Please use a PC Browser to access Register-Tadawul

Adient’s ModuTec Seat Platform Launch Draws Investor Focus On Valuation

Adient plc ADNT | 24.86 | -0.64% |

- Adient (NYSE:ADNT) has introduced ModuTec, a new modular seat design platform for automotive manufacturers.

- The company says ModuTec is built to streamline seat production, support higher levels of automation, and simplify assembly.

- This launch positions ModuTec as an industry first modular solution aimed at changing how vehicle seats are manufactured.

Adient is a major global supplier of automotive seating, so a change in how seats are designed and assembled can matter for a wide range of automakers. ModuTec fits into a broader industry push toward modular vehicle platforms and more automated factories, where simplified components can help reduce complexity on the production line. For investors, it is another example of how parts suppliers are trying to align with automakers that want faster, more flexible manufacturing.

Looking ahead, the key question is how quickly major customers adopt ModuTec in new programs and refresh cycles. Investor attention may focus on whether this modular approach helps Adient expand content per vehicle, improve manufacturing efficiency, or deepen relationships with large OEMs that are investing heavily in automation.

Stay updated on the most important news stories for Adient by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Adient.

Quick Assessment

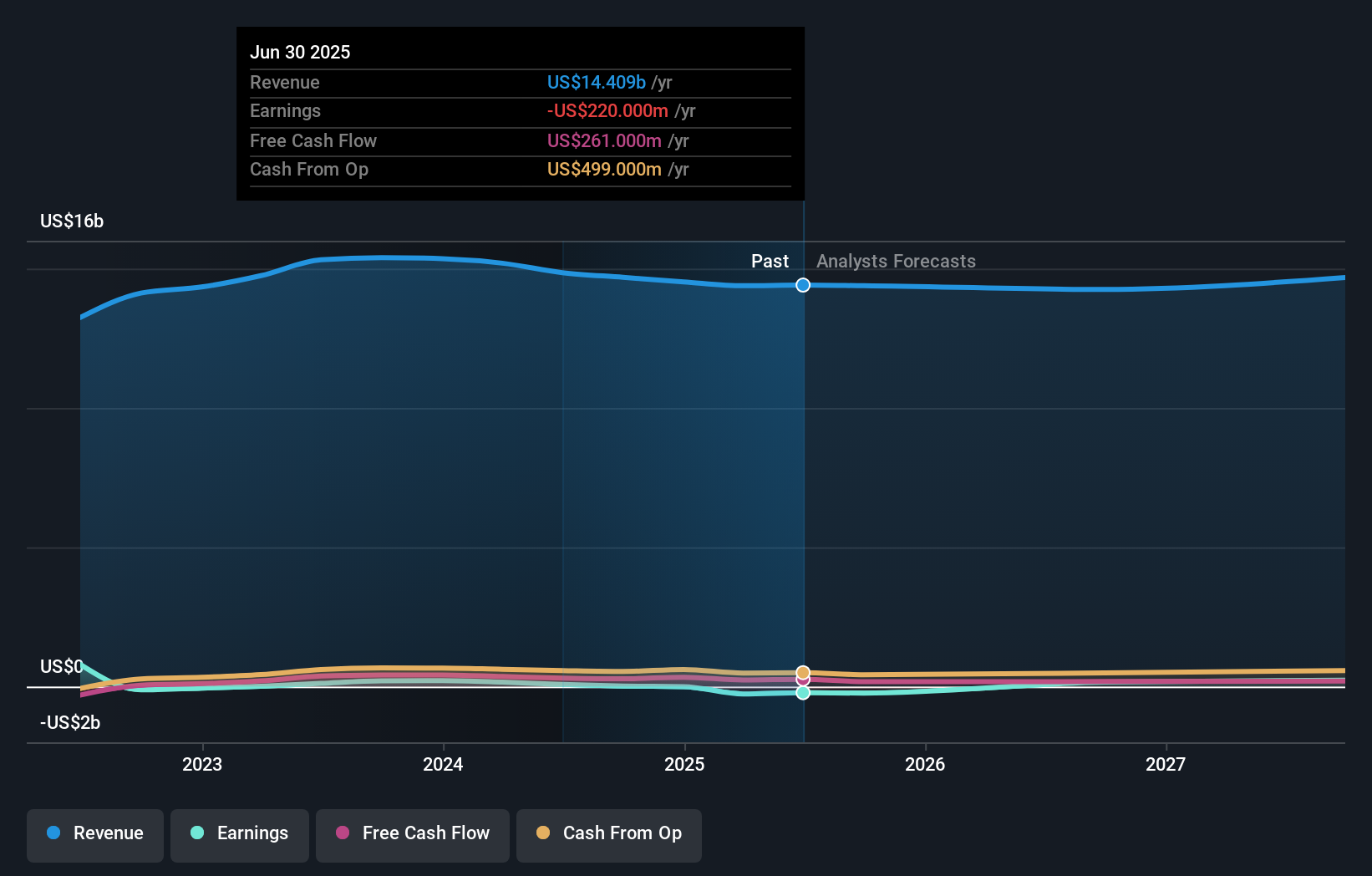

- ✅ Price vs Analyst Target: At US$21.59, the share price sits about 14% below the US$25.05 analyst target.

- ✅ Simply Wall St Valuation: The shares are described as trading 69.1% below the estimated fair value.

- ✅ Recent Momentum: The 30 day return of 11.46% signals short term positive momentum as ModuTec is launched.

Check out Simply Wall St's in depth valuation analysis for Adient.

Key Considerations

- 📊 ModuTec could support Adient's push to supply more automated plants, which may influence how investors think about its long term role in auto components.

- 📊 Watch customer wins, content per vehicle, and any commentary on ModuTec driven efficiency in future updates.

- ⚠️ Execution risk remains, as ModuTec needs meaningful adoption from major automakers for the benefits to fully show up in the numbers.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Adient analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.