser to access Register-Tadawul

A Look At Winnebago Industries (WGO) Valuation As Recent Gains Revive Interest In The Stock

Winnebago Industries, Inc. WGO | 46.82 | +1.85% |

With no single headline event setting the tone today, Winnebago Industries (WGO) is drawing attention as investors weigh its recent share performance, current valuation signals, and the backdrop of its recreational vehicle and marine businesses.

Recent trading has been relatively steady, with a 30 day share price return of 12.83% and a 90 day gain of 27.54% from the current US$46.08 level. The 1 year total shareholder return of 3.12% contrasts with weaker 3 and 5 year total shareholder returns, suggesting shorter term momentum is firming after a tougher multi year stretch for investors.

If Winnebago has caught your eye, it can be useful to compare it with other auto related names. This could be a good moment to scan auto manufacturers.

So with Winnebago trading near US$46.08, showing modest 1 year gains after weaker multi year returns and sitting only slightly below analyst targets, is the stock still underappreciated, or is the market already pricing in future growth?

Most Popular Narrative: 4.8% Undervalued

At a last close of $46.08 versus a most followed fair value estimate of about $48.42, the leading narrative suggests Winnebago is modestly undervalued, with that view hinging on how its product lineup and brand mix play out over time.

The fair value estimate has increased slightly from about US$45.55 to roughly US$48.42 per share.

The future P/E has risen slightly from about 8.97x to roughly 9.46x, indicating a modestly higher valuation multiple applied in the latest analysis.

Curious what justifies paying up for Winnebago in this narrative? The story leans on steadier revenue assumptions, healthier margins, and a re rated earnings multiple. The specific mix of growth and profitability expectations is where it gets interesting.

Result: Fair Value of $48.42 (UNDERVALUED)

However, softer retail RV demand and pressure on premium pricing could easily cap margins and make those higher earnings and P/E assumptions more difficult to achieve.

Another Take: Expensive On Current Earnings

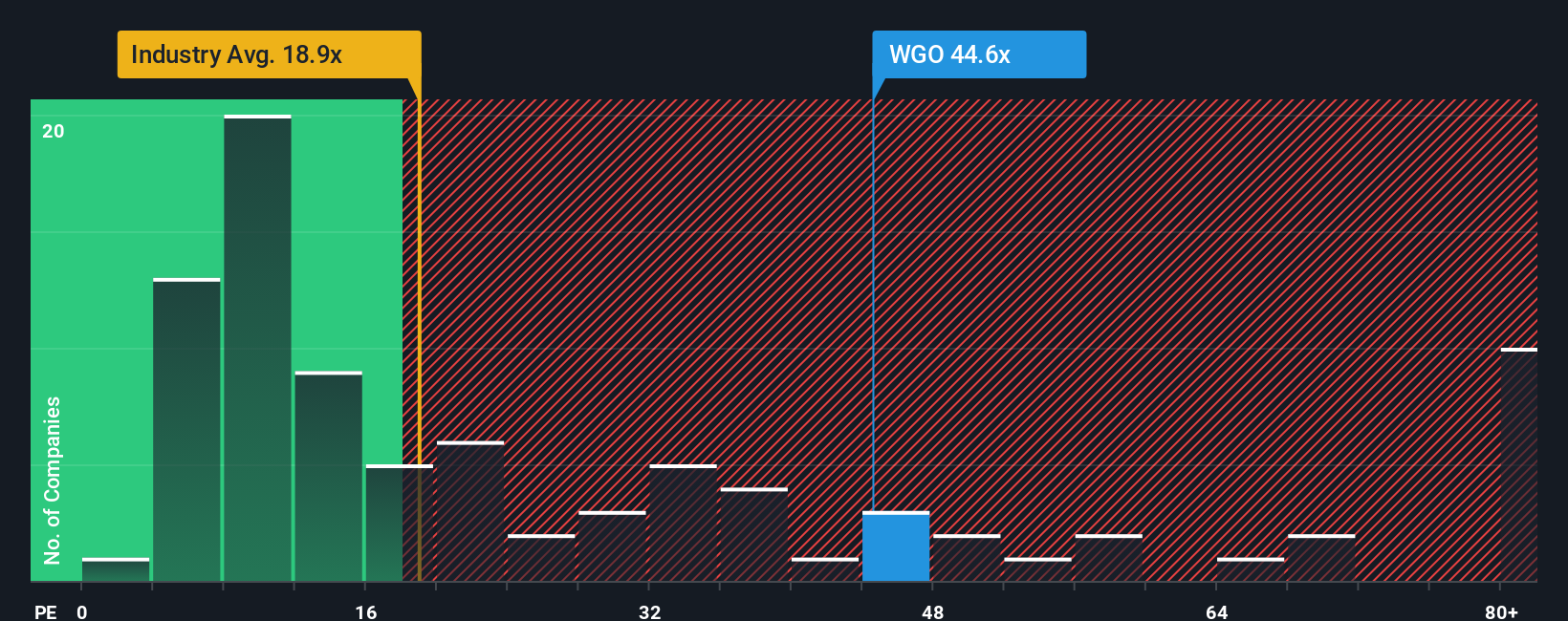

That 4.8% “undervalued” fair value story runs into resistance when you look at the current P/E. At about 35.7x, Winnebago trades well above the US auto peer average of 15.6x, the global auto average of 17.9x, and even its own 25.9x fair ratio estimate. This flags clear valuation risk if expectations cool.

Build Your Own Winnebago Industries Narrative

If you look at the numbers and come to a different conclusion, that is okay. You can shape the story yourself in just a few minutes, Do it your way.

A great starting point for your Winnebago Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are weighing Winnebago, it can be helpful to compare it with other types of opportunities so you are not relying on a single storyline.

- Spot potential value in out of favor names by scanning these 3542 penny stocks with strong financials that still show solid underlying metrics.

- Target long term growth themes by checking out these 24 AI penny stocks that are tied to artificial intelligence trends across multiple industries.

- Focus on price versus fundamentals by reviewing these 877 undervalued stocks based on cash flows that screen as cheap based on cash flow expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.