Please use a PC Browser to access Register-Tadawul

Amazon.com (NasdaqGS:AMZN) Powers EHR Data Revolution With OMNY Health Partnership

Amazon.com, Inc. AMZN | 226.19 | -1.78% |

Recently, Amazon.com (NasdaqGS:AMZN) introduced Nova Sonic, a new AI model poised to enhance the company's voice application capabilities. This development aligns with broader market trends where technology stocks saw gains. During the past week, Amazon's shares rose by 6%, contrasting with the broader market's relative stability. The rise in Amazon's stock may have been influenced by this AI advancement, in conjunction with a positive overall tech sector performance, amidst volatile market conditions that saw fluctuating tariff news and economic data affecting investor sentiment.

The recent announcement of Amazon.com's Nova Sonic AI model could significantly influence the company's future prospects, particularly enhancing its voice application capabilities. This aligns with Amazon's broader strategy of integrating AI and automation across its retail and cloud services. Over the past five years, Amazon's total return, including share price and dividends, reached 52.61%, showcasing robust long-term performance. This increase contrasts with the past year, during which Amazon underperformed the U.S. Multiline Retail industry that showed no change. The short-term share price gain of 6% potentially reflects optimism around recent developments, although it remains below the consensus price target of US$261.79, indicating potential upside from its current price.

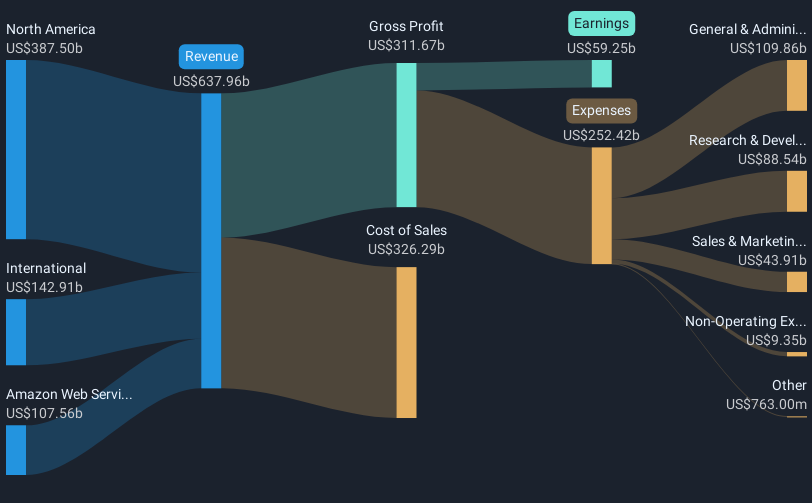

This AI advancement, along with ongoing investments in fulfillment automation and AWS, could bolster revenue and earnings projections. Analysts expect Amazon's revenue to grow annually by 9.8% over the next three years, with earnings projected to rise from US$59.25 billion to as much as US$103.9 billion by April 2028. However, these forecasts depend on numerous variables, including capital expenditure and market conditions, which could impact profitability. This underscores the consensus view that Amazon's share price could see significant appreciation, as the current market price [US$170.66] holds a considerable discount to the analyst price target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.