Please use a PC Browser to access Register-Tadawul

ACNB (ACNB) Q4 Earnings Spotlight As Net Interest Margin Reaches 4.23%

ACNB Corporation ACNB | 51.80 | +0.43% |

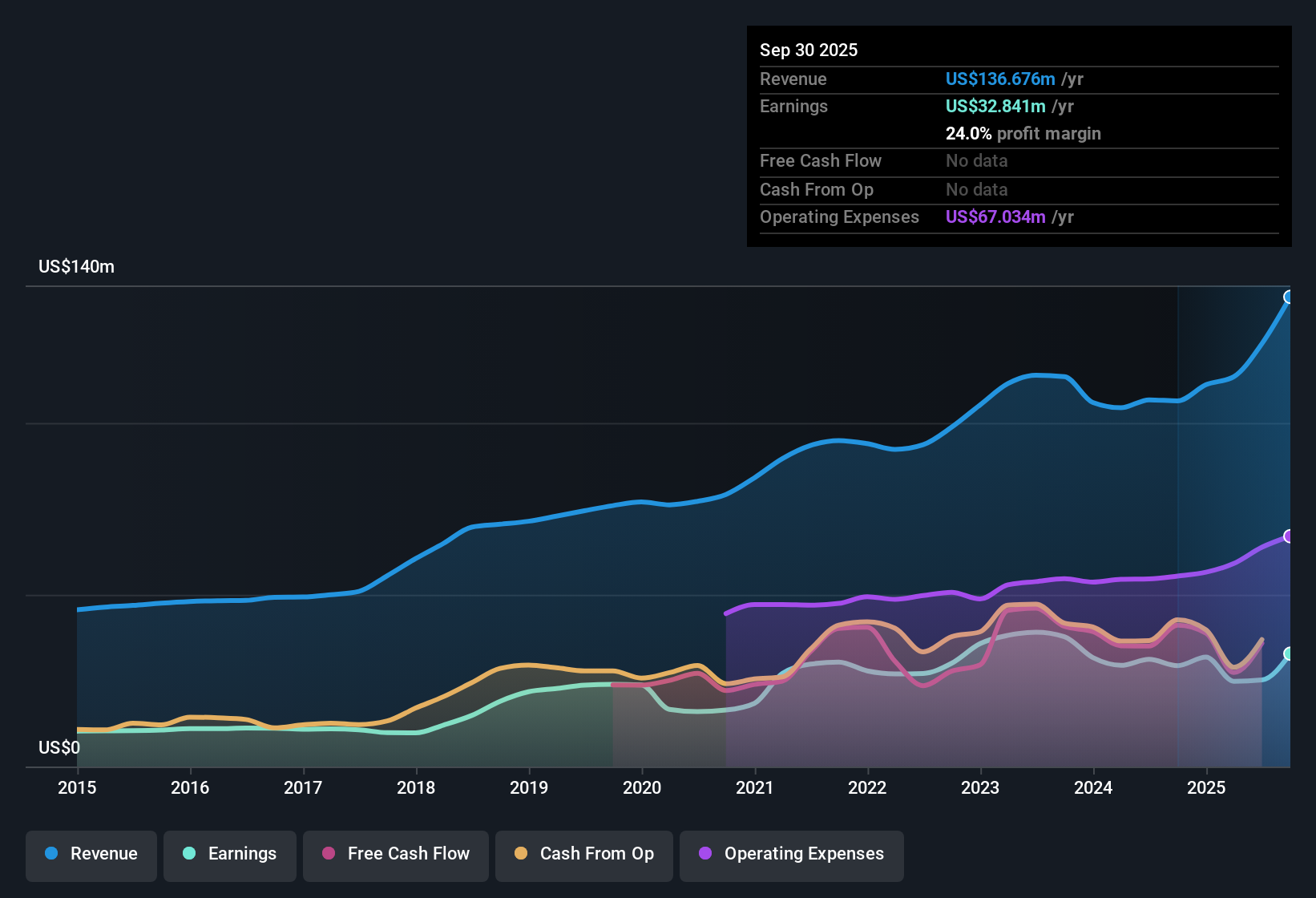

ACNB (ACNB) has wrapped up FY 2025 with fourth quarter revenue of US$36.6 million and EPS of US$1.04, supported by net income of US$10.8 million. Over the last few quarters, revenue has moved from US$26.6 million in Q4 2024 to US$41.3 million in Q3 2025 before landing at US$36.6 million in Q4 2025, while quarterly EPS has ranged from US$0.77 in Q4 2024 to US$1.43 in Q3 2025 and US$1.04 most recently, setting up a results season in which investors are weighing earnings power against the quality and sustainability of margins.

See our full analysis for ACNB.With the headline numbers on the table, the next step is to see how this earnings profile lines up with the prevailing narratives around ACNB’s growth prospects, risk profile, and profitability story.

Margins Hold With 4.23% Net Interest Spread

- On a trailing twelve month basis, ACNB reported a 4.23% net interest margin and a 25.3% net profit margin, compared with a 3.79% net interest margin and 28.7% net profit margin a year earlier.

- What stands out for the bullish view is that earnings are described as high quality, with about 16.3% earnings growth over the past year and a 3.5% per year pace over five years, yet this sits alongside a lower trailing net profit margin than last year, which means:

- Bulls can point to higher earnings growth paired with a higher trailing net interest margin of 4.23% versus 3.79% a year ago as support for the idea that the core spread business is contributing to the profit story.

- At the same time, the move in net profit margin from 28.7% to 25.3% gives bears a clear data point to argue that some cost or mix pressure is present even as earnings growth has picked up.

Loan Book Near US$2.3b With Stable Credit Metrics

- Total loans have sat close to US$2.3b through FY 2025, moving between US$2,323.9 million and US$2,343.7 million across the four quarters, while reported non performing loans in the quarterly data stayed around US$10.0 million.

- For a bullish angle, investors often like to see a sizeable loan book and contained problem credits, and here they have loan balances around US$2.3b with non performing loans around US$10.0 million. Yet the data also show that non performing loans were US$6.6 million to US$6.8 million in late 2024, which means:

