Please use a PC Browser to access Register-Tadawul

ACADIA Pharmaceuticals (ACAD): Evaluating Valuation After New LOTUS Study Evidence for DAYBUE in Rett Syndrome

ACADIA Pharmaceuticals Inc. ACAD | 26.77 | -1.80% |

ACADIA Pharmaceuticals (ACAD) is making headlines after interim results from its LOTUS study were published in a leading medical journal, sparking interest among both investors and the wider healthcare community. The study highlights DAYBUE, currently the only FDA-approved treatment for Rett syndrome in the US and Canada, with caregiver-reported improvements in behavioral symptoms and manageable gastrointestinal side effects. For anyone tracking ACADIA's progress in rare disease innovation, this clinical update represents a meaningful step in the ongoing rollout of DAYBUE into everyday patient care.

This news comes as ACADIA's share price has gained 46% over the past year and is up 27% since the start of the year, indicating growing momentum that has been building for several months. Performance over the past month shows a pullback, but the broader trend has remained noticeably stronger. Previous announcements, from regulatory wins to commercial launches, have built a narrative of gradual progress for ACADIA, particularly as DAYBUE becomes more established in its target market.

After a year of strong gains and with this new evidence regarding DAYBUE’s impact, investors may be considering whether ACADIA Pharmaceuticals offers a new entry point for those seeking growth, or if the market has already accounted for its future potential.

Most Popular Narrative: 21.6% Undervalued

According to the most widely followed narrative, ACADIA Pharmaceuticals is viewed as significantly undervalued, with strong earnings growth and diverse catalysts shaping the company's outlook.

Favorable regulatory trends and industry consolidation are enabling faster market access and unlocking new partnership and growth opportunities. High reliance on a single drug, rising costs, regulatory risks, and intensifying competition pose significant threats to future growth and profitability.

What is fueling this bullish valuation? Analysts are betting on a combination of rapid earnings growth, ambitious revenue targets, and a premium profit multiple that outpaces the rest of the biotech industry. Curious about the bold assumptions powering this forecast and what it means for ACADIA’s trajectory? The numbers behind this valuation might be surprising.

Result: Fair Value of $30.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increasing competition in CNS therapies and the risk of U.S. pharmaceutical price controls could limit ACADIA's growth and compress future profit margins.

Find out about the key risks to this ACADIA Pharmaceuticals narrative.Another View: Market Comparisons Tell a Different Story

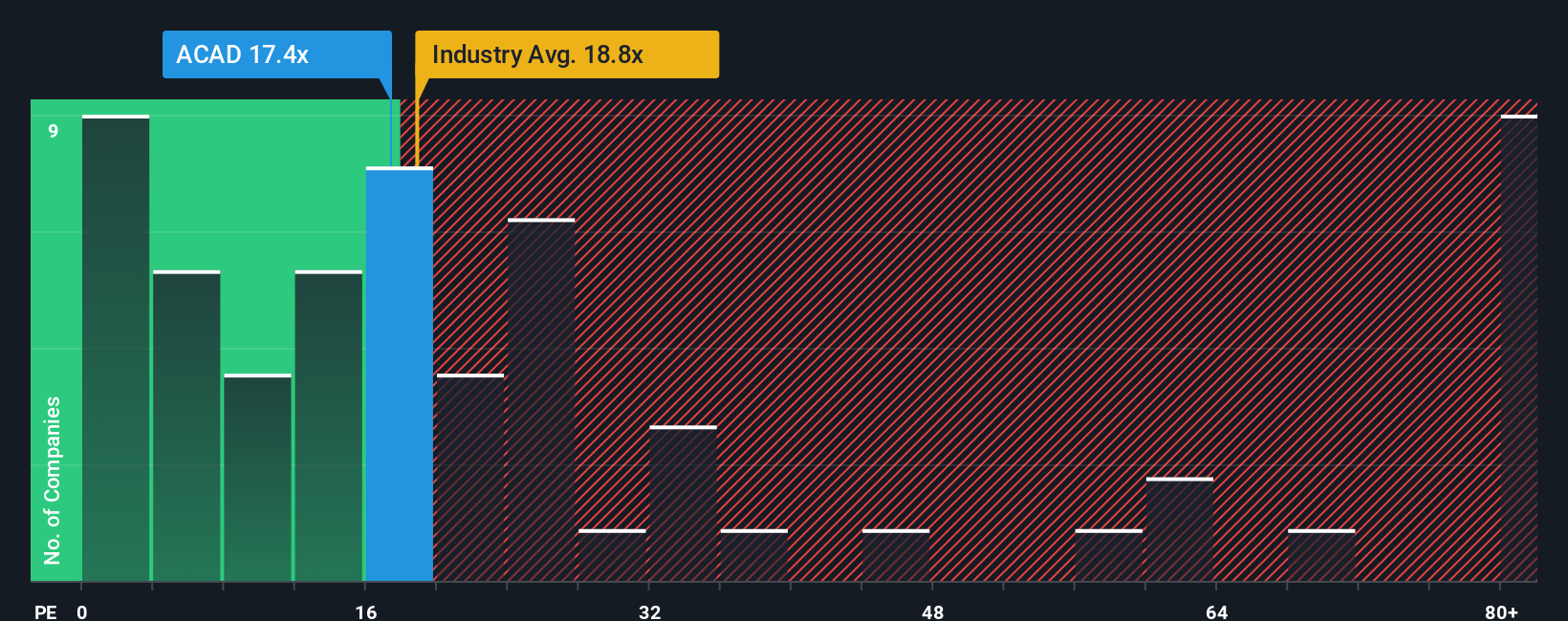

While the analyst consensus sees ACADIA as undervalued, our market comparison with similar biotech companies suggests the shares may not be as much of a bargain as they first appear. Could the market be signaling caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ACADIA Pharmaceuticals Narrative

If you see the situation differently or want to look deeper, you have the tools to assemble your own perspective in just a few minutes. Do it your way.

A great starting point for your ACADIA Pharmaceuticals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for one stock when you could uncover a portfolio of winners? Grow your knowledge and spot fresh opportunities with these powerful tools below.

- Unlock income potential by tracking companies offering generous yields with our curated list of dividend stocks with yields > 3%.

- Seize early-stage opportunities through a handpicked selection of penny stocks with strong financials that have the financials to stand out from the crowd.

- Explore innovation by scanning for trailblazers in artificial intelligence in our exclusive collection of AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.