Please use a PC Browser to access Register-Tadawul

AbbVie (ABBV) Boosts Dividend After Net Income Slips—What Does This Reveal About Its Capital Priorities?

AbbVie, Inc. ABBV | 223.01 | +1.17% |

- AbbVie reported third quarter 2025 earnings, highlighting increased sales of US$15.78 billion but a significant reduction in net income to US$186 million, alongside a US$847 million intangible asset impairment and a quarterly dividend increase to US$1.73 per share starting February 2026.

- This combination of higher revenues, a large impairment charge, and a growing dividend illustrates the company’s intent to balance shareholder returns with financial discipline amid evolving business conditions.

- We’ll explore how the recent dividend increase and third-quarter results may shape AbbVie’s investment narrative and future outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

AbbVie Investment Narrative Recap

To be a shareholder in AbbVie right now, you’d need to be confident in the company’s ability to drive growth through its immunology and neuroscience franchises, balancing expansion with disciplined capital returns even as earnings face temporary headwinds. The recent Q3 news of higher sales but a sharp fall in net income, triggered by a non-cash impairment, does not materially change the immediate catalyst: maintaining strong revenue growth from new therapies while offsetting Humira’s ongoing decline. The most pressing risk remains heightened pricing pressure and patent expirations for key products, which could impact future profitability.

The announced increase in AbbVie’s quarterly dividend, up 5.5% to US$1.73 per share starting in February 2026, is particularly relevant in this context. While the boost reinforces the commitment to rewarding shareholders, it also draws attention to the challenge of sustaining robust cash flows as patent cliffs and competitive pressures loom. For investors, it underscores how closely cash return policies are intertwined with the company’s long-term growth trajectory and risk management, especially as pipeline and portfolio diversification become more critical.

Yet, in contrast to the rising dividend, there’s emerging pressure from pricing reforms and regulatory shifts that all investors should be aware of...

AbbVie's narrative projects $73.0 billion revenue and $20.8 billion earnings by 2028. This requires 7.7% yearly revenue growth and a $17.1 billion increase in earnings from $3.7 billion today.

Uncover how AbbVie's forecasts yield a $241.29 fair value, a 4% upside to its current price.

Exploring Other Perspectives

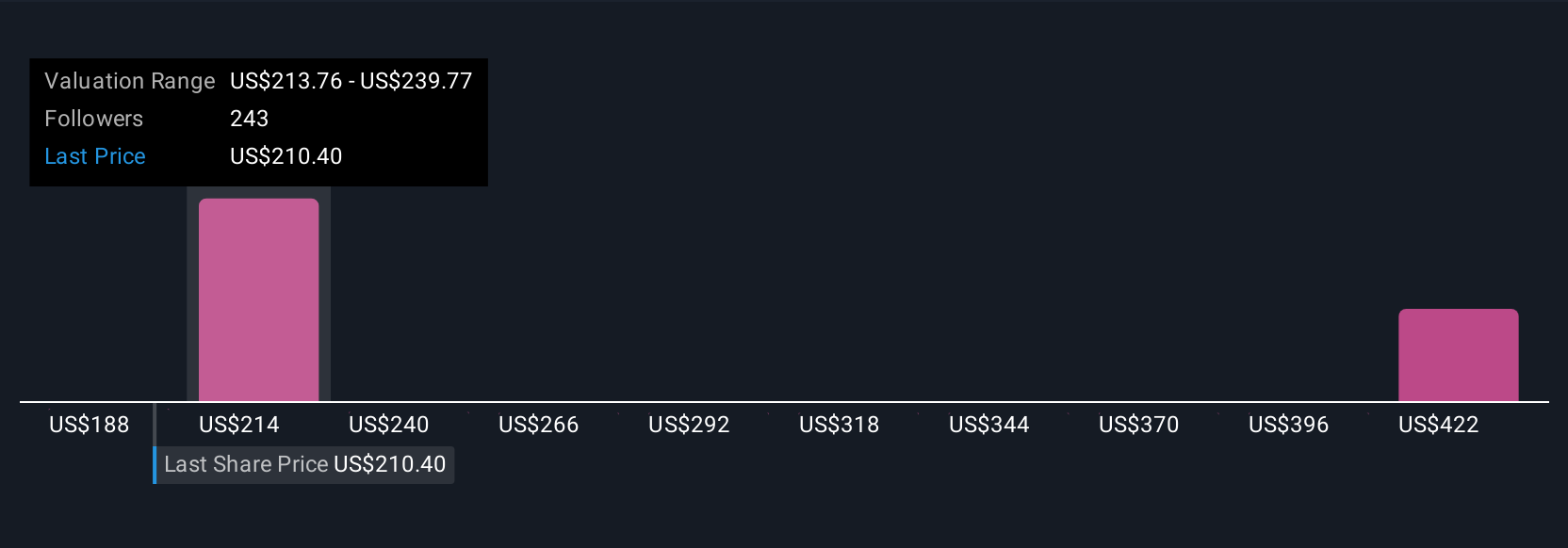

Fair value estimates from four Simply Wall St Community members range from US$232 to US$435, reflecting wide views on future growth and risk. Your outlook on AbbVie may also hinge on competition and potential revenue erosion as major product exclusivities expire, suggesting it is valuable to compare different perspectives before making up your mind.

Explore 4 other fair value estimates on AbbVie - why the stock might be worth as much as 87% more than the current price!

Build Your Own AbbVie Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AbbVie research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free AbbVie research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AbbVie's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.