Please use a PC Browser to access Register-Tadawul

A Piece Of The Puzzle Missing From Sonoma Pharmaceuticals, Inc.'s (NASDAQ:SNOA) 35% Share Price Climb

Sonoma Pharmaceuticals SNOA | 3.59 | -3.23% |

Despite an already strong run, Sonoma Pharmaceuticals, Inc. (NASDAQ:SNOA) shares have been powering on, with a gain of 35% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 33% in the last year.

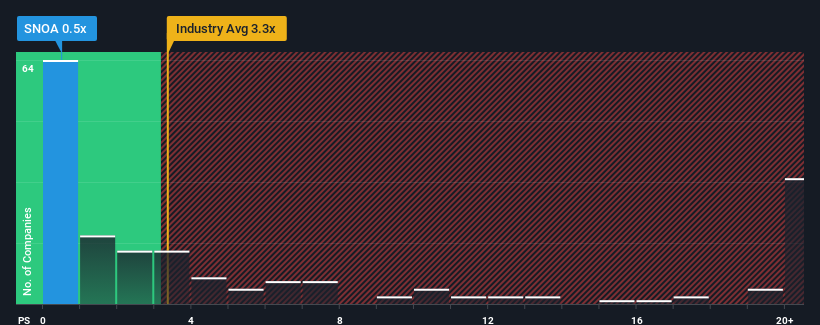

Even after such a large jump in price, Sonoma Pharmaceuticals may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 3.5x and even P/S higher than 12x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

We've discovered 4 warning signs about Sonoma Pharmaceuticals. View them for free.

What Does Sonoma Pharmaceuticals' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Sonoma Pharmaceuticals has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Sonoma Pharmaceuticals will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Sonoma Pharmaceuticals would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 12% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 32% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 18%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Sonoma Pharmaceuticals' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Sonoma Pharmaceuticals' P/S

Shares in Sonoma Pharmaceuticals have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Sonoma Pharmaceuticals' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You need to take note of risks, for example - Sonoma Pharmaceuticals has 4 warning signs (and 3 which are significant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.