Please use a PC Browser to access Register-Tadawul

Amgen (AMGN) Unveils US$600 Million Innovation Hub Expanding R&D Efforts in California

Amgen Inc. AMGN | 366.58 | +0.53% |

Amgen (AMGN) recently announced plans to invest $600 million for a new science and innovation center at its headquarters, demonstrating a robust commitment to its U.S. operations. While the company's recent price movement was largely flat over the last quarter, this investment aligns with their broader strategy of enhancing research capabilities. During the same period, Amgen also received positive regulatory updates for Repatha® and reported solid earnings growth, providing a counterbalance to broader market trends. Overall, Amgen's strategic investments and regulatory successes continue to support its market position amid fluctuating economic conditions.

The recent investment announcement by Amgen highlights the company’s focus on enhancing its research capabilities, which may help mitigate some concerns around its reliance on aging therapies and patent expirations. This capital commitment can be anticipated to support both revenue stability and earnings potential by fostering future innovation. Despite stagnation in recent quarterly share price movement, Amgen has delivered a total return of 39.20% over the past five years, indicating robust long-term shareholder returns. This contrasts sharply with its performance over the past year, where it underperformed both the US market and the biotech industry.

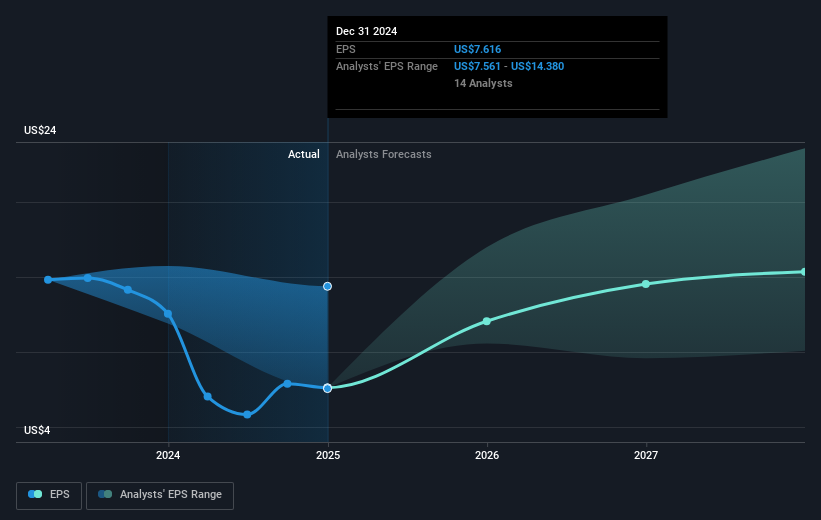

Amgen's strategic initiatives could potentially impact revenue and earnings forecasts as the company navigates pricing pressures and competition. The $600 million science and innovation center investment might bolster the company’s capacity to develop new products, which could offset declining margins and drive long-term growth. With a current share price of US$286.92, there is a discount to the consensus price target of US$311.88, reflecting a potential upside as analysts assess the outcomes of Amgen’s strategic efforts. However, consensus remains varied, with some analysts adopting a more bearish outlook based on looming challenges in the competitive landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.