AerCap Holdings N.V.'s (NYSE:AER) Share Price Is Matching Sentiment Around Its Earnings

AerCap Holdings NV AER | 0.00 |

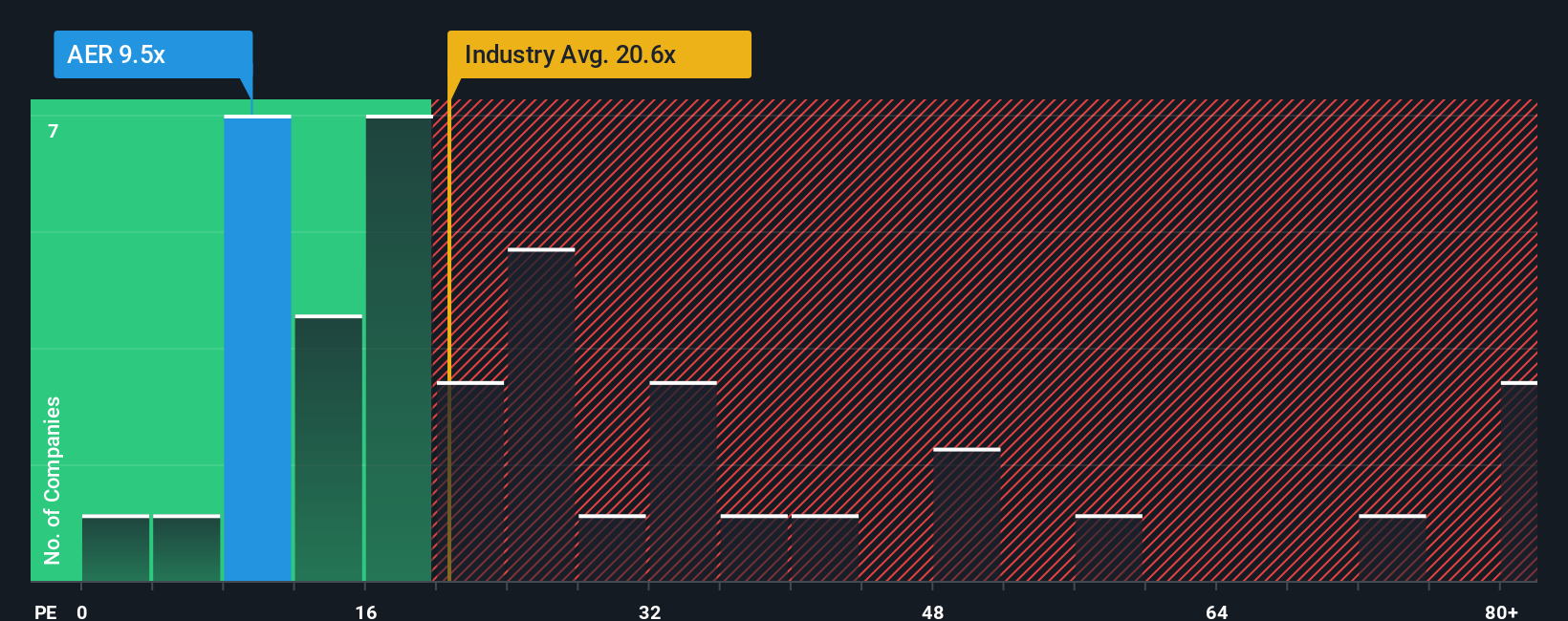

AerCap Holdings N.V.'s (NYSE:AER) price-to-earnings (or "P/E") ratio of 9.5x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

While the market has experienced earnings growth lately, AerCap Holdings' earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

How Is AerCap Holdings' Growth Trending?

AerCap Holdings' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 0.6% as estimated by the seven analysts watching the company. Meanwhile, the broader market is forecast to expand by 13%, which paints a poor picture.

With this information, we are not surprised that AerCap Holdings is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On AerCap Holdings' P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of AerCap Holdings' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Simply Wall St 02/12 19:32

AerCap Holdings (NYSE:AER): Valuation Check After First Boeing 777-300ERSF Freighter Conversion Delivery

Simply Wall St 03/12 01:24DXP Enterprises Acquires Pump Solutions for Texas Water Platform Expansion

Reuters 03/12 13:01Transcat Leaders Highlight Service-Driven Growth in CEO Interview

Reuters 03/12 14:05Is It Too Late To Consider United Rentals After A 235% Five Year Surge?

Simply Wall St 03/12 17:19CEO Austin Chandler Willis Reports Disposal of Willis Lease Finance Corporation Common Shares

Reuters 03/12 22:56How Etsy’s OpenAI-Powered ChatGPT Shopping Integration At Etsy (ETSY) Has Changed Its Investment Story

Simply Wall St Today 02:24Did AER’s US$1 Billion Buyback and 777-300ERSF Bet Just Shift AerCap Holdings' Investment Narrative?

Simply Wall St 26m