Please use a PC Browser to access Register-Tadawul

American Water Works (AWK) Narrows 2025 EPS Guidance as Acquisition Pipeline Grows—What Does This Mean for Long-Term Expansion?

American Water Works Company, Inc. AWK | 132.96 | -0.87% |

- American Water Works Company reported second-quarter 2025 results, showcasing revenue of US$1.28 billion and net income of US$289 million, while announcing several new acquisitions and narrowing its 2025 earnings per share guidance to US$5.70–US$5.75 on a weather-normalized basis.

- The company’s ongoing acquisition pipeline and significant infrastructure investment plans underscore its ambition to grow its regulated customer base and enhance long-term operational resilience.

- We'll examine how American Water Works Company's active acquisition strategy could influence its investment narrative and future growth potential.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

American Water Works Company Investment Narrative Recap

To own American Water Works Company, investors typically need to believe in the long-term value of regulated utility infrastructure and the company's ability to grow through acquisitions and consistent rate base expansion. The recent earnings update, solid revenue and net income growth, along with narrowed guidance, reinforces stability, though it does not materially change the key short-term catalyst: the continued execution and regulatory approval of acquisitions. However, regulatory risk remains the central operational challenge, particularly in states with strict rate-setting environments.

One of the most relevant announcements is American Water's confirmation of its substantial capital investment plans, nearly US$3.3 billion targeted for 2025. This supports the primary driver for future revenue and earnings: expanding and upgrading its regulated utility footprint. Successful follow-through will depend on continued regulatory support for cost recovery and the smooth integration of newly acquired systems.

Yet, in contrast to the company’s growth plans, investors should be aware that if regulatory outcomes fall short of expectations in key states, the timeline for earnings growth could shift...

American Water Works Company's outlook anticipates $5.9 billion in revenue and $1.3 billion in earnings by 2028. This projection is based on a 6.8% annual revenue growth rate and a $0.2 billion earnings increase from the current level of $1.1 billion.

Uncover how American Water Works Company's forecasts yield a $142.55 fair value, in line with its current price.

Exploring Other Perspectives

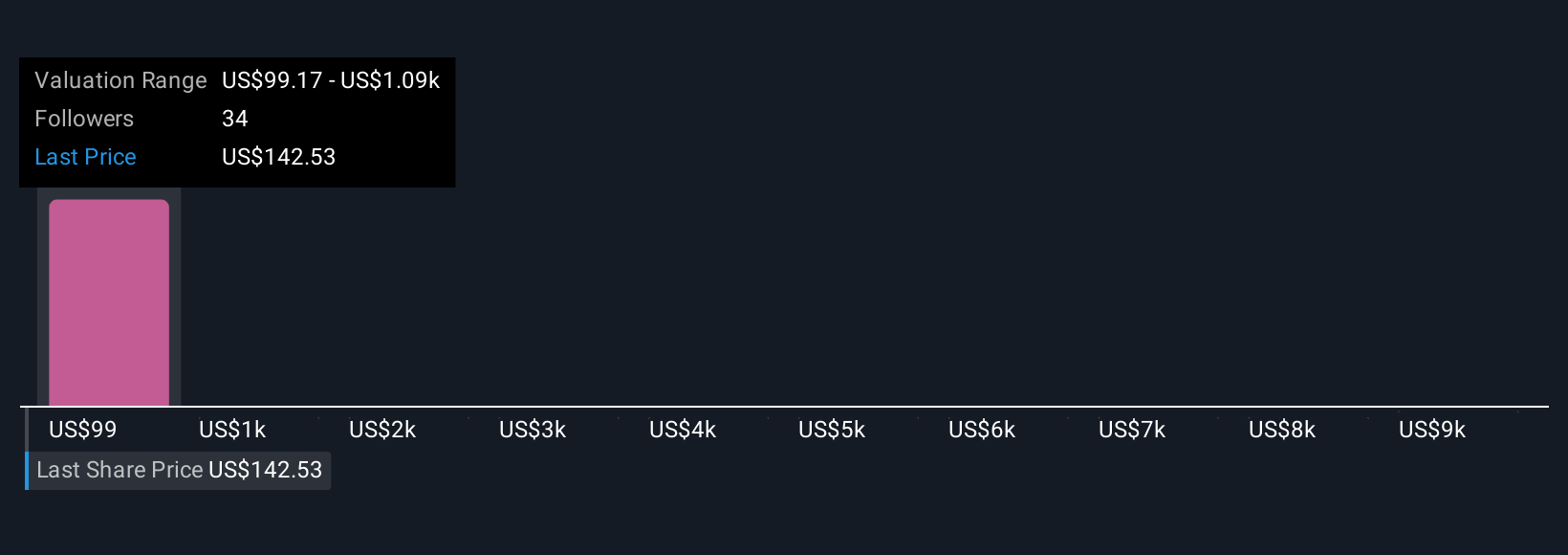

The Simply Wall St Community shared four fair value estimates for American Water Works Company ranging from US$101.15 up to US$9,999. Recent news reinforces the importance of regulatory consistency and rate approvals, both central to shaping the company's outlook.

Explore 4 other fair value estimates on American Water Works Company - why the stock might be a potential multi-bagger!

Build Your Own American Water Works Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Water Works Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Water Works Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Water Works Company's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.