Please use a PC Browser to access Register-Tadawul

Alibaba (NYSE:BABA) Valuation: How Do Massive AI Bets and Nvidia Partnership Reshape the Investment Case?

Alibaba Group Holding Ltd. Sponsored ADR BABA | 150.96 | -3.03% |

Alibaba Group Holding (NYSE:BABA) grabbed attention this week after striking a headline AI partnership with Nvidia and unveiling its new Qwen3-Max model. The announcement spurred a sharp share price jump as investors took notice of Alibaba’s escalating AI ambitions.

Alibaba’s recent AI headlines arrive on top of a wave of momentum, with shares rallying sharply in response to new partnerships, cloud expansion, and record-setting engagement in local services. After underperforming in prior periods, the company’s steady strategic pivots have reignited optimism, reflected in a 1-year total shareholder return of just over 0.7%, alongside modest but building gains in shorter-term share price returns as investors increasingly buy into its heavy AI commitments.

If Alibaba’s growth streak has piqued your interest, this is the perfect time to explore the latest tech and AI disruptors. See the full list for free at See the full list for free..

But with shares surging and analysts divided on the outlook, the central question facing investors becomes clear: Is Alibaba still undervalued given its AI momentum, or has the market already priced in the next wave of growth?

Most Popular Narrative: 76.8% Overvalued

Alibaba’s current share price of $189.34 is far above the most popular narrative’s estimated fair value, which signals elevated expectations. The discount rate behind this calculation reflects steeper macro and regulatory risks, pointing to a marked disconnect between market optimism and the underlying cash flow assumptions.

"While Alibaba shows strong operational momentum, particularly in AI and cloud services, the current stock price appears to fully reflect near-term growth prospects given macro headwinds and geopolitical risks. Just in the end I put my doubt, why has Michael Burry sold all ?"

What’s really driving that hefty premium? The narrative leans on foundational assumptions about future growth and margin stability. These are challenging expectations given Alibaba’s fierce rivals. Uncover the precise projections that push this valuation sky high and see if you agree with the bold outlook.

Result: Fair Value of $107.09 (OVERVALUED)

However, sudden shifts in US-China trade relations or tighter regulatory measures could quickly change the current trajectory for Alibaba investors.

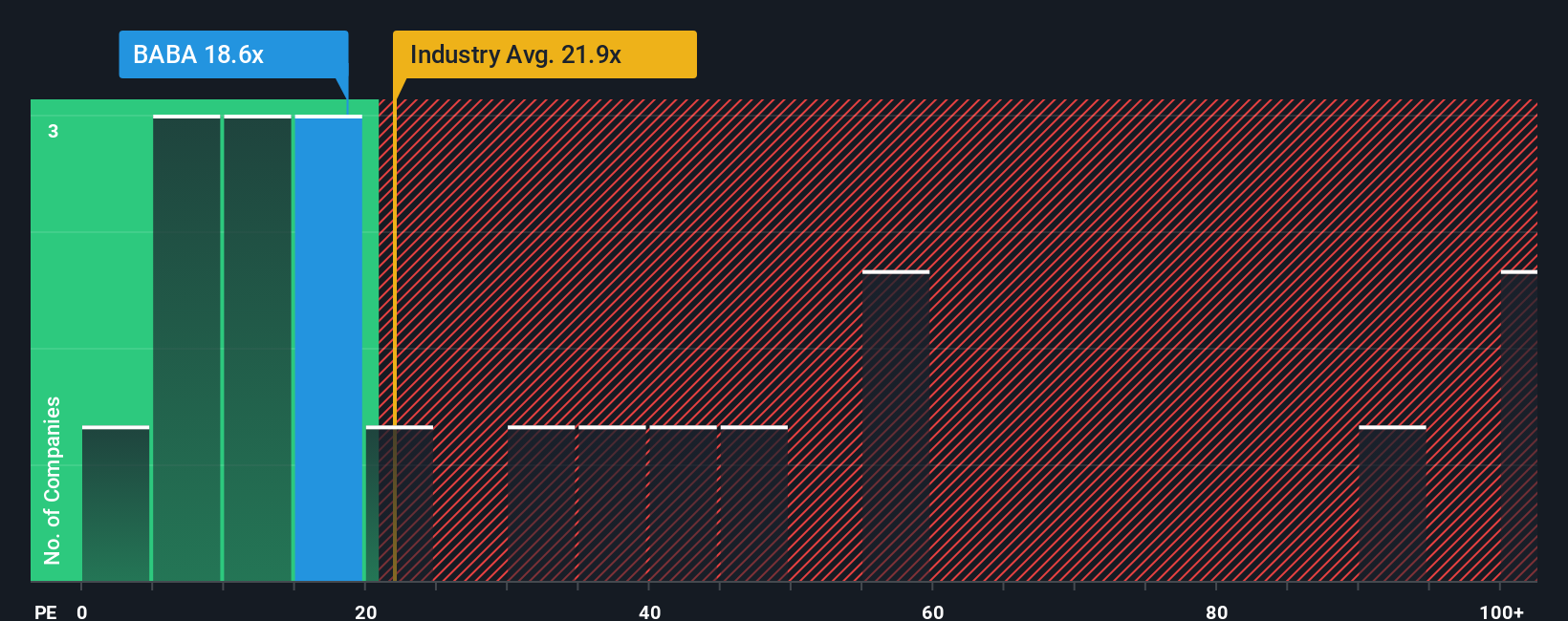

Another View: What Do Price Multiples Reveal?

While one narrative points to Alibaba being overvalued by discounted cash flow, price-to-earnings tells a different story. At 20.3x, Alibaba’s valuation is actually lower than both its industry average (21.7x) and its peers (48.6x). It is also below the fair ratio of 29.4x, suggesting the market may be undervaluing near-term potential. Could multiples be hinting at a mispriced opportunity, or are they simply reflecting the risks that others perceive?

Build Your Own Alibaba Group Holding Narrative

If you have your own perspective or would rather dig into the numbers firsthand, shaping a personal Alibaba narrative can take just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Alibaba Group Holding.

Looking for more investment ideas?

Make sure you are ahead of the market by tapping into handpicked opportunities across emerging sectors and trends. Here are three ways to spot the next big winners before others catch on:

- Tap into tomorrow’s breakthrough medical solutions by researching these 31 healthcare AI stocks and find out which companies are positioned at the forefront of healthcare innovation.

- Power up your strategy with steady income by checking out these 19 dividend stocks with yields > 3%, which deliver attractive yields above 3% and add stability to your portfolio.

- Ride the wave of technological transformation by searching through these 24 AI penny stocks poised to reshape industries with intelligent automation and new AI-driven business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.