Please use a PC Browser to access Register-Tadawul

Ameresco (AMRC) Is Up 7.3% After MOU to Deploy Up to 50 Micro-Reactors With Terra and GSR

Ameresco, Inc. Class A AMRC | 30.06 | -6.38% |

- In the past week, Terra Innovatum Srl and GSR III Acquisition Corp. announced they had signed an MOU with Ameresco to plan and deploy up to 50 SOLO micro-modular reactors across federal and commercial sites, leveraging Ameresco's extensive network for siting and development.

- This collaboration aligns with Ameresco's expanding role in advanced clean energy solutions and could accelerate the commercial rollout of new modular reactor technology in the U.S. energy landscape.

- We'll examine how Ameresco's participation in pioneering micro-modular reactor projects could reshape its long-term growth narrative and market position.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Ameresco Investment Narrative Recap

To be a shareholder in Ameresco, you need to believe in the accelerating demand for clean energy infrastructure and the company’s ability to execute on high-value, innovative projects. The recent announcement of Ameresco’s plan to deploy up to 50 SOLO micro-modular reactors is an early-stage milestone, but has not yet materially changed the most important short-term catalyst, a healthy pipeline conversion of projects tied to U.S. incentives. The biggest risk remains persistent supply chain and equipment sourcing challenges, especially as the scale of Ameresco’s ambitions grows.

Alongside the micro-modular reactor initiative, Ameresco just completed its 15th renewable natural gas facility with Republic Services in Illinois. This project highlights Ameresco’s strength in bringing new technologies to market, aligning with catalysts around expanded government support and the growing need for sustainable energy solutions. Such milestones reinforce Ameresco's push to diversify its revenue streams and stabilize margins as it grows.

However, investors should pay attention to the risk that, if supply chain constraints and equipment shortages worsen, the timeline for...

Ameresco's narrative projects $2.4 billion in revenue and $87.4 million in earnings by 2028. This requires 8.8% yearly revenue growth and a $25.4 million earnings increase from current earnings of $62.0 million.

Uncover how Ameresco's forecasts yield a $34.22 fair value, a 8% downside to its current price.

Exploring Other Perspectives

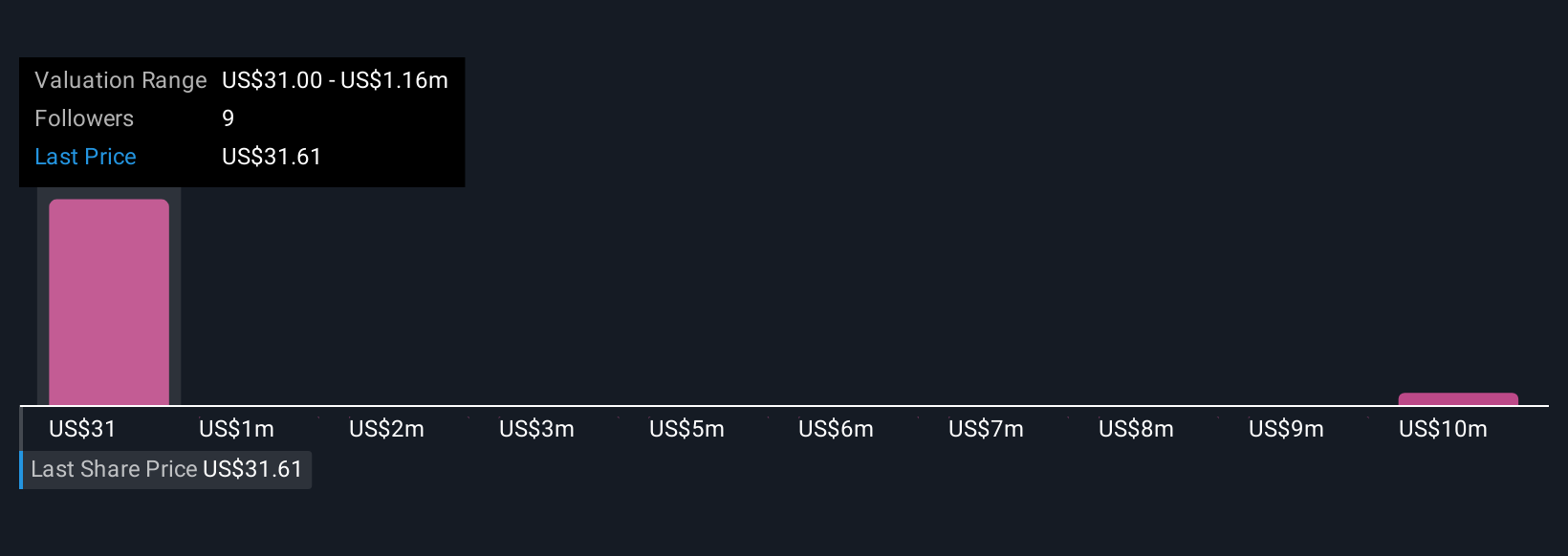

Four investors from the Simply Wall St Community estimate Ameresco’s fair value anywhere from US$34 to over US$11,587,157 per share. While opinions are wide-ranging, ongoing risks related to project execution timelines and supply chains may challenge expectations for consistent earnings over time, explore these varied outlooks before forming your own view.

Explore 4 other fair value estimates on Ameresco - why the stock might be a potential multi-bagger!

Build Your Own Ameresco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ameresco research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ameresco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ameresco's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.