Please use a PC Browser to access Register-Tadawul

After Leaping 29% Lemonade, Inc. (NYSE:LMND) Shares Are Not Flying Under The Radar

Lemonade LMND | 57.31 | -7.07% |

Lemonade, Inc. (NYSE:LMND) shares have continued their recent momentum with a 29% gain in the last month alone. The last month tops off a massive increase of 177% in the last year.

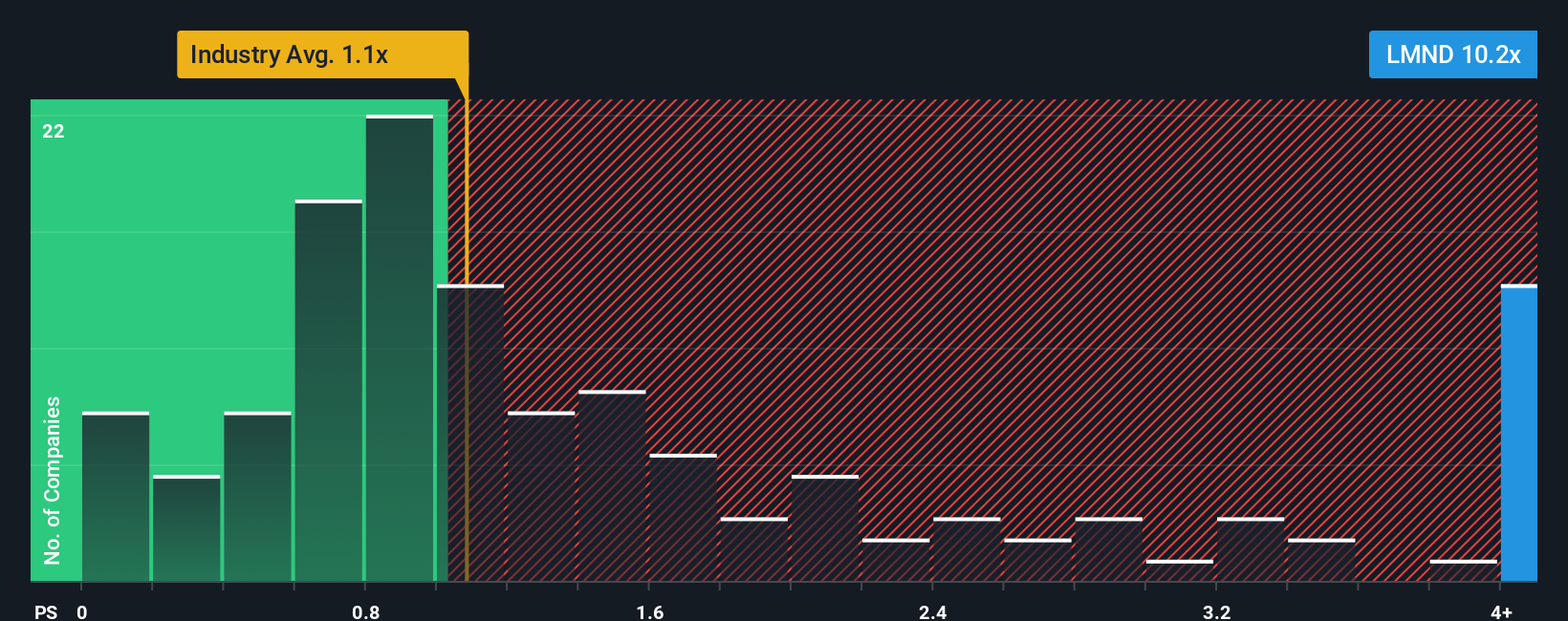

Since its price has surged higher, given around half the companies in the United States' Insurance industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Lemonade as a stock to avoid entirely with its 10.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Lemonade's Recent Performance Look Like?

Recent times have been advantageous for Lemonade as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Lemonade's future stacks up against the industry? In that case, our free report is a great place to start.How Is Lemonade's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Lemonade's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. The strong recent performance means it was also able to grow revenue by 215% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 43% each year during the coming three years according to the eleven analysts following the company. That's shaping up to be materially higher than the 4.9% per annum growth forecast for the broader industry.

In light of this, it's understandable that Lemonade's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Lemonade's P/S?

Lemonade's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Lemonade's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

If you're unsure about the strength of Lemonade's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.