Please use a PC Browser to access Register-Tadawul

A Piece Of The Puzzle Missing From Perella Weinberg Partners' (NASDAQ:PWP) 27% Share Price Climb

Perella Weinberg Partners Class A PWP | 21.48 | -1.69% |

Perella Weinberg Partners (NASDAQ:PWP) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 15% over that time.

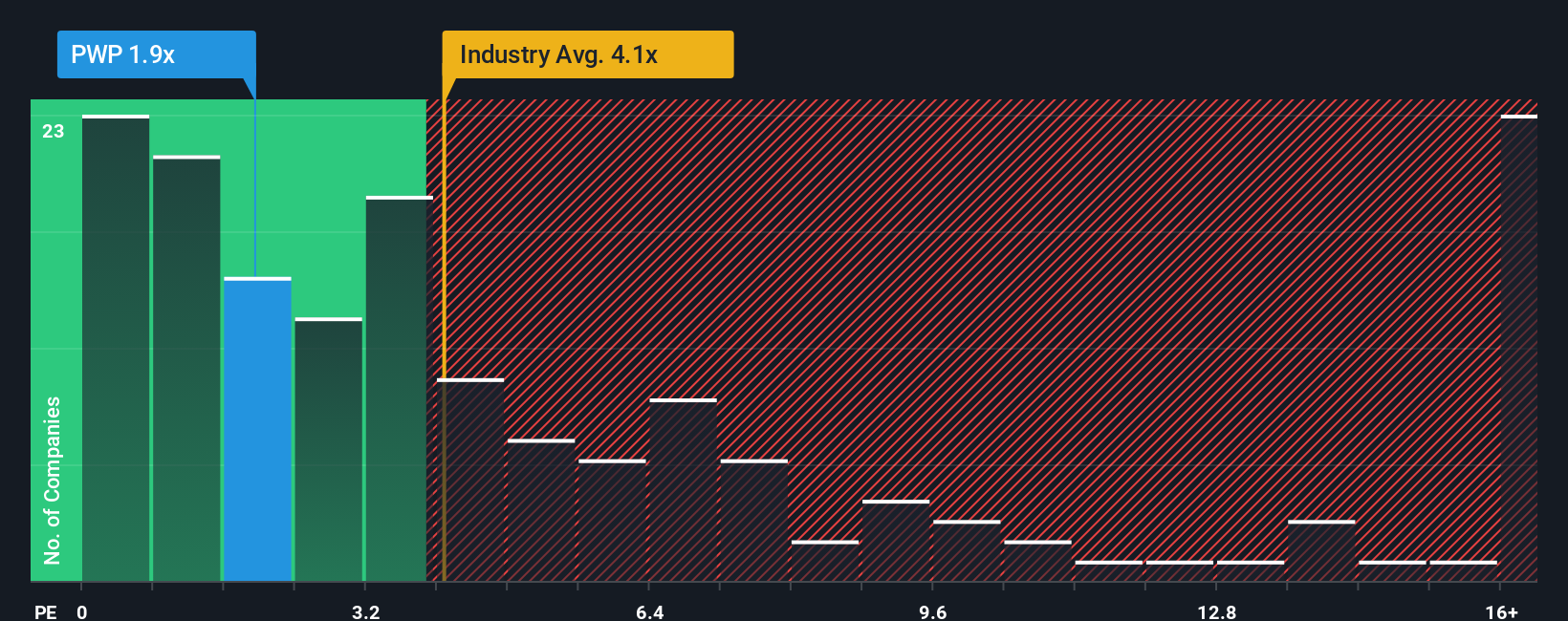

In spite of the firm bounce in price, Perella Weinberg Partners may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.9x, since almost half of all companies in the Capital Markets industry in the United States have P/S ratios greater than 4.1x and even P/S higher than 10x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How Perella Weinberg Partners Has Been Performing

Perella Weinberg Partners could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Perella Weinberg Partners.How Is Perella Weinberg Partners' Revenue Growth Trending?

In order to justify its P/S ratio, Perella Weinberg Partners would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 17% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 20% during the coming year according to the four analysts following the company. With the industry only predicted to deliver 7.3%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Perella Weinberg Partners is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Perella Weinberg Partners' P/S

Perella Weinberg Partners' recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Perella Weinberg Partners' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks.

If you're unsure about the strength of Perella Weinberg Partners' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.