- Supporters can argue that the bank has scaled the loan book from about US$1.68b in late 2024 to roughly US$2.3b in 2025 while keeping non performing loans at a level that is small relative to total loans.

- Cautious investors can point out that non performing loans increased in dollar terms from the US$6.6 million to US$6.8 million range to roughly US$10.0 million, so credit quality is a factor to keep an eye on even if it is not dominating the story right now.

Growth And Valuation Pull In Different Directions

- ACNB’s trailing P/E of 13.7x sits above the US Banks industry at 12.1x and peer average of 10.3x, while the shares trade at US$49.03 compared with a DCF fair value estimate of about US$88.97 and an allowed reference analyst price target of US$55.67.

- What is interesting for both bullish and bearish narratives is that earnings are forecast to grow around 16.4% per year with revenue at about 6.5% per year, yet the stock is described as expensive versus peers on P/E while also trading materially below the DCF fair value of roughly US$88.97, which means:

- Bulls can lean on the combination of forecast earnings growth near 16.4% per year, a dividend yield of about 3.1%, and a share price of US$49.03 that is well below the DCF fair value estimate to argue that the market may be underestimating the earnings stream.

- Bears can focus on the premium P/E versus the 12.1x industry and 10.3x peer averages and the mention of shareholder dilution in the past year as evidence that, even with growth and dividends, some investors may be paying a higher multiple than comparable banks.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ACNB's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

ACNB’s premium P/E, lower net profit margin, and higher non performing loans highlight pressure points around profitability and balance sheet quality that some investors may want to sidestep.

If those trade offs make you uneasy, use our solid balance sheet and fundamentals stocks screener (388 results) to quickly focus on companies with stronger financial foundations and tighter credit metrics right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.