Please use a PC Browser to access Register-Tadawul

American Express's Options: A Look at What the Big Money is Thinking

American Express Company AXP | 379.80 | -0.72% |

Investors with a lot of money to spend have taken a bearish stance on American Express (NYSE:AXP).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AXP, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 16 uncommon options trades for American Express.

This isn't normal.

The overall sentiment of these big-money traders is split between 12% bullish and 50%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $259,650, and 11 are calls, for a total amount of $1,474,285.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $230.0 and $360.0 for American Express, spanning the last three months.

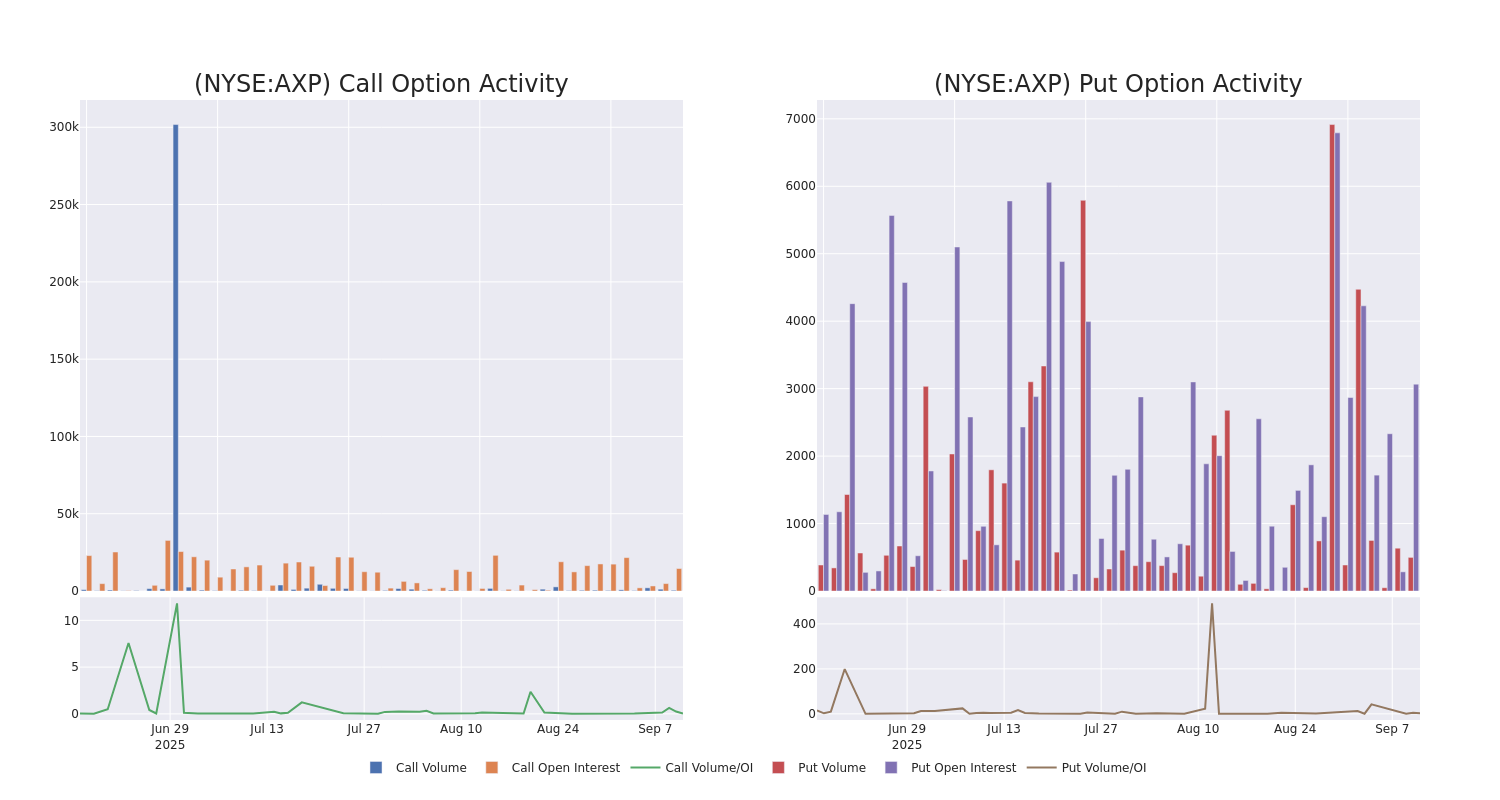

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in American Express's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to American Express's substantial trades, within a strike price spectrum from $230.0 to $360.0 over the preceding 30 days.

American Express 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXP | CALL | TRADE | BEARISH | 01/16/26 | $103.4 | $102.0 | $102.48 | $230.00 | $512.4K | 892 | 50 |

| AXP | CALL | TRADE | BEARISH | 10/17/25 | $100.05 | $99.75 | $99.75 | $230.00 | $478.8K | 215 | 49 |

| AXP | CALL | TRADE | BEARISH | 10/17/25 | $24.3 | $22.9 | $23.3 | $310.00 | $116.5K | 736 | 53 |

| AXP | PUT | SWEEP | BEARISH | 09/19/25 | $5.05 | $5.0 | $5.0 | $330.00 | $100.0K | 261 | 267 |

| AXP | CALL | TRADE | NEUTRAL | 01/16/26 | $27.75 | $27.35 | $27.55 | $320.00 | $68.8K | 10.8K | 107 |

About American Express

American Express is a global financial institution, operating in about 130 countries, that provides consumers and businesses charge and credit card payment products. The company also operates a highly profitable merchant payment network. The firm operates in four segments: US consumer services, US commercial services, international card services, and global merchant and network services. In addition to payment products, the company's commercial business offers expense management tools, consulting services, and business loans.

In light of the recent options history for American Express, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is American Express Standing Right Now?

- With a volume of 1,015,112, the price of AXP is up 2.0% at $329.82.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 36 days.

What Analysts Are Saying About American Express

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $375.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on American Express with a target price of $375.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest American Express options trades with real-time alerts from Benzinga Pro.