Please use a PC Browser to access Register-Tadawul

Amazon.com (NasdaqGS:AMZN) Partners With Dynatrace & HighByte As Share Price Falls 6%

Amazon.com, Inc. AMZN | 226.19 | -1.78% |

Amazon.com (NasdaqGS:AMZN) experienced a 6% decline over the past week, despite positive news, such as its collaboration with Dynatrace, focusing on AI and cloud automation. Simultaneously, the broader market, represented by indices like the S&P 500 and Dow Jones, experienced a volatile week primarily due to concerns over impending trade tariffs and weaker-than-expected manufacturing data. While some tech giants saw gains, Amazon did not replicate this trend. External market pressures and investor unease seem to have overshadowed Amazon's strategic advancements, resulting in this downtrend, reflecting broader concerns over economic impacts from policy shifts and market volatility.

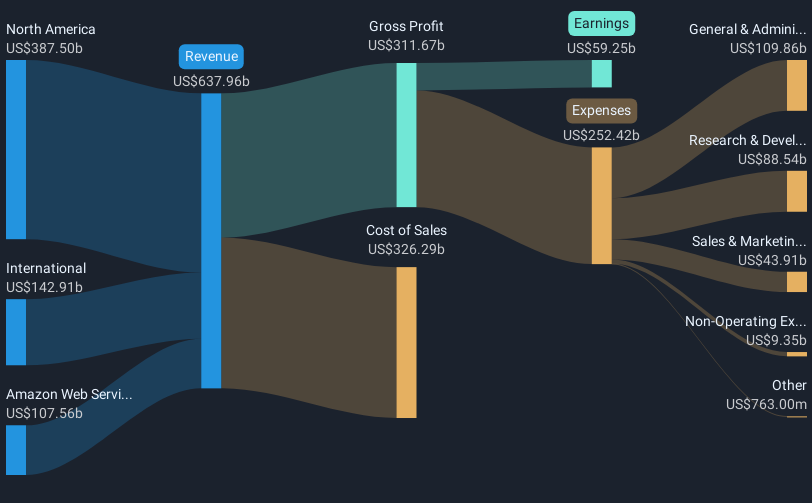

Amazon.com's shares improved significantly over the past five years, achieving a total return of 90.49%. This performance was fuelled by robust growth in its core business areas. Enhanced profitability from its advertising segment, which hit a $69 billion annual revenue rate, added considerable value. The company's focus on fulfillment automation contributed to operational efficiencies that bolstered margins. Integration of advanced robotics and AI in logistics and AWS further expanded growth potential. Despite some hurdles, such as significant capital expenditure and foreign exchange headwinds, Amazon's revenue and earnings saw substantial upticks, with recent earnings showing a marked increase in net income from US$3.2 billion to US$10.4 billion year-over-year.

Over the past year, Amazon performed at par with the US market return of 6.1%, though it lagged behind the US Multiline Retail industry, which returned 11.2%. Market collaborations, like the one with Dynatrace to advance AI capabilities, play a role in Amazon's expansion narrative, alongside the announced AWS region launch in Tel Aviv, broadening cloud service capabilities. Legal and labor issues remain ongoing challenges, evidenced by class-action lawsuits and union-related disputes. However, these factors have not overshadowed Amazon's ability to capitalize on technological advancements to drive future earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.