Please use a PC Browser to access Register-Tadawul

A Piece Of The Puzzle Missing From Apyx Medical Corporation's (NASDAQ:APYX) 34% Share Price Climb

Bovie Medical Corporation APYX | 3.73 | -1.58% |

Despite an already strong run, Apyx Medical Corporation (NASDAQ:APYX) shares have been powering on, with a gain of 34% in the last thirty days. The last 30 days bring the annual gain to a very sharp 90%.

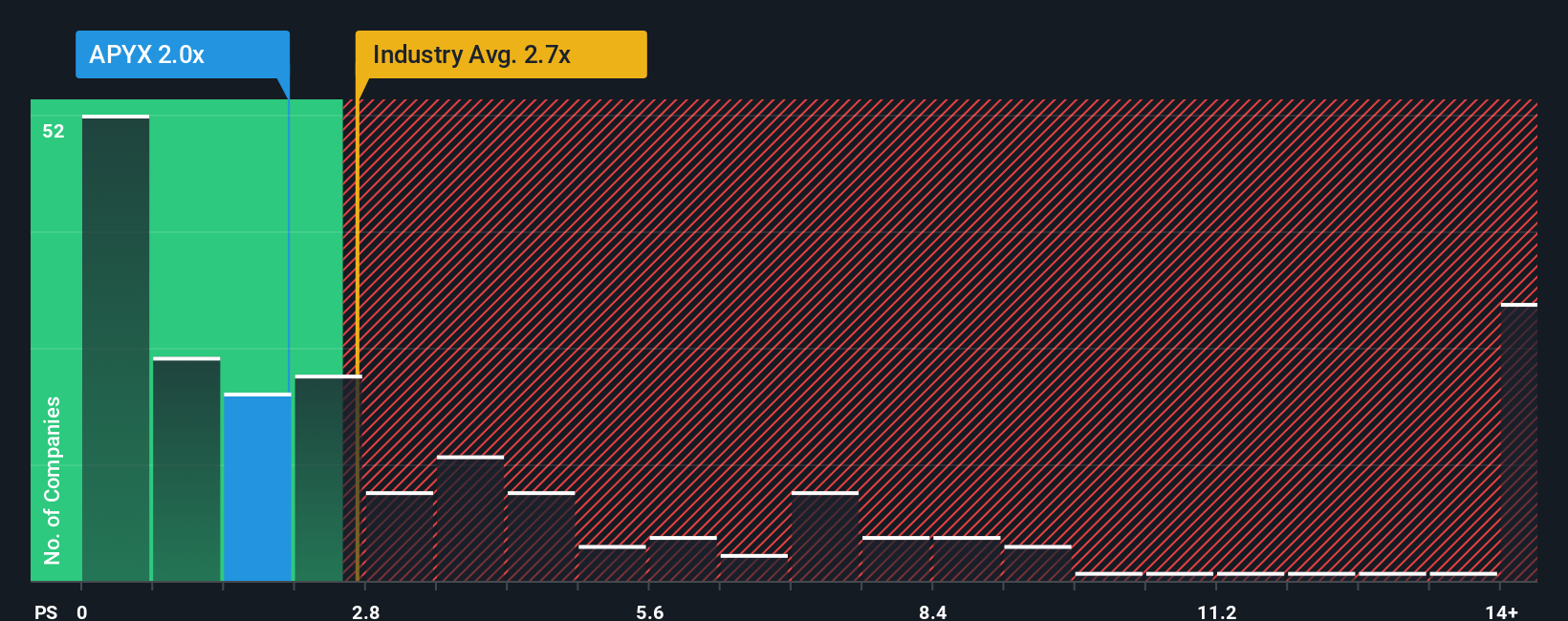

Even after such a large jump in price, Apyx Medical's price-to-sales (or "P/S") ratio of 2x might still make it look like a buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 2.7x and even P/S above 8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Apyx Medical Has Been Performing

While the industry has experienced revenue growth lately, Apyx Medical's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Apyx Medical's future stacks up against the industry? In that case, our free report is a great place to start.How Is Apyx Medical's Revenue Growth Trending?

In order to justify its P/S ratio, Apyx Medical would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 6.3% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 9.7% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 8.8% per year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 9.8% each year, which is not materially different.

With this in consideration, we find it intriguing that Apyx Medical's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Apyx Medical's P/S

Apyx Medical's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like the P/S figures for Apyx Medical remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

You should always think about risks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.