Please use a PC Browser to access Register-Tadawul

American Eagle (AEO) Is Up 10.4% After Sydney Sweeney Fall Campaign Sparks Viral Attention and Debate

American Eagle Outfitters, Inc. AEO | 27.36 | +1.30% |

- In July 2025, American Eagle Outfitters launched its Fall '25 campaign with Sydney Sweeney, introducing a limited-run denim collaboration that supports domestic violence awareness and leverages innovative digital marketing strategies targeting Gen Z.

- This campaign drew high-profile political attention and stirred broad consumer engagement, sparking national conversation around the brand and its message.

- Against this backdrop, we'll explore how the campaign’s celebrity partnership and technology integration could influence American Eagle’s investment outlook.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

American Eagle Outfitters Investment Narrative Recap

To be a shareholder in American Eagle Outfitters right now, you need to believe in the brand’s ability to harness cultural moments and digital innovation to fuel consumer excitement, even as the company faces pressure from a slower retail environment and cost headwinds. The recent surge in American Eagle’s share price, following political endorsement and viral attention on its Sydney Sweeney-led campaign, touches on what could be the biggest short-term catalyst, brand relevance driving foot traffic and sales. Whether this momentum delivers lasting improvement or fades remains the most important question, while ongoing risks such as increased markdowns and weak consumer demand still loom large.

Among the recent developments, the July 2025 Fall campaign launch stands out, leveraging celebrity partnerships, immersive digital marketing, and a philanthropic initiative to broaden audience reach. This announcement is directly tied to the current stock move and illustrates how high-visibility events can quickly become a double-edged sword for short-term results. There’s clear momentum here, but...

American Eagle Outfitters' outlook calls for $5.3 billion in revenue and $166.2 million in earnings by 2028. This projection assumes an annual revenue decline of 0.3% and a decrease in earnings of $30.5 million from current earnings of $196.7 million.

Uncover how American Eagle Outfitters' forecasts yield a $11.40 fair value, a 14% downside to its current price.

Exploring Other Perspectives

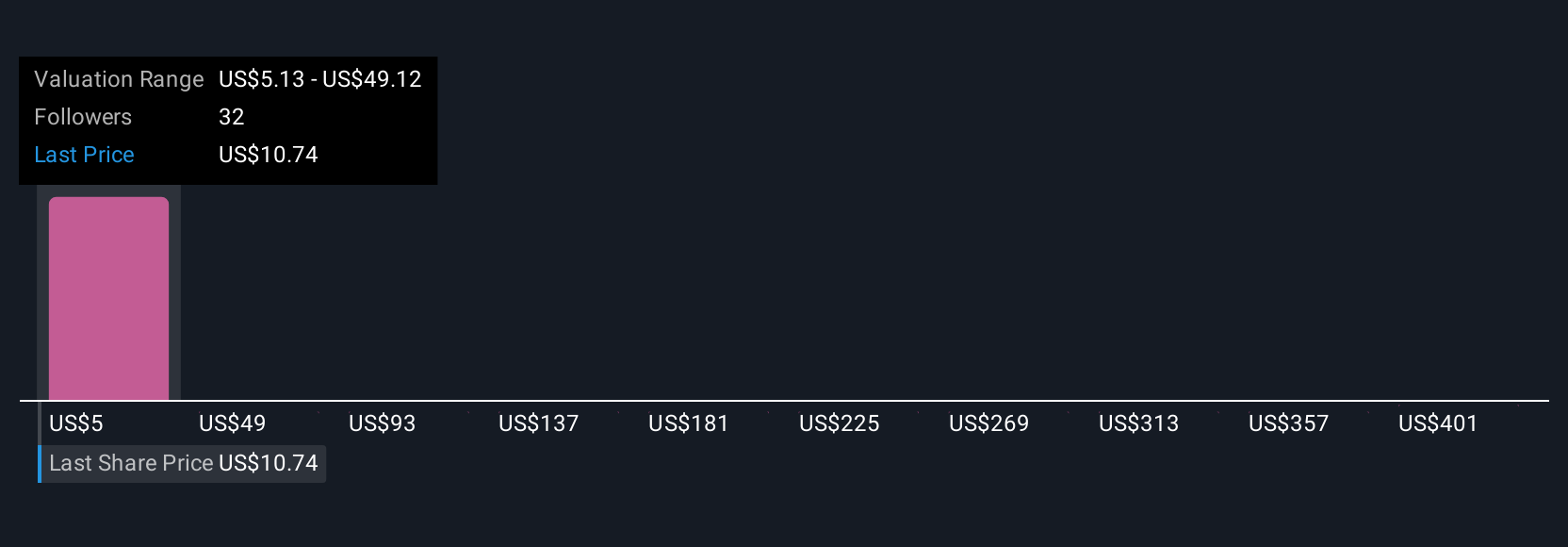

Seven members of the Simply Wall St Community value American Eagle Outfitters anywhere from US$5.13 to US$445.03 per share, reflecting exceptionally broad perspectives. With consumer uncertainty still a top concern, it’s worth exploring how each view weighs the impact of evolving brand relevance and promotional campaigns.

Explore 7 other fair value estimates on American Eagle Outfitters - why the stock might be worth less than half the current price!

Build Your Own American Eagle Outfitters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Eagle Outfitters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free American Eagle Outfitters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Eagle Outfitters' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